Shares of PayPal Holdings (PYPL) gained in trading after the fintech company reported strong Q2 results. The company reported adjusted earnings of $1.19 per share, up by 36% year-over-year, which beat analysts’ consensus estimate of $0.98 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased by 8% year-over-year, with revenue hitting $7.9 billion. This exceeded analysts’ expectations of $7.8 billion. More importantly, PYPL delivered growth on a key metric—transaction margin in dollar terms. This metric measures the profitability of the payment processing business, which grew 8% in Q2 to $3.6 billion. This was the company’s best growth in this metric since 2021.

Growth in Branded Checkout Eases Investor’s Worries

Furthermore, the company highlighted on its earnings call that branded checkout services, such as Braintree and Venmo, experienced the highest growth in transaction margin dollars since 2021. This means these services generated more profit per transaction than they have in recent years. Additionally, total payment volumes in branded checkout grew by about 6% in the second quarter.

This boost in payment volumes was important because it alleviated investor concerns about the impact of lower-margin revenue streams on overall growth. In other words, the strong performance in high-margin services helped offset worries that revenue from less profitable sources could drag down overall financial results.

Investors have been worried about the rising competition from digital wallets such as Apple Pay (AAPL) and Google Pay (GOOGL). These competitors could potentially put pressure on PayPal’s margins.

On the earnings call, PayPal’s CFO, Jamie Miller, highlighted that the company is focusing on high-quality, profitable growth. However, he acknowledged that slower volume and revenue growth are expected for the remainder of the year.

PYPL’s Q3 and FY24 Outlook

Looking forward, management now expects Q3 revenues to grow in “mid-single digits,” while adjusted earnings per share are likely to rise in the high single digits per share. For FY24, PYPL has projected its adjusted earnings to rise in the “low to mid-teens” per share, compared with its prior forecast of a “mid-to-high single-digit” increase.

Is PYPL a Buy or Sell?

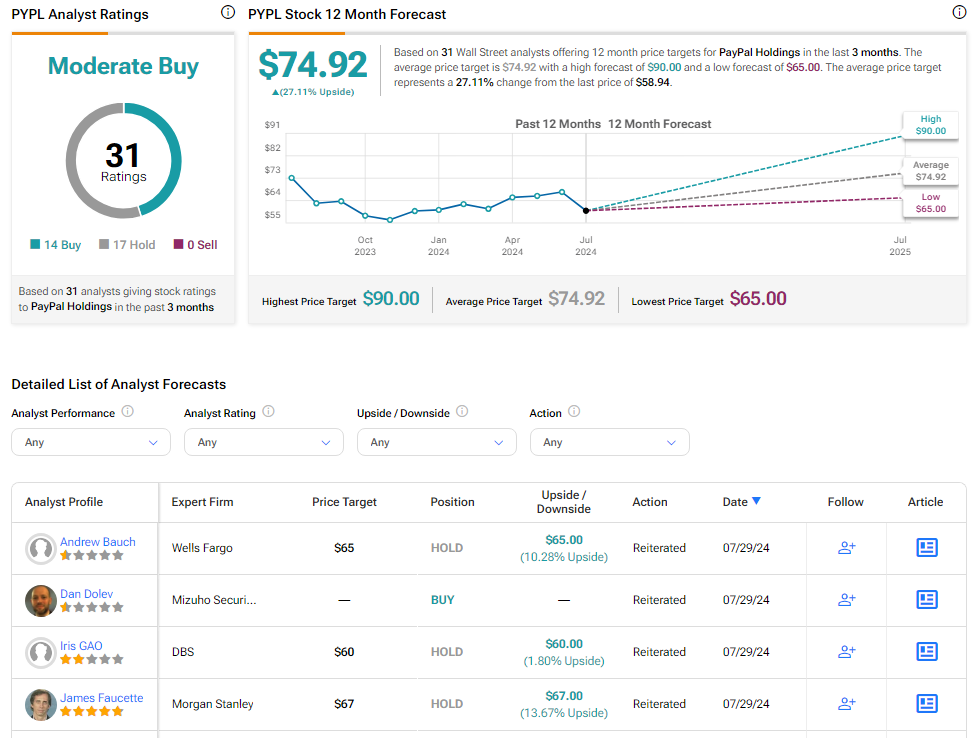

Analysts remain cautiously optimistic about PYPL stock, with a Moderate Buy consensus rating based on 14 Buys and 17 Holds. Over the past year, PYPL has declined by more than 20%, and the average PYPL price target of $74.92 implies an upside potential of 27.1% from current levels. These analyst ratings are likely to change following PYPL’s results today.