Streaming giant Netflix (NFLX) may be about to be a victim of its own success. While it has certainly delivered the kind of numbers that make a four-figure-per-share price tag look almost reasonable, there are mounting concerns that Netflix simply cannot keep that kind of growth going forever. Regardless, shareholders are on board, and shares were up over 1.5% in the closing minutes of Monday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, Netflix is doing great right now. It has already raised its guidance once, and that modified guidance looks like it will ultimately happen. Netflix is on track to pull in $13.5 billion in operating income for the year in 2025, and that blows its nearest competitor Disney (DIS) out of the water by better than 10-to-one.

However, there is a potentially fatal flaw lurking here. Netflix stock is priced like Netflix will see explosive growth, running somewhere in the neighborhood of 44 times projected earnings. Granted, Netflix has ambitious internal goals, including hitting the $1 trillion market cap point by 2030. And while Netflix hopes to double its ad business this year, there are still plenty of ways these ambitious targets may falter. And as earlier assessments from about three weeks ago made clear: any disappointment would be a risk.

Growth Fodder

But Netflix is not resting idle. Growth requires new properties, and new fodder. Indeed, Netflix is poised to take a bit of a risk, hoping that lightning will strike twice in the video game adaptation field. Netflix had a winner with The Witcher, and looks to follow that up with an Assassin’s Creed series next. The series is poised to give us “…power and violence and sex and greed and vengeance,” which suggests it will find brisk viewership for at least a couple of episodes.

Further, Netflix will also be bringing in, or bringing back, a slew of reality series shows as well. Harry Jowsey’s search for love will come to a head with Let’s Marry Harry, and Simon Cowell: The Next Act will give us the snarky American Idol judge in his element: creating a boy band from scratch. Further on tap is just about everything from young chefs to bodybuilders and well beyond, so chances are, finding something to watch on Netflix should be just a few remote button presses away.

Is Netflix Stock a Good Buy Right Now?

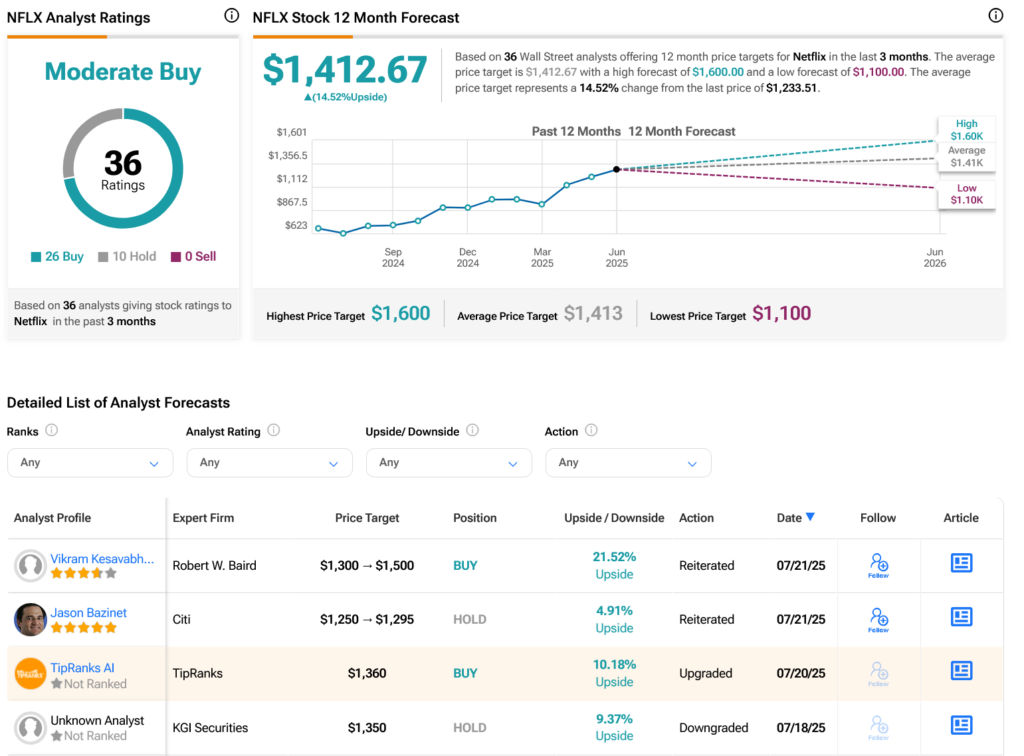

Turning to Wall Street, analysts have a Strong Buy consensus rating on NFLX stock based on 26 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 86.76% rally in its share price over the past year, the average NFLX price target of $1,413 per share implies 14.52% downside risk.