Audio streaming service Spotify Technology (SPOT) has seen its share price double year-to-date and more than triple over the past five years as it continues to rack up new subscribers. Spotify’s business looks like it will continue to grow, but the rally has made the share price expensive and given the stock little room for error. As such, I am neutral on SPOT stock due to its lofty valuation. Still, I acknowledge that it has a good business model and other investors might want to consider it.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Spotify’s Subscriber Additions

Despite my neutral position, Spotify’s growth in monthly active users and paid subscribers is encouraging for long-term investors who have a five to 10 year time horizon. Growth has been a key point for bulls, as the company reached 246 million premium subscribers in the second quarter. That’s a 12% year-over-year increase. The company also has many monthly active users that it can still convert into paid subscribers. Spotify closed the quarter with 626 million monthly active users, which represents a 14% year-over-year increase.

Spotify is also testing out artificial intelligence (AI) playlists that allow users to create lists of songs by typing in their own prompts. It’s currently in Beta testing and is only available in the United Kingdom and Australia. Incorporating AI can keep users engaged in the app, a development that could lead to higher retention rates and more people converting from free users to paid subscribers.

Spotify isn’t just music. It’s also becoming a hub for podcasts and audiobooks. The company features more than 250,000 podcasts. Authors are also turning to the platform to sell their audiobooks. The addition of Countdown Pages for audiobooks will make it easier for listeners to buy new audiobooks when they come out.

Spotify’s Growth is Likely to Accelerate

While I remain neutral on SPOT stock, I admit that the music streaming giant’s most recent guidance offered more fuel for bulls. Spotify’s Q3 2024 outlook implies that the company is headed towards 639 million monthly active users and 251 million premium subscribers. Those are quarter-on-quarter growth rates of 2%. Looking at Q3 2023 results, monthly active users are projected to jump by 11.3% year-over-year while subscribers are expected to rise by 11.1% year-over-year.

Total revenue is forecast to have reached €4 billion in this year’s third quarter, representing a 19.2% year-over-year growth rate. That’s a similar improvement to the firm’s 19.8% year-over-year revenue growth in the second quarter. Profits almost tripled year-over-year as well, which offers more optimism for patient investors.

Spotify’s net income has outpaced revenue growth for several quarters. More growth on the topline should lead to accelerated net income growth. It may not be much longer before Spotify reports net profit margins above 10%. The audio streamer closed out the second quarter with a 7.2% net profit margin.

SPOT Stock’s Valuation is Concerning

The main weakness with Spotify stock is its lofty price-to-earnings (P/E) ratio. It’s the one thing that makes me neutral instead of bullish on this security. The stock sports a 154 P/E ratio, which is at nosebleed levels. Spotify generated $274 million in net income in the second quarter of 2024, which includes a $4 million tax benefit. Multiplying this figure by four results in roughly $1.1 billion compared to a $76 billion market cap.

The valuation is very excessive if you compare Spotify with fellow streaming giant Netflix (NFLX). Netflix trades at a 43 P/E ratio. While Netflix has lower revenue and net income growth rates than Spotify, the video streamer is still posting respectable growth rates. Netflix also has higher profit margins that exceeded 24% in the most recent quarter.

A good company can be a bad stock if the valuation gets too high. While Spotify offers a lot of promise, it’s best to wait for a correction before accumulating shares given the lofty valuation. A lower stock price will minimize the valuation concerns and present a more attractive entry point for investors.

Is Spotify Stock a Buy?

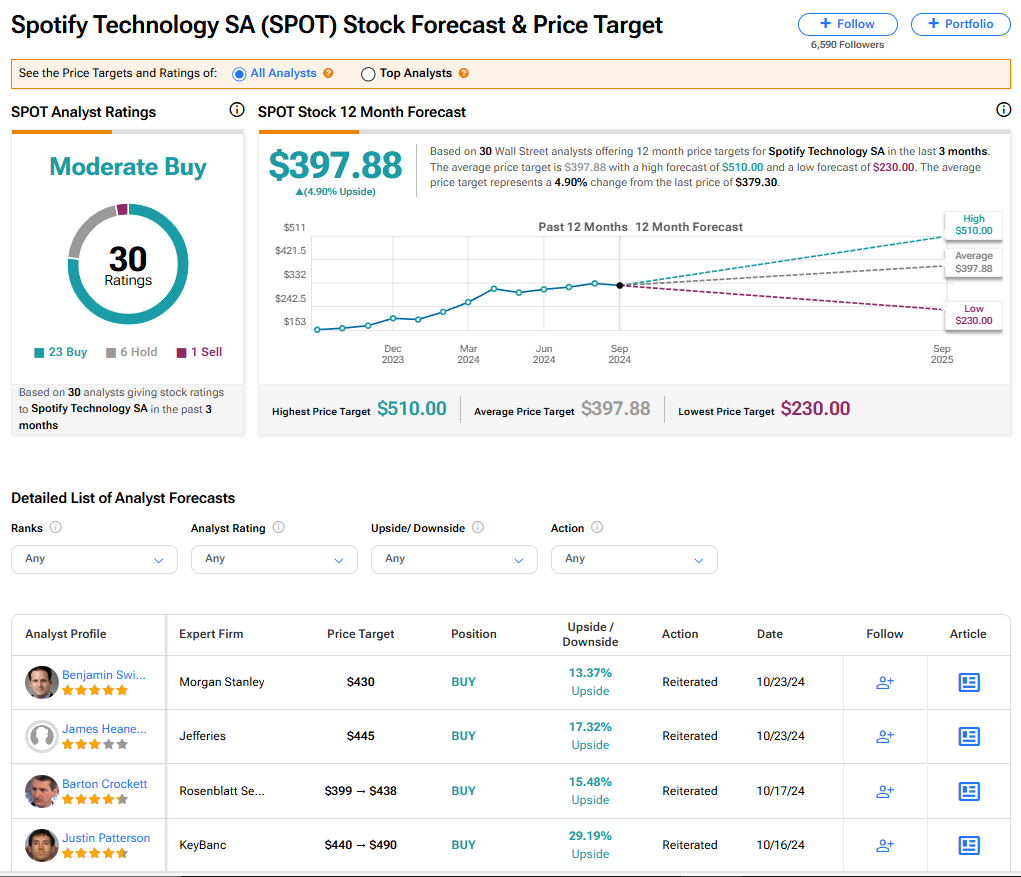

Spotify is currently rated as a Moderate Buy with a projected 5% upside from current levels. The stock has received 23 Buy ratings, six Hold ratings, and one Sell rating. The highest price target of $510 per share suggests 35% upside. However, the lowest price target of $230 per share suggests a potential 39% decline from current levels.

Read more analyst ratings on SPOT stock

The Bottom Line on SPOT Stock

Spotify stock makes more sense for bullish investors who can hold onto the stock for at least five to 10 years. However, a high valuation is discouraging. The business model is strong, but the valuation remains an obstacle. Risk-averse investors who want a better entry point may benefit from waiting for a correction. Investors can choose many other stocks that are posting respectable growth rates and have more reasonable valuations than Spotify. For these reasons, I remain neutral on this security.