Restaurant Brands International (QSR) has reported first-quarter financial results that missed Wall Street’s expectations due to a same-store sales decline at its Burger King and Tim Hortons chains.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Toronto-based company, which also owns restaurant chains Popeyes and Firehouse Subs, announced earnings per share (EPS) of $0.75, which missed the consensus estimate among analysts of $0.78. Revenue in the period totaled $2.11 billion, which missed the $2.13 billion that was forecast on Wall Street.

Overall sales were up 21% from a year earlier due to higher revenue generated at Popeyes and Firehouse Subs. However, Restaurant Brands posted overall same-store sales growth of only 0.1% as its three largest brands saw same-store sales decline during the quarter.

Strong Overseas Traffic

Tim Hortons, a leading chain in Canada that accounts for more than 40% of Restaurant Brands’ revenue, reported that its same-store sales fell 0.1%, missing analyst estimates that called for growth of 1.4%. Burger King’s same-store sales shrank 1.3%, steeper than estimates of a 0.9% decline. Popeyes saw its same-store sales slide 4%, the biggest drop of the quarter.

While demand was weak in the key markets of Canada and the U.S., Restaurant Brands fared better abroad, with its international segment posting same-store sales growth of 2.6%. In terms of 2025 guidance, Restaurant Brands reiterated its previous outlook that calls for $400 million to $450 million in capital expenditures and 3% same-store sales growth.

QSR stock is up 4% this year.

Is QSR Stock a Buy?

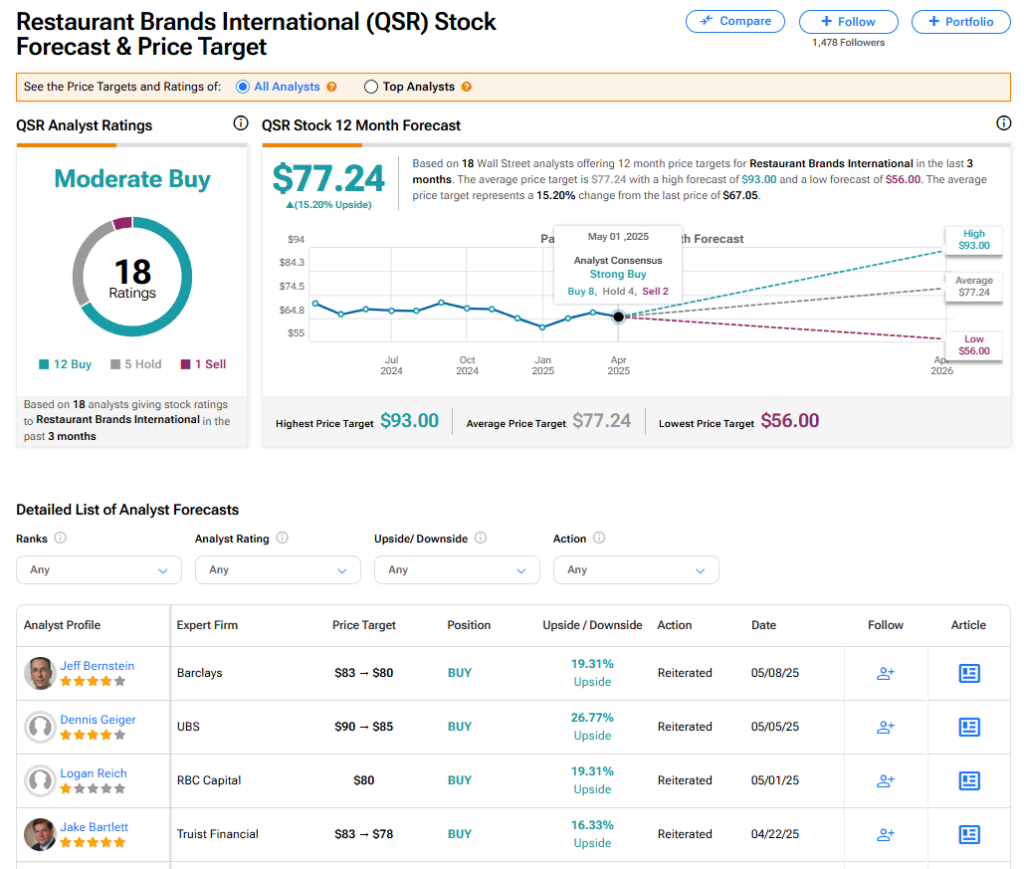

The stock of Restaurant Brands International has a consensus Moderate Buy rating among 18 Wall Street analysts. That rating is based on 12 Buy, five Hold, and one Sell recommendations issued in the past three months. The average QSR price target of $77.24 implies 15.20% upside from current levels. These ratings are likely to change after the company’s financial results.