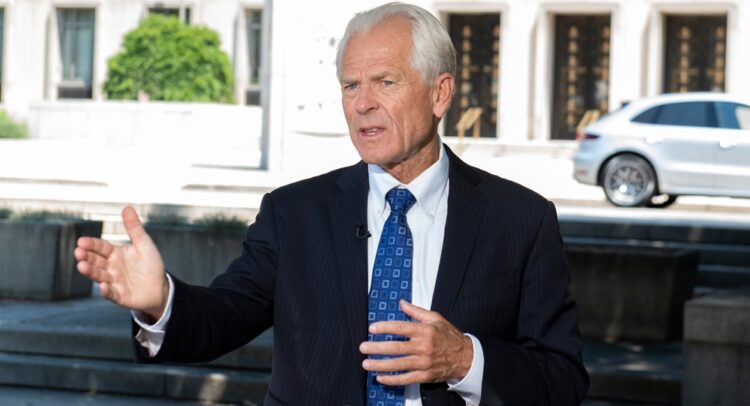

White House trade advisor Peter Navarro has spoken out against Fed Chair Jerome Powell in a new op-ed in The Hill and an interview with CNBC. Like President Trump, Navarro believes that Powell has delayed interest rate cuts for too long, resulting in increased U.S. government interest payments and harm to the American consumer.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

According to Navarro, if the interest rate is 50 bps too high, this could result in GDP reduction of between 0.25% and 0.50%. It also results in higher interest rates for consumers.

“He’s costing Americans with their credit card debt,” said Navarro. “He’s costing us in terms of our national debt growing.”

Powell Hasn’t Learned from His Previous Mistakes, Says Navarro

Navarro added that Powell made similar mistakes in 2018, raising rates despite tame inflation and a healthy labor market amid Trump’s tax cuts and tariffs.

“Powell seems incapable of recognizing that Trumponomics — driven by pro-growth deregulation, productivity-enhancing tax cuts, strategic tariffs, and America First supply chain policies — is again delivering strong GDP growth and low unemployment without fueling inflation, just as in Trump’s prosperous first term,” explained Navarro.

He concluded that the Fed should immediately begin cutting rates at the next Federal Open Market Committee (FOMC) meeting on July 29 and 30.

The federal funds rate currently sits in a range between 4.25% and 4.50%.