Shares of Qualcomm (QCOM) surged in after-hours trading after the semiconductor and equipment giant announced its third-quarter earnings, which exceeded market expectations. The company reported earnings of $2.33 per share on revenue of $9.39 billion versus analysts’ predictions of $2.25 per share on revenue of $9.22 billion. Interestingly, QCOM has beaten earnings estimates in its previous nine quarters (including today).

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

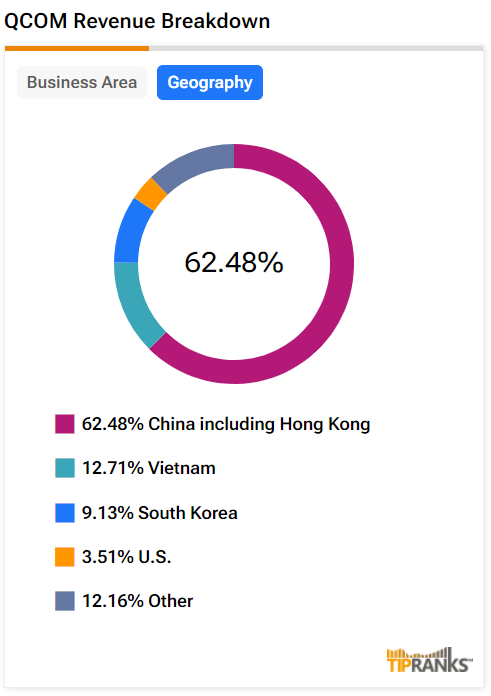

When breaking down Qualcomm’s revenue, we can see that over 62% of its business comes from China and Hong Kong, as shown in the image below. This is followed by Vietnam and South Korea, at over 12% and 9%, respectively. Only 3.15% of the firm’s revenue comes from the U.S.

For the upcoming fourth quarter, Qualcomm projects earnings of $2.45 to $2.65 per share and anticipates revenue to fall between $9.5B to $10.3B. These forecasts, at the midpoint, surpassed analysts’ expectations, which were pegged at earnings of $2.47 per share and revenue of $9.7 billion.

Is Qualcomm a Buy, Sell, or Hold?

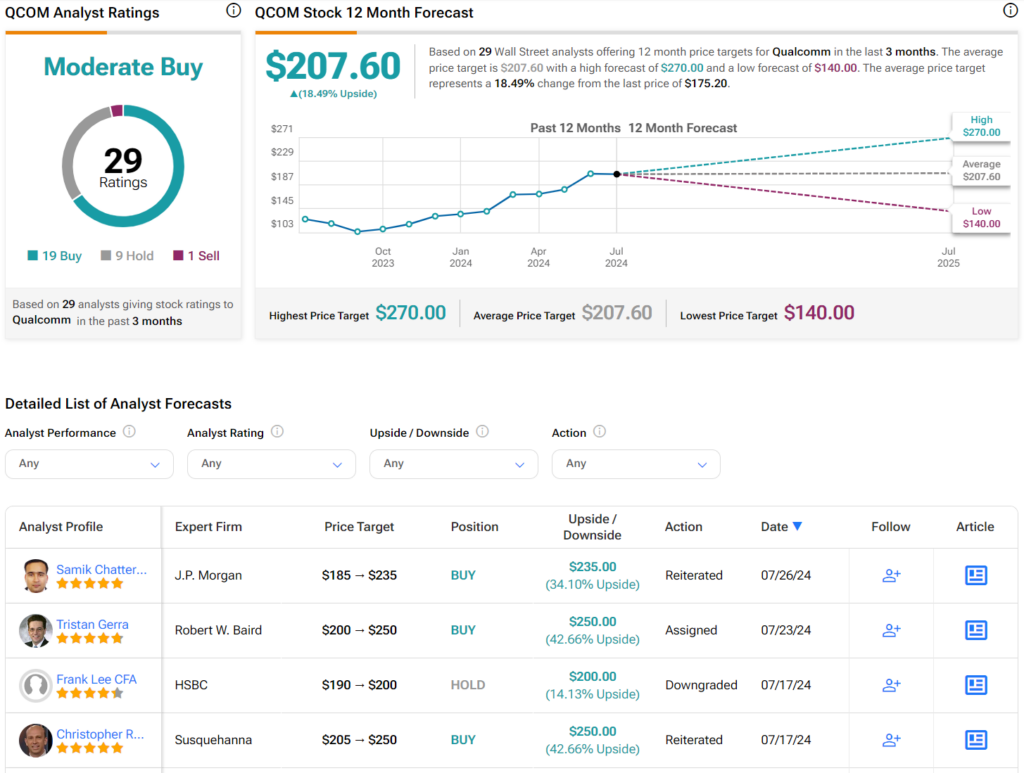

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QCOM stock based on 19 Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 36% rally in its share price over the past year, the average QCOM price target of $207.60 per share implies 18.49% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.