Palantir (NASDAQ:PLTR) stock enters the new year against a backdrop of persistent geopolitical flashpoints – some familiar, others newly emerging. As a company that positions itself as a technological bulwark against evolving threats, Palantir should find no shortage of opportunities to put its capabilities to work in 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company has demonstrated a remarkable ability to attract new clients and upsell existing ones, from both government and industry. The company’s last reported quarter set a new sales record with revenues north of $1 billion, while its Rule of 40 score expanded to an astonishing 114%.

The big issue plaguing many investors is the company’s astronomical valuation, which by practically every metric is widely inflated. This exposes PLTR to a risk of a painful multiple contraction if growth slows or larger fears ripple throughout the market.

That risk–reward imbalance is precisely what has caught the attention of at least one top investor. Writing under the pseudonym JR Research, a top-2% stock pro tracked by TipRanks argues that valuation concerns now loom larger than the company’s operational execution.

“Geopolitical tensions and critical defense partnerships solidify PLTR’s strategic relevance in both government and commercial AI domains. However, excessive valuations befuddle the fundamentals thesis,” JR explains.

In JR’s view, Palantir carries the “double accolade” of being both one of the most consequential AI companies and one of the most expensive. While the investor dismisses the “permabear” narrative – noting that Palantir’s “breathtaking profitability” has already put that argument to rest – they also stop short of fully embracing the bull case, given how much optimism appears priced in.

After all, the incredible growth won’t be able to continue forever. The investor notes that Palantir’s expected growth rates are forecasted to soften from a projected 54% in 2025 to 37% in FY2027, which could spell trouble for investors.

“I think it’s unreasonable for the company to still be able to command such an eye-popping growth premium above the 200 forward P/E level with growth rates anticipated to slow down markedly over the next couple of years,” adds JR.

That sets up what JR describes as a possible reckoning, particularly for “the frothiest parts of the market.” As a result, the investor assigns PLTR a Sell rating and even floats, though cautiously, the possibility of a pullback toward $140. (To watch JR Research’s track record, click here)

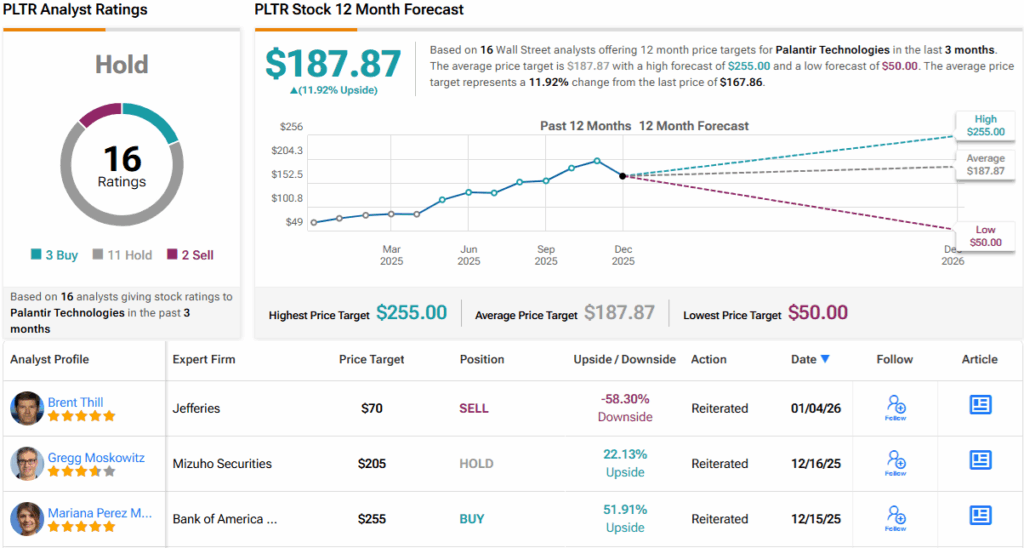

Wall Street, for now, is taking a more measured stance. With 3 Buys, 11 Holds, and 2 Sells, Palantir carries a consensus Hold (i.e., Neutral) rating. The stock’s 12-month average price target of $187.87 implies potential upside of ~12% heading into 2026. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.