U.S. publisher McGraw Hill is planning to hold an initial public offering (IPO) at a valuation of $4.2 billion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in Columbus, Ohio, McGraw Hill is one of the most recognized names in the publishing industry with a global sales team of nearly 1,500 people. The company is best known for producing school textbooks, although it has branched out into digital learning tools and adaptive technologies in recent years.

McGraw Hill is looking to raise up to $537 million by issuing 24.39 million shares priced between $19 and $22 apiece. An exact date for the IPO has not yet been set. But the company plans to trade on the New York Stock Exchange (NYSE) under the ticker symbol “MH.”

Tapping Public Markets

McGraw Hill is the latest in a series of U.S. companies that have gone public this year, following CoreWeave (CRWV) and Circle Internet Group (CRCL) in recent months. Market hopefuls are tapping public markets as investor sentiment remains largely bullish.

The U.S. IPO market has gotten a lift since U.S. President Donald Trump returned to the White House in January of this year, and as trade and tariff turmoil has settled down. Wall Street investment bank Goldman Sachs (GS) is serving as the lead underwriter for McGraw Hill’s upcoming IPO.

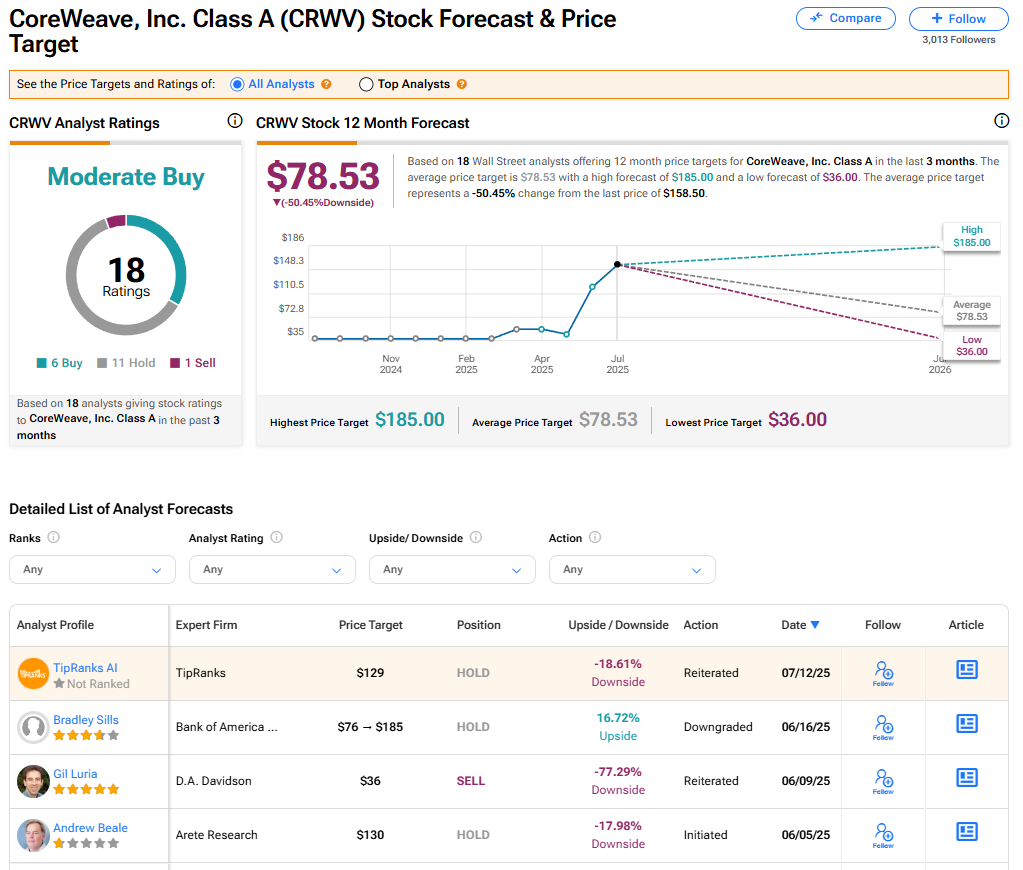

Is CRWV Stock a Buy?

As McGraw Hill is not yet publicly traded, we’ll look at the stock of another recent IPO, CoreWeave. CRWV stock has a consensus Moderate Buy rating among 18 Wall Street analysts. That rating is based on six Buy, 11 Hold, and one Sell recommendations issued in the last three months. The average CRWV price target of $78.53 implies 50.45% downside from current levels.