The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index (NDX). It gives exposure to 100 of the largest non-financial companies on the Nasdaq exchange. Its low expense ratio and liquidity make it an attractive option for those seeking long-term growth in high-growth sectors. The QQQ stock is down 8% so far in 2025 due to market volatility and fears of a potential economic slowdown. However, technical indicators suggest that QQQ stock is a Buy, on a one-month timeframe, implying further upside from current levels.

Analyzing QQQ Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, QQQ ETF is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 375.99, while its price is $468.94, implying a bullish signal. Further, its shorter duration EMA (20 days) also signals an uptrend.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For QQQ, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. QQQ stock currently has an ROC of 16.66, which signals a Buy.

Is QQQ ETF a Good Buy?

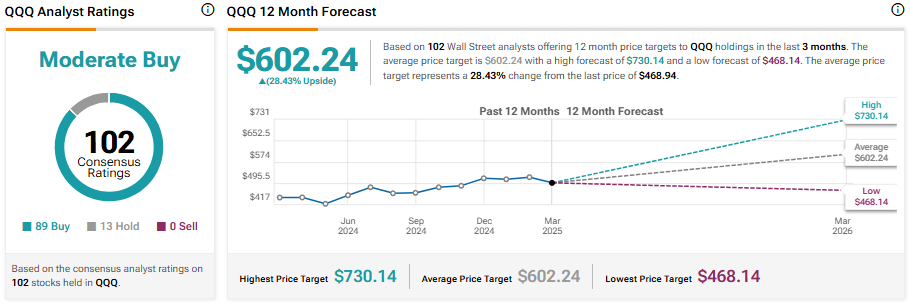

Turning to Wall Street, QQQ stock has a Moderate Buy consensus rating based on 89 Buys and 13 Holds assigned in the last three months. At $602.24, the average QQQ ETF price target implies a 28.43% upside potential.