Xanadu, a quantum computing firm based in Canada, is going public on the Nasdaq (NDAQ) exchange via a $3.6 billion special purpose acquisition company (SPAC) deal.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Xanadu Quantum Technologies says it plans to list on the Nasdaq after completing a merger with blank-check firm Crane Harbor Acquisition Corp. (CHAC). The stock of Crane Harbor is up 16% on news that it will merge with Xanadu.

The Canadian quantum computing firm says it expects to earn nearly $500 million from the SPAC deal, including a $275 million private investment in public equity. Quantum computers are a hot sector right now as they are regarded as the next frontier in computing.

Other quantum computing stocks, such as Rigetti Computing (RGTI) and IONQ (IONQ) have seen their share prices rise 30% or more this year amid investor enthusiasm.

Commercialization

Analysts seem to agree that quantum computing has progressed from theory, with the next step being commercialization of the technology. Beyond start-up companies such as Xanadu, quantum computing is getting growing attention from technology giants such as IBM (IBM) and Alphabet (GOOGL).

Even U.S. bank JPMorgan Chase (JPM) has announced a quantum computing strategy. Qubits, which are the building blocks of quantum computing, can compute in minutes what would take traditional computers years to complete.

SPACs are shell companies that raise money through initial public offerings (IPOs) and then merge with a private company and take it public.

Is IBM Stock a Buy?

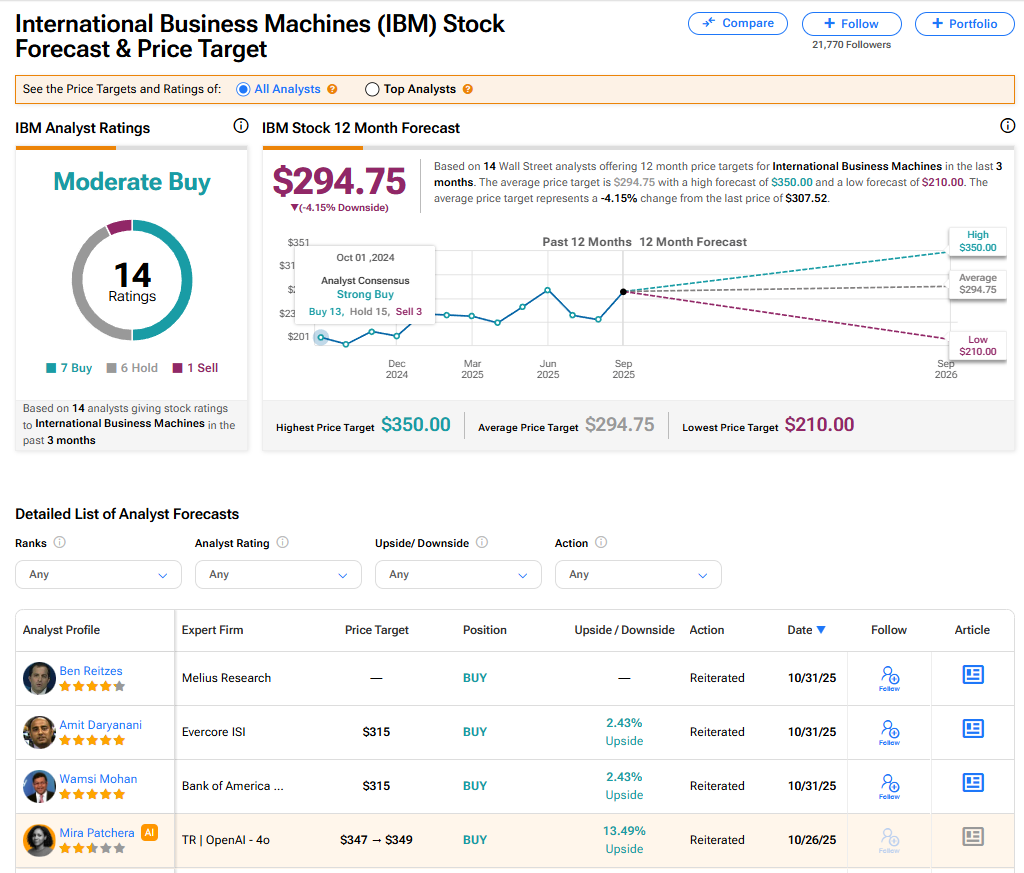

The stock of IBM, a leading quantum computing concern, has a consensus Moderate Buy rating among 14 Wall Street analysts. That rating is based on seven Buy, six Hold, and one Sell recommendations issued in the last three months. The average IBM price target of $294.75 implies 4.15% downside from current levels.