Chipmaker Qualcomm (QCOM) announced that a U.S. District Court judge granted the company a “complete victory” over Arm Holdings (ARM) in their long-running licensing dispute. The judge ruled that neither Qualcomm nor its subsidiary Nuvia breached Nuvia’s license agreements with Arm. However, the legal battle could continue as Arm stated that it will “immediately file an appeal seeking to overturn the judgment.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Arm Holdings stated that it remains confident about its position in its ongoing dispute with Qualcomm.

Qualcomm Wins Favorable Court Ruling

Qualcomm stated that the U.S. District Court dismissed the lone remaining claim in Arm’s lawsuit against the company and Nuvia, in which Arm alleged breach of the architecture license agreement (ALA) with Nuvia.

The ruling follows Qualcomm’s win over Arm during the December 2024 trial in which a jury decided unanimously that the chip giant did not breach the Nuvia ALA and that the central processing unit (CPU) cores obtained in the Nuvia acquisition were properly licensed under QCOM’s own ALA. The Court upheld the December 2024 jury verdicts and rejected Arm’s attempts to overturn them. Furthermore, the Court rejected Arm’s request for a new trial.

“Our right to innovate prevailed in this case and we hope Arm will return to fair and competitive practices in dealing with the Arm ecosystem,” said Ann Chaplin, Qualcomm’s General Counsel & Corporate Secretary.

Is QCOM a Good Stock to Buy?

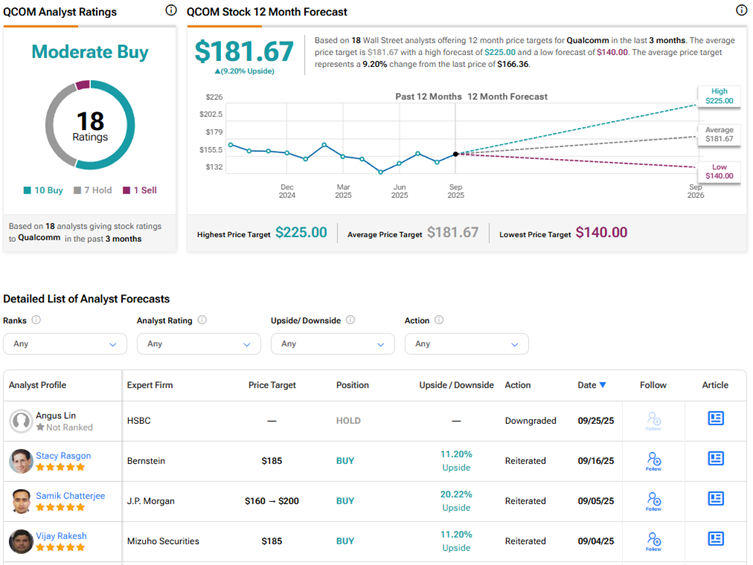

Currently, Wall Street has a Moderate Buy consensus rating on Qualcomm stock based on 10 Buys, seven Holds, and one Sell recommendation. The average QCOM stock price target of $181.67 indicates 9.2% upside potential from current levels. QCOM stock has risen 10% year-to-date.