Attacks on Federal Reserve Chair Jerome Powell are intensifying after White House economic adviser Kevin Hassett said that President Donald Trump is “studying” whether to fire the central bank governor.

Hassett said the White House is “actively considering” whether to remove the chairman of the U.S. Federal Reserve before his current term expires in May 2026. Economists and market analysts have warned that firing Powell would call into question the independence of the U.S. central bank and likely upend global financial markets.

Hassett’s comments to the media come a day after Trump reignited his feud with Powell, demanding that he cut interest rates immediately and accusing the Fed chair of “playing politics” by not lowering rates to stimulate the U.S. economy and boost the stock market. Trump has repeatedly threatened to fire Powell, and recently said he wanted to remove the Fed chair “real fast.”

Fed Independence

The latest row between the White House and the Federal Reserve comes after Powell said in a speech he delivered in Chicago that President Trump’s tariffs “complicate” the central bank’s job and that interest rates are likely to remain at current levels until there is greater clarity on the economy’s direction. Those comments led to a steep selloff in U.S. financial markets, angering President Trump.

Following President Trump’s re-election last fall, Powell said that the law does not allow for his removal and that he would not leave as Fed Chair if asked to do so by President Trump. Powell has said that he intends to serve out his current term to the end in May 2026. Somewhat ironically, it was President Trump who appointed Powell as Fed Chair during his first term in office, which ran from 2016 to 2020.

After a series of interest rate cuts last fall, the Fed has left its benchmark policy rate on hold in its current range of 4.25% to 4.50% since last December.

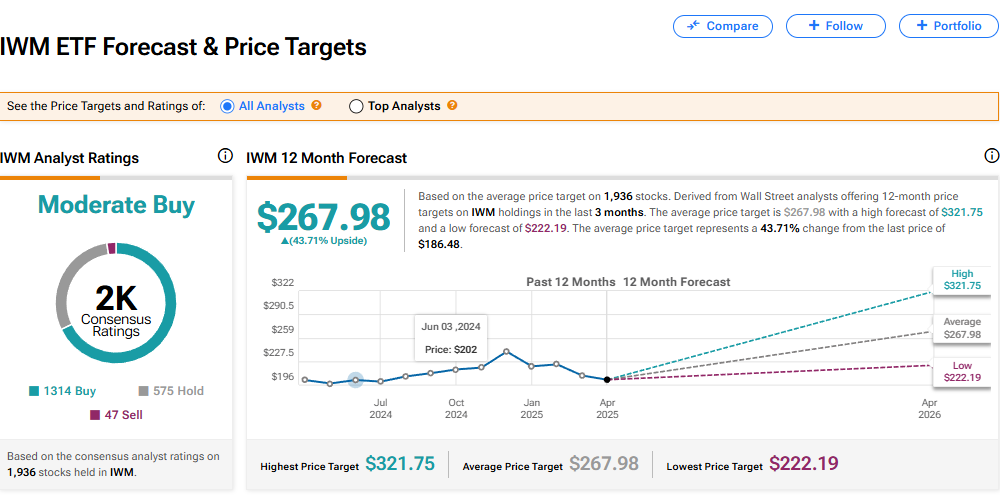

Is the iShares Russell 2000 ETF a Buy?

The iShares Russell 2000 exchange-traded fund (IWM) has a consensus Moderate Buy rating among 1,936 analysts on Wall Street. That rating is based on 1,314 Buy, 575 Hold, and 47 Sell recommendations assigned in the past three months. The average IWM price target of $267.98 implies 43.71% upside from current levels.