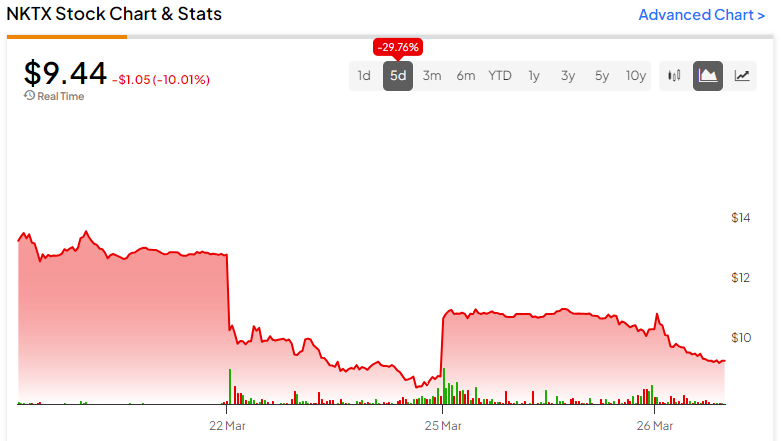

Investors interested in clinical-stage biopharmaceutical companies like Nkarta (NASDAQ:NKTX) are often in a dilemma due to the uncertainty related to drug development and regulatory approval. NKTX recently was on a rollercoaster ride of a 31% price drop in the shares, only to have it whip back 17.6% the next trading day. At this stage, though apparently promising, Nkarta is an appropriate investment target only for those investors seeking to add highly speculative biopharma exposure to their diversified portfolio and willing to endure a volatile ride.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Did you know that, on average, it takes 10-15 years and $2.6 billion to develop one new medicine? Only roughly 10% of new drug treatments will survive Phase I, Phase II, Phase III, and FDA review to make it to market.

To put it another way, 90% of the potential treatments in biopharmaceutical company pipelines will consume time, company resources, and investor capital but deliver no tangible financial results. With this backdrop, let’s delve deeper into NKTX stock.

What Does Nkarta Do?

Nkarta is a clinical-stage biopharmaceutical company focused on developing and commercializing natural killer cell therapies for cancer and autoimmune disease treatment. The company has recently shifted focus to a new lead product, NKX019 (currently in Phase 1 clinical trials), which targets the treatment of relapsed/refractory non-Hodgkin Lymphoma and potentially Lupus Nephritis.

The global non-Hodgkin’s Lymphoma treatment market is expected to reach $20 billion by 2036, while the Lupus Nephritis treatment market is projected to grow to around $3.32 billion by 2029.

Nkarta shifted its focus away from NKX101, a product candidate for treating r/r acute myeloid leukemia, higher-risk myelodysplastic syndrome, and solid tumors, to NKX019. This had been its most promising pipeline candidate and had engendered a good deal of investor enthusiasm. The company’s announcement of a shift in focus likely led to the recent bout of share volatility, as bulls and bears voted with their dollars on the outlook for the company’s research pipeline priorities.

The Current State of Nkarta’s Financials

Having yet to bring a treatment to market, Nkarta has no revenue. The company recently reported Q4 results and announced an EPS of -$0.57, slightly better than the consensus of -$0.58.

The company’s financial position appears to be solid. Its current cash and equivalents, totaling $250.9 million, are projected to adequately fund operations into 2026.

The company also just priced an underwritten stock offering of 21,010,000 shares at $10 per share, alongside pre-funded warrants allowing the purchase of an additional 3,000,031 shares. The offering attracted a mix of new and existing investors and is set to generate roughly $240.1 million in gross proceeds. The funds raised will support continued research and clinical development, enhancement of internal manufacturing capabilities, and arrangement of working capital for general corporate purposes.

What is the Forecast for NKTX Stock?

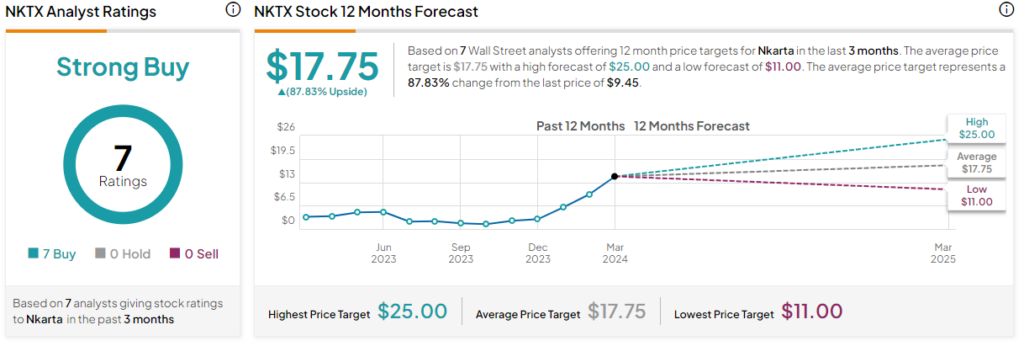

Analysts following Nkarta have been quite bullish on its prospects. In a recent report, H.C. Wainwright analyst Emily Bodnar reiterated a Buy rating on NKTA stock with a price target of $20. The analyst highlights the strategic shift toward the development of NKX019, which strengthens the optimistic forecast for the company, given its potential.

The company is currently rated a Strong Buy based on Buy ratings from seven Wall Street analysts in the past three months. Their average price target for NKTX is $17.75, which suggests an 87.83% upside from current levels.

Final Verdict on NKTX

Navigating the volatile terrain of biopharmaceutical investment is not for the faint-hearted. Yet, Nkarta’s recent strategic shift and strong financial position offer a promising beacon for patient investors willing to sustain the biopharma sector’s ebbs and flows and the stock price’s ups and downs.