Prologis (NYSE:PLD) reported better-than-expected results for the fourth quarter of 2023, despite a challenging macroeconomic environment. Despite beating estimates, PLD stock fell 2.4% in yesterday’s trading session. The decline can be attributed to investors’ concerns over the slowing average occupancy growth rate.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

PLD is a global logistics real estate company specializing in industrial properties.

Q4 Snapshot

PLD reported Q4 net earnings of $0.68 per share, which surpassed the Street’s expectations of $0.59 and increased 8% year-over-year. Meanwhile, the company’s revenues rose by about 7.8% to $1.89 billion. Also, the top line came in higher than the consensus estimate of $1.85 billion.

Moreover, the company’s rental income increased 10.4% year-over-year to $1.76 billion. Also, leasing activity improved to 43.7 million square feet (msf), compared with 42.5 msf in the year-ago quarter.

The Q4 average occupancy level in Prologis’ owned and managed portfolio was 97.1%, in line with the prior quarter but down 90 basis points on a year-over-year basis. Furthermore, PLD’s share of net effective rent change declined to 74.1% in the fourth quarter due to its geographic mix.

Looking ahead, the company expects annual market rent to increase between 4% and 6% over the next three years. Additionally, PLD expects to report net earnings in the range of $3.20 to $3.45 per share in 2024. Further, the average occupancy level is anticipated to be between 96.50% and 97.50%.

Is PLD a Good Stock to Buy?

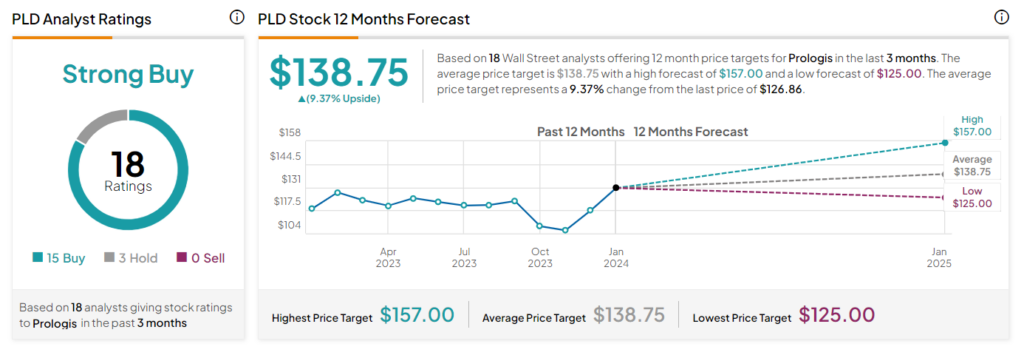

Overall, Wall Street analysts have a Strong Buy consensus rating on the stock. This is based on 15 Buys and three Holds assigned in the past three months. At $138.75, the average Prologis stock forecast suggests 9.4% upside potential. Shares of the company have gained 22.3% in the past three months.

Supporting the bull case is PLD’s impressive dividend history. The company has been increasing payouts every year since 2014. Overall, PLD scores a Smart Score of “Perfect 10,” implying it has the potential to beat the broader market averages.