The upcoming Fed meeting is garnering more attention following the surge in oil prices and the escalation of tensions in the Middle East. Just a few weeks ago, markets were confident that rate cuts were coming later this year. Now, that outlook is getting cloudy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

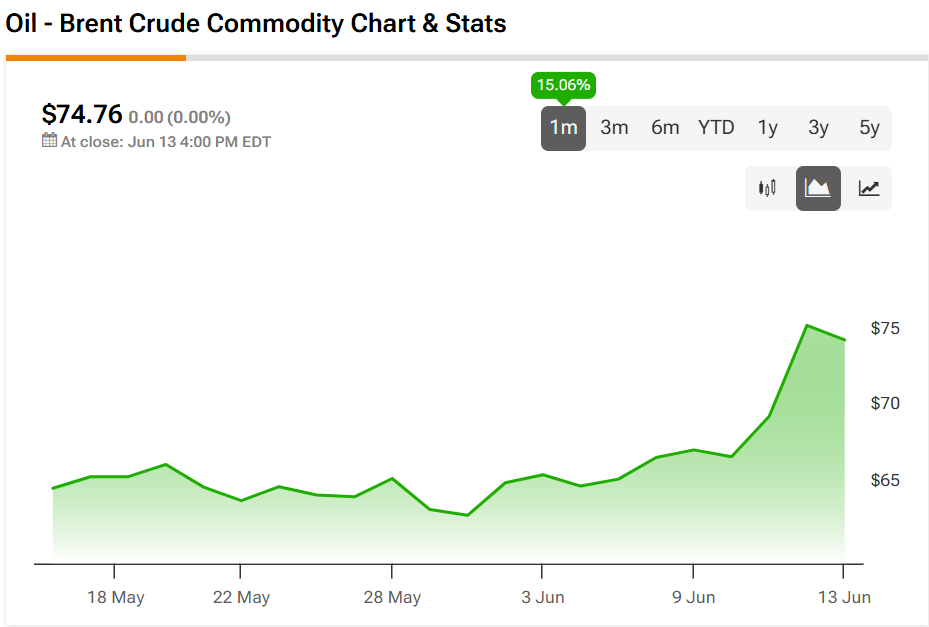

On June 13, Iran fired more than 150 ballistic missiles and over 100 drones at Israel in response to Israeli airstrikes. The attack sent Brent crude up 7.96% to $74.76 and West Texas Intermediate (WTI) to $73.92, both hitting five-month highs. With the Strait of Hormuz in focus, traders say prices could move past $80, or even hit $120, if the situation gets worse.

That’s a problem for the Fed. Rising oil prices tend to push inflation higher, which could prompt the Fed to reconsider cutting rates.

Clear Market Signals

The S&P 500 dropped roughly 1% on Friday as investors pulled back from sectors that don’t do well in a high-rate environment. Travel and airline stocks took a hit, while energy and defense stocks saw modest to more meaningful gains. Stocks such as (XOM), (CVX), and (LMT) all moved higher. Gold stayed close to all-time highs, and the dollar got a boost, showing a clear move toward safety.

If the Fed comes out sounding worried about inflation and signals no cuts for now, volatility could stick around. Tech, real estate, and consumer stocks might take another hit. But if the Fed’s Chair, Jerome Powell, leaves the door open for easing later this year, especially if oil prices calm down, markets might bounce.

TipRanks data indicates that more analysts have been focusing on energy and defense recently. Stocks like (SLB), (HAL), and (RTX) have picked up upgrades, while outlooks on consumer names have softened.

For now, markets are in wait-and-see mode. The Fed’s tone this week will shape how investors position for the rest of the summer. If oil keeps climbing and inflation starts to creep back up, rate cuts may be off the table.

We used TipRanks’ Comparison Tool to bring together the energy and defense stocks mentioned above, giving you a broader view of each company and how it stacks up within its industry.