Prologis (PLD) has long been known as a strong dividend stock, and its recent pivot into AI by making a major foray into data centers makes it an even more attractive long-term investment opportunity.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

I’m bullish on Prologis based on its large and diversified portfolio of properties, unmatched size and scale in the REIT sector, strong balance sheet, its push into lucrative and higher-margin opportunities in data centers, and attractive 2.91% dividend yield.

What Is Prologis?

With a market cap of $118.24 billion, Prologis is the world’s largest real estate investment trust, or REIT (a publicly traded real estate investment company that distributes most of its income to investors and follows specific rules).

The San Francisco-based company owns 1.2 billion square feet of real estate spanning nineteen countries across four continents.

Leveraging Unmatched Size and Scale

As the largest REIT with an extensive and diversified global portfolio of properties (not to mention access to $58 billion of third-party capital), Prologis enjoys unmatched size, which gives it significant scale advantages. It can also serve as a one-stop shop for its customers, with a wide variety of property types to serve their needs. The company’s 2022 acquisition of competitor Duke Realty, another major industrial REIT, compounded these advantages.

I like Prologis’ strong diversification across geographies and customers, as this gives the company plenty of downside protection to weather the blow if one customer or industry suffers a downturn in its fortunes.

Prologis Diversifies into AI-Driven Markets

Prologis is also becoming more diversified in terms of the industries it serves. The company is best known as an industrial REIT, specializing in facilities like warehouses and fulfillment centers for online retailers and B2B companies. But Prologis doesn’t solely limit itself to these types of properties. It describes itself as being focused on “high-barrier, high-growth markets.”

One of these high-growth markets is data centers, thanks to the proliferation of generative AI applications. Prologis says it will be investing $7-8 billion into 3GW of data center development through 2028, and this seems like a strong and well-timed way to diversify into a compelling area of long-term growth. Prologis currently has $1.4 billion of development in data centers underway.

The company views this as its best use of capital, stating that these offer a development yield of 7.5-10% (versus 6.5%-7.5% for developing new warehouses), and a margin of 25-50% (versus 15-20% for warehouses). The growth outlook for data centers looks compelling.

Supporting this, McKinsey & Company, a global management consulting firm, projects that power demand from data centers will more than double from 17GW in 2022 to 35GW by 2030. Additionally, some critics point out that industrial properties like warehouses are fairly commoditized and easily replaceable, so expanding into data centers will give Prologis more differentiation and a bigger moat around its business.

While there is considerable competition in the data center REIT sector from major players like Equinix (EQIX) and Digital Realty (DLR), the massive projected growth in demand indicates there is likely room for multiple winners. Plus, Prologis’ strong position as the largest REIT globally will surely give it confidence that it can effectively compete in this area.

Prologis Delivers an Attractive and Growing Dividend Yield

Prologis currently yields 2.91% on a forward basis. This is an attractive dividend yield, and it’s worth noting that Prologis yields more than twice as much as the S&P 500 (SPX), which currently sports a yield of just 1.3%.

Prologis is a strong dividend stock for other reasons as well. The company has a proven history of paying and increasing its dividend, having issued payments for 13 consecutive years and raised its dividend for the past 10 years. As Prologis is expected to keep increasing its payouts in the coming years, investors purchasing the stock now are likely to see an improved yield-on-cost in the future.

Lastly, the fact that Prologis’ dividend is supported by rental payments from 6,700 customers at its 5,600 buildings gives me confidence in the stability and security of the company’s dividend.

PLD Navigates Challenges amid Port Disruptions

Meanwhile, Prologis may also benefit in the shorter term from a catalyst of an entirely different kind.

Prologis Chairman and CEO Hamid Moghadam says that while the shutdown of ports on the east coast of the United States due to striking longshoremen will cause economic “havoc,” the effect on his company’s business will be “positive” as all of the goods will need storage. However, he doesn’t like making money in this way.

It’s difficult to know how the strikes will play out or what their ultimate effect on the economy will be, but Prologis seems like one business well-equipped to weather the storm better than many other stocks.

Is PLD Stock a Buy, According to Analysts?

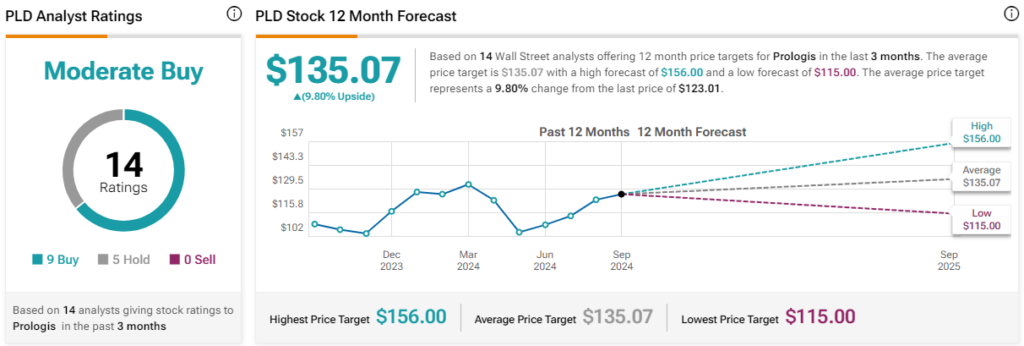

Turning to Wall Street, PLD earns a Moderate Buy consensus rating based on nine Buys, five Holds, and zero Sell ratings assigned in the past three months. The average PLD stock price target of $135.07 implies 9.8% upside potential from current levels.

Intriguing Long-term Opportunity

I’m bullish on shares of Prologis. The company boasts massive size and scale, and a diversified portfolio of properties worldwide that it earns income from. Its attractive 3.1% dividend yield is backed by the 6,700 customers who lease these specialized facilities from Prologis.

Prologis’ move into the lucrative data center market, which is expected to grow rapidly in the years to come and features better returns than the industrial property market, makes it even more intriguing as a long-term investment opportunity poised to benefit from AI tailwinds.