PayPal (PYPL) stock took a beating on Tuesday following the release of the payment company’s Q2 2025 earnings report. Adjusted earnings per share of $1.40 came in above Wall Street’s estimate of $1.30, and also increased 17.65% year-over-year from $1.19 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue reported by PayPal in Q2 was $8.3 billion, compared to analysts’ estimate of $8.08 billion. The company’s revenue was up 5% year-over-year from $7.86 billion. PayPal President and CEO Alex Chriss attributed this to “continued strength across many of our strategic initiatives ranging from PayPal and Venmo branded experiences to PSP and value-added services.”

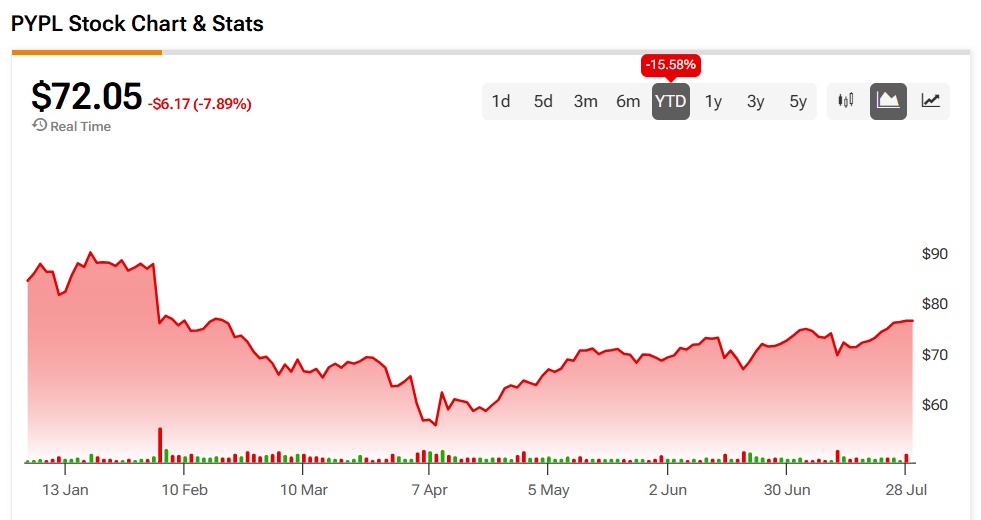

PayPal stock was down 7.89% on Tuesday morning, extending a 15.58% drop year-to-date. However, the shares were up 22.22% over the past 12 months.

PayPal Guidance

PayPal provided updated guidance in its latest earnings report. The company expects adjusted earnings per share for Q3 2025 to range from $1.18 to $1.22. This would see the midpoint of $1.20 per share match Wall Street’s estimate for the period.

PayPal also included an updated 2025 outlook in its Q2 2025 earnings report. This has it expecting adjusted EPS for the year between $5.15 and $5.30. With a midpoint of $5.23, this would come in well above analysts’ estimate of $5.09 for the year.

The company also recently introduced a “Pay with Crypto” feature. It’s unclear how this addition will affect future earnings, but it could be a strong source of extra revenue for the payment processor.

Is PayPal Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for PayPal is Moderate Buy, based on eight Buy, 10 Hold, and two Sell ratings over the past three months. With that comes an average PYPL stock price target of $80.50, representing a potential 12.68% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.