Tech giants Adobe (ADBE) and Qualcomm (QCOM) are expanding their relationship with the use of Adobe GenStudio, which is a generative AI platform that makes content creation faster and more efficient. Indeed, Qualcomm plans to use the system to improve how its marketing teams develop and deliver personalized campaigns. More specifically, GenStudio will help automate work such as resizing, translating, and creating variations of marketing materials, while also linking together workflows across teams.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To put this into practice, Qualcomm will use several of Adobe’s tools. These include GenStudio for Performance Marketing, which helps make sure that content remains consistent with brand guidelines, and Adobe Firefly, an AI model that is trained to generate on-brand images. The company will also expand its use of Adobe Experience Manager in order to test different content variations for specific audiences.

Unsurprisingly, executives from both companies stated that the partnership is meant to address the growing pressure on marketers to produce more content. Don McGuire, who is Qualcomm’s Chief Marketing Officer, said that GenStudio will help the company create personalized assets more quickly while having a greater impact. In addition, Varun Parmar, the General Manager of Adobe GenStudio, added that inefficient content pipelines often slow businesses down, and this platform is designed to solve that problem.

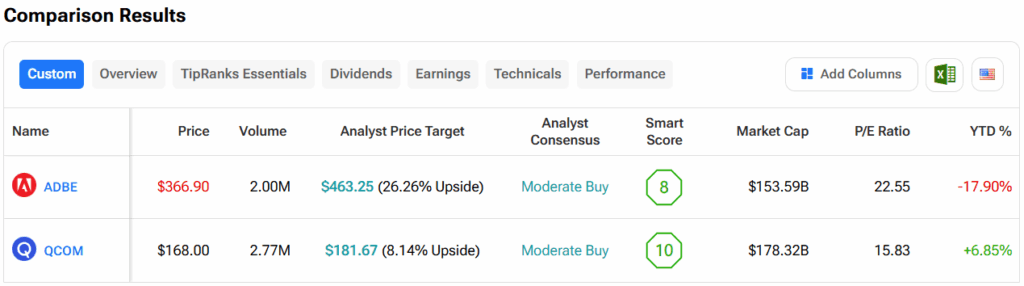

Which Tech Stock Is the Better Buy?

Turning to Wall Street, out of the two stocks mentioned above, analysts think that ADBE stock has more room to run than QCOM. In fact, ADBE’s price target of $463.25 per share implies 26.3% upside versus QCOM’s 8.1%.