Shares of Restaurant Brands International (QSR) slumped in pre-market trading after the company’s Q3 results fell short of estimates. The company behind brands like Burger King and Tim Horton’s saw its Q3 adjusted earnings increase by 4.6% year-over-year on an organic basis to $0.93 per share, which fell slightly short of consensus estimates of $0.94 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

QSR’s Tim Horton’s Revenues Inch Higher in Q3

Furthermore, the company’s revenues increased by 24.7% year-over-year to $2.3 billion in the third quarter. In comparison, analysts were expecting revenues of $2.33 billion. In addition, QSR’s comparable sales inched higher by 0.3% in the third quarter.

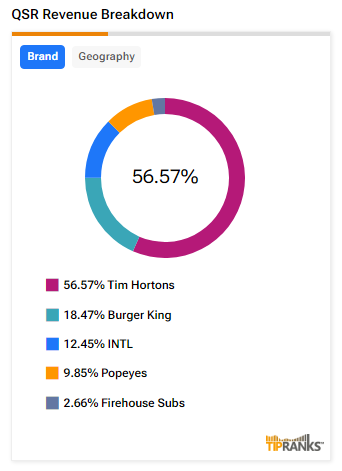

Looking at QSR’s revenue breakdown in Q3, Tim Horton’s brand remained the top performer. This coffee shop chain comprised more than 45% of its total Q3 revenues and clocked revenues of $1.04 billion, a rise of 0.7% year-over-year.

QSR Reiterates Outlook

Looking ahead, the company expects capex of around $300 million in FY24, with adjusted net interest expense likely to be between $565 million and $575 million. Over the long term, between 2024 and 2028, the company expects to achieve an average growth of 3% in comparable sales and an 8% rise in system-wide sales growth. Additionally, during this same period, QSR expects to achieve an average adjusted operating margin “at least as fast as system-wide sales growth.”

Is QSR Stock a Good Buy?

Analysts remain cautiously optimistic about QSR stock, with a Moderate Buy consensus rating based on 11 Buys, six Holds, and one Sell. Over the past year, QSR has increased by more than 5%, and the average QSR price target of $84.07 implies an upside potential of 20% from current levels. These analyst ratings are likely to change following QSR’s results today.