Shares of Qualcomm (QCOM) are surging at the time of writing after the chipmaker announced plans to launch new AI chips for data centers. This will put the firm in direct competition with Nvidia (NVDA), which currently leads the market. Until now, Qualcomm has focused mostly on smartphone and wireless chips, not the powerful chips used in massive AI server farms. Nevertheless, the two new chips, called the AI200 and AI250, are expected to be released in 2026 and 2027 and will come in large, liquid-cooled racks that fill an entire server cabinet, just like the systems offered by Nvidia and AMD (AMD).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, the chips use Qualcomm’s Hexagon neural processing units (NPUs), which were first developed for its smartphone chips. According to Durga Malladi, head of Qualcomm’s data center and edge business, the company wanted to prove its capabilities in mobile devices before moving up to data centers. This expansion comes as global spending on AI data centers is expected to hit $6.7 trillion by 2030, mostly for systems built around AI chips. While Nvidia still dominates the market, other companies like AMD are gaining ground, and tech giants like Google (GOOGL) are building their own AI chips.

Moreover, Qualcomm’s new chips are designed to run AI models rather than train them, and the company says that its racks will be cheaper to run and use about 160 kilowatts, which is on par with Nvidia’s. Qualcomm will also sell its chips and parts separately for customers who want to build their own systems. In addition, while the company didn’t reveal prices or exact specs, it claimed that its chips are more energy-efficient and cost-effective, with support for up to 768GB of memory per card. This is more than what Nvidia or AMD currently offer.

Is QCOM Stock a Good Buy?

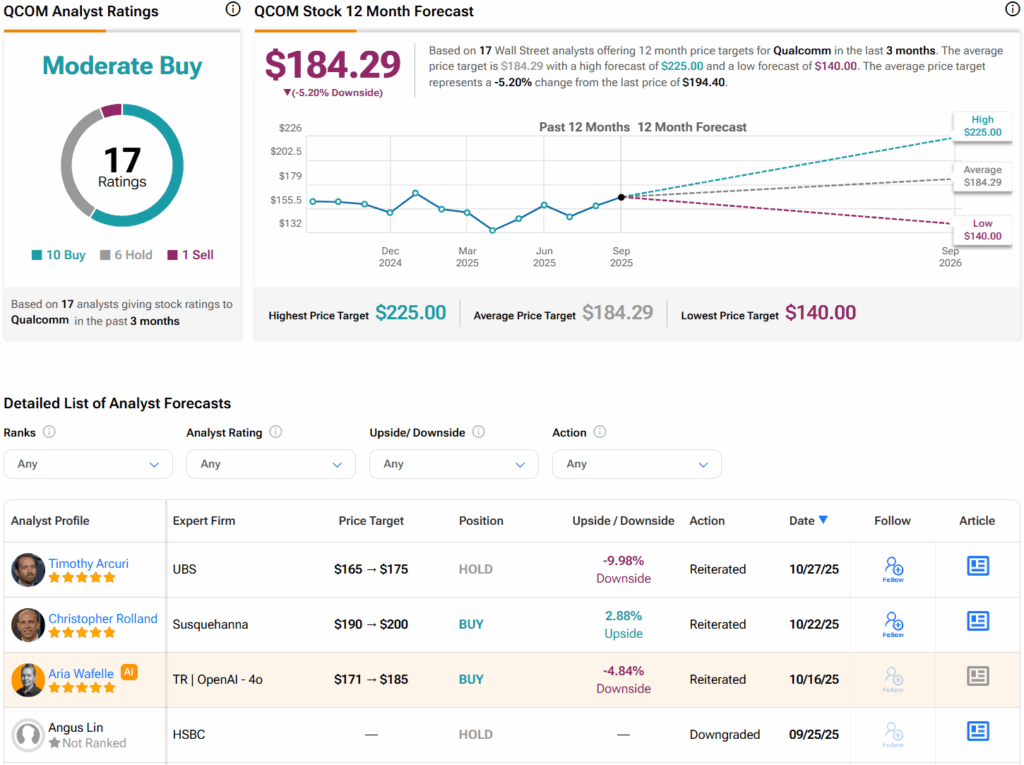

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QCOM stock based on 10 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average QCOM price target of $184.29 per share implies 5.2% downside risk.