Chipmaker Qualcomm (QCOM) announced at this year’s Consumer Electronics Show that it signed deals with Hyundai Mobis (HYMLF) and Volkswagen (VWAGY) in order to grow its automotive unit. Interestingly, both deals will focus on improving vehicle software, with smarter driver assistance, better infotainment systems, and stronger connectivity.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With Hyundai Mobis, Qualcomm will work on smart-driving features such as automated parking and driving assistance. Their first goal is to build these systems using Qualcomm’s Snapdragon Ride Flex chip and bring them to fast-growing markets like India, where demand for smarter, safer cars is rising. Over time, the two companies plan to build more advanced systems that combine Hyundai’s software with Qualcomm’s chip technology. The goal is to make future vehicles more efficient, stable, and easier to upgrade.

Meanwhile, Qualcomm is expanding its long-term relationship with Volkswagen. The plan is to use Qualcomm’s Snapdragon Digital Chassis and Cockpit platforms to power new in-car entertainment systems and advanced driving features, starting in 2027. These systems will support wireless updates and could even help with self-driving capabilities. The company will also add 5G and real-time communication features for safer, more connected driving.

Is QCOM Stock a Good Buy?

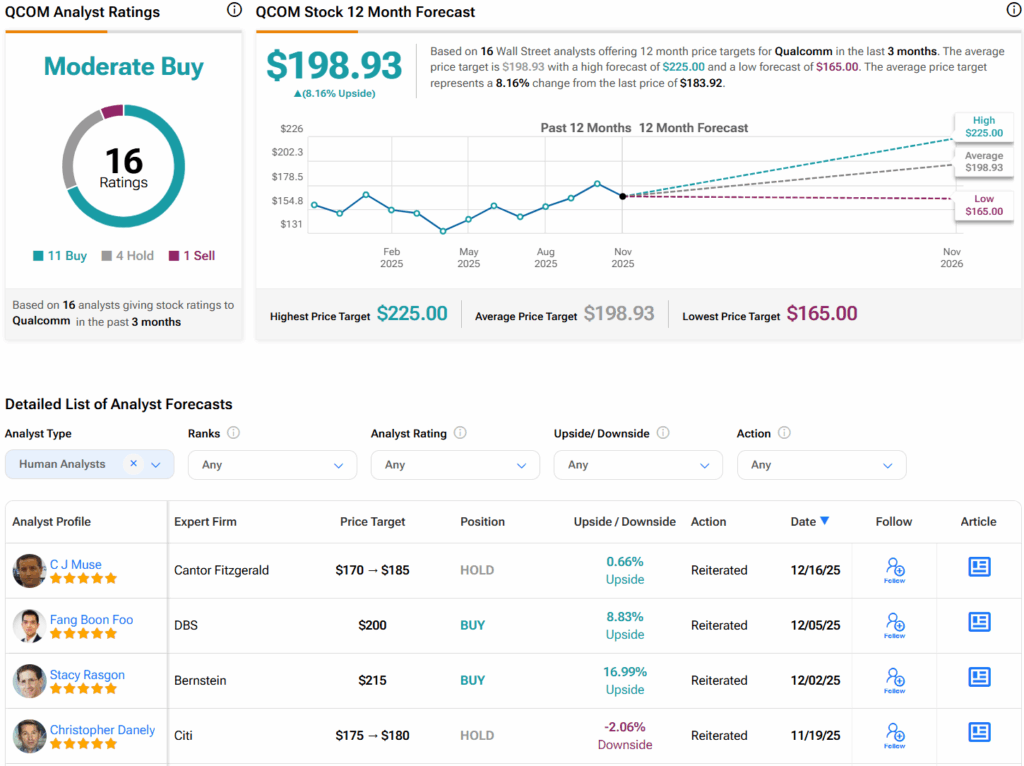

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QCOM stock based on 11 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average QCOM price target of $198.93 per share implies 8.2% upside potential.