Progress Software (PRGS) has enjoyed a roughly 20% surge in share price after exceeding top and bottom-line expectations for Q3. The company has also embarked on an acquisition journey with ShareFile, a cloud software group unit that provides SaaS-native, AI-powered collaboration tools. This $875 million acquisition is projected to add over $240 million in both annual revenue and annualized recurring revenue (ARR), propelling annual revenue to nearly $1 billion and ARR to over $800 million. Further, the stock trades at a discount to the industry, making it a solid option for value-oriented investors interested in the technology sector.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Progress Growing Through Acquisition

Progress Software specializes in offering a platform for the development and deployment of critical business applications. Their operations are categorized into three business segments. The OpenEdge Business segment aims to boost partner solution sales through product enhancements and marketing aid. The core focus of the Data Connectivity and Integration segment is on the growth of the company’s data assets, including the data integration components of its cloud offering. The Application Development and Deployment segment contributes to developing customer applications.

The company has agreed to acquire ShareFile, a SaaS-native, AI-powered, document-centric collaboration service for various industry sectors, including business and professional services, financial services, healthcare, and construction. This acquisition is expected to add an estimated $240M in annual revenue and more than 86,000 customers.

The company also announced that it will suspend its quarterly dividend at the close of the ShareFile acquisition, intending to redirect this capital towards debt repayment, increased liquidity for future M&A, and share repurchases.

Analysis of Progress’ Recent Financial Results & Outlook

The company recently reported results for Q3. Revenue was $179 million, a 2.3% increase year-over-year, surpassing analyst expectations by $3.07M. The ARR was relatively stable at $582 million. Operating margins reached 23%, while non-GAAP operating margin was 41%. Earnings per share (EPS) grew 17% to $1.26, exceeding estimates by $0.12.

At the quarter’s end, cash and cash equivalents totaled $232.7 million.

Management has updated its fiscal year 2024 guidance, expecting an increase in revenue and a slight decrease in diluted earnings per share. The revised revenue projection is $745-$755 million, while diluted earnings per share are anticipated to be between $1.69 and $1.81. Similarly, the operating margin is expected to be between 16%-17%, with cash from operations or adjusted free cash flow to range between $196 and $206 million.

What Is the Price Target for PRGS Stock?

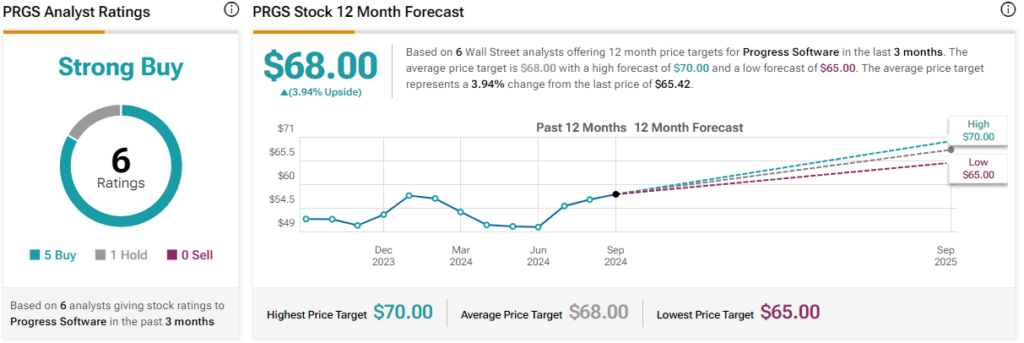

The stock has been on an extended upward run, climbing over 85% in the past five years. It trades near the top of its 52-week price range of $48.00 to $66.52 and shows positive price momentum, trading above its 20-day (59.48) and 50-day (57.51) moving averages. The P/S ratio of 4.1x sits below the Software Infrastructure industry average of 9.5x, suggesting the stock is trading at a relative discount.

Analysts following the company have been bullish on the stock. For example, Guggenheim analyst John DiFucci recently reiterated a Buy rating on the firm while raising the price target on the shares from $70 to $78, noting IT spending has remained consistent, and the company is “set up well” for the rest of the year.

Progress Software is rated a Strong Buy overall, based on six analysts’ cumulative recommendations and price targets. The average price target for PRGS stock is $68.00, which represents a potential upside of 3.94% from current levels.

Progress Software in Summary

Progress Software continues to show solid performance. Its recent financial results beat expectations, and the strategic acquisition of ShareFile is set to further add to annual revenue and ARR. At the same time, the revised fiscal year 2024 guidance anticipates further upside. The company trades at a discount compared to its industry peers, making it an attractive proposition for value-minded investors in the technology sector.