Private equity deals in Canada during the first nine months of this year reached a record $56.5 billion, topping pre-pandemic levels.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Canadian Venture Capital and Private Equity Association says there were 483 private equity transactions carried out across the country between January and the end of September this year. However, the record dollar value of the deals was driven by four large privatization deals.

Among the big private equity deals were Garda World Security Corp. going private in a $14-billion deal, an Abu Dhabi sovereign wealth fund buying CI Financial for $12.1 billion, and Innergex Renewable Energy being acquired for $10 billion.

Markets and Economy

The increasing number of Canadian companies being taken private comes amid signs that the economy is slowing and might be headed for a recession due largely to U.S. tariffs. It also comes as a growing number of Canadian companies move away from volatile and demanding public markets.

Canada’s benchmark Toronto Stock Exchange is up 24% this year, outpacing the 17% gain in the S&P 500 index. The rise in private equity deals this year is a notable change from 2022 and 2023, which saw record-low deals totaling $14.7 billion and $10 billion, respectively.

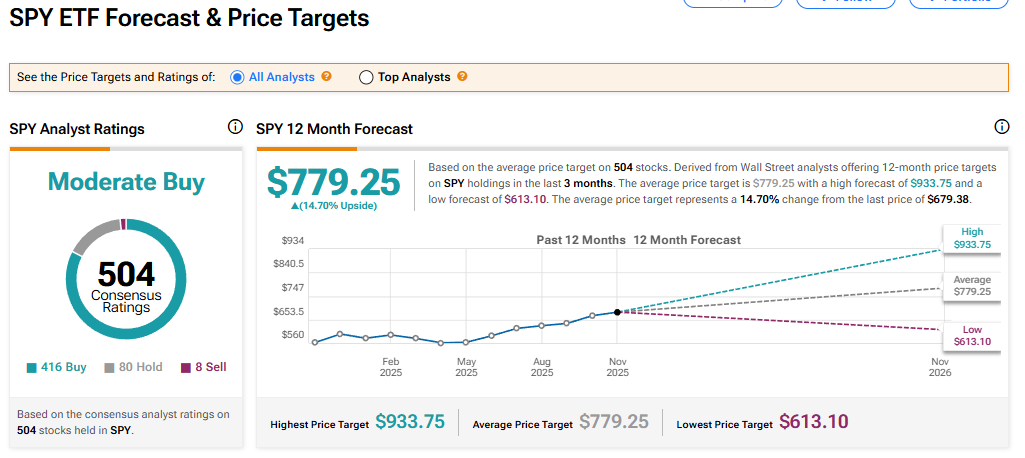

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 416 Buy, 80 Hold, and eight Sell recommendations issued in the last three months. The average SPY price target of $779.25 implies 14.70% upside from current levels.