Shares of Qualcomm (QCOM) fell in after-hours trading after the semiconductor and equipment giant announced its second-quarter earnings, which exceeded market expectations. The company reported earnings of $2.85 per share on revenue of $10.98 billion versus analysts’ predictions of $2.82 per share on revenue of $10.64 billion. Interestingly, QCOM has beaten earnings estimates in its previous nine quarters (including today).

The most significant segment for the company was the QCT segment, which designs and provides software and other technologies for smartphones and other devices. QCT sales grew by 18% year-over-year to $9.47 billion. Handsets were the major growth driver of QCT sales, as revenue increased 12% to $6.92 billion.

Guidance for Q3 2025

Looking forward, management has provided the following guidance for Q3 2025:

- Q3 revenue between $9.9 billion and $10.7 billion versus estimates of $10.35 billion

- Q3 EPS of 2.60 to $2.80 compared to expectations of $2.69

As you can see, the earnings guidance was just slightly better than expected at the midpoint. However, the revenue guidance missed, which is likely why the stock price fell in after-hours trading.

Is Qualcomm a Buy, Sell, or Hold?

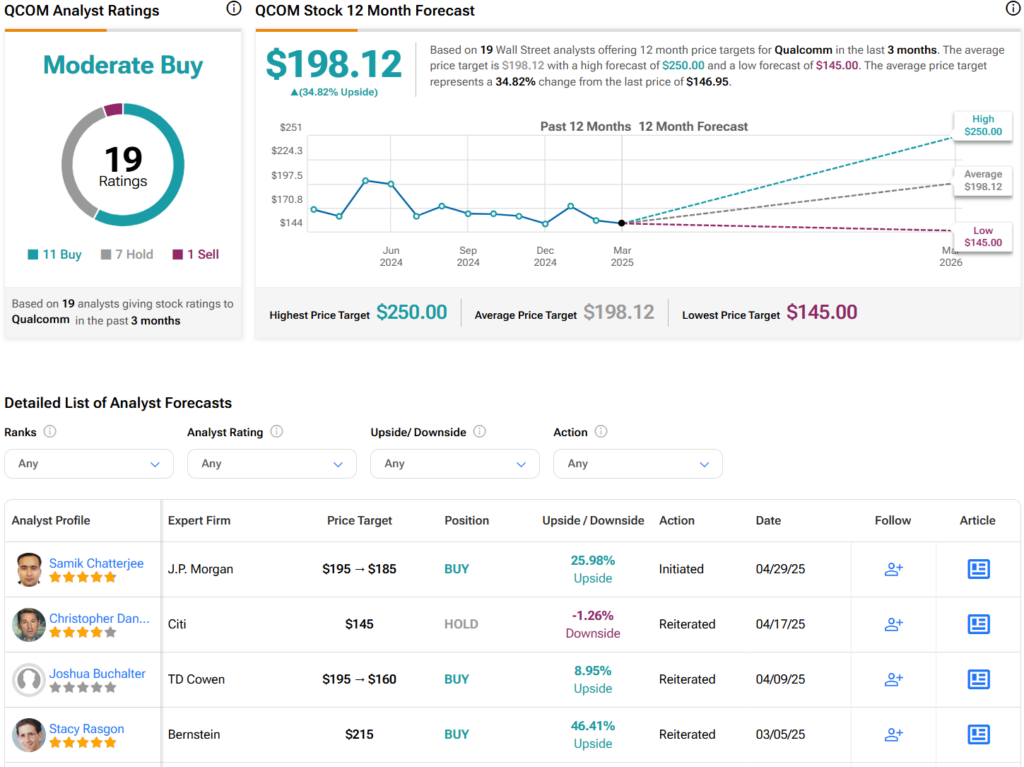

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QCOM stock based on 11 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average QCOM price target of $198.12 per share implies 34.8% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.