Digital payments giant PayPal’s (NASDAQ:PYPL) shares soared by over 6% today after its first-quarter results smashed estimates on the back of higher payment volumes. Revenue increased by 10% year-over-year to $7.7 billion, exceeding estimates by $180 million. Similarly, the EPS of $1.40 outpaced consensus by $0.18.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

PayPal’s Robust Q1 Growth

During the quarter, PayPal’s total payment volume increased by 14% to $403.9 billion, and payment transactions improved by 11% to $6.5 billion. Importantly, the company’s payment transactions per active account increased by 13% to 60 on a trailing 12-month basis. In contrast, its number of active accounts declined by 1% year-over-year to 427 million. Still, this was an improvement of 0.4% on a sequential basis.

These volume gains were accompanied by a 98 basis point expansion in PayPal’s operating margin. The company’s operating income ballooned by 17% to $1.17 billion.

PayPal’s Forward Guidance

For the upcoming quarter, PayPal expects a 7% increase in its net revenue. The EPS for the quarter is seen rising by a low-double-digit percentage.

For the full year, the company anticipates that its EPS will increase by a mid to high single-digit percentage. This EPS outlook incorporates PayPal’s new methodology for calculating non-GAAP results, which now includes the impact of stock-based compensation expense and associated employer payroll taxes. Under this new methodology, the company’s EPS for the first quarter stood at $1.08.

Is PYPL a Buy, Sell, or a Hold?

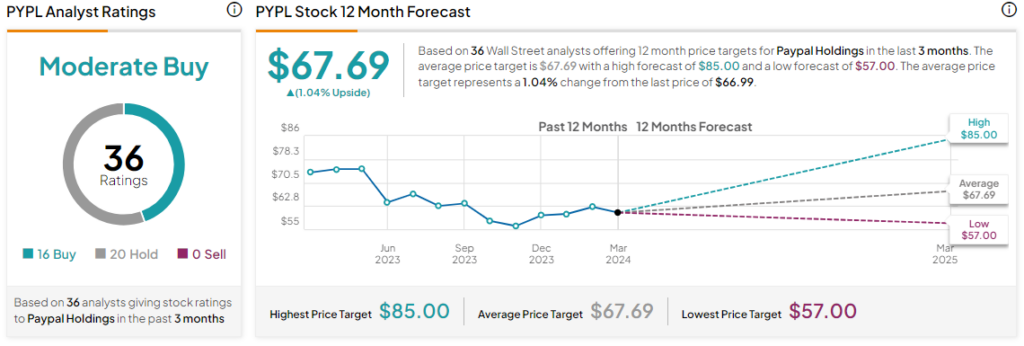

Today’s price gains come on top of a nearly 31% jump in the company’s share price over the past six months. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average PYPL price target of $67.69. However, analysts’ views on PYPL stock could see a revision following today’s earnings report.

Read full Disclosure