Palantir (NASDAQ:PLTR) stock is heading into the new year amid a cooling phase for AI enthusiasm, as the market takes a breather after two years’ surge. In fact, many AI-focused stocks have pulled back in recent months, and Palantir has felt that shift as well.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

PLTR has lost some 19% of its value since delivering yet another star-studded earnings report at the beginning of November. The recent dip has little to do with the company’s performance and is much more reflective of a market beset by concerns about a potential AI bubble.

It’s no secret that the biggest concern surrounding the big data analytics company is its sky-high valuation, making it particularly susceptible to a downturn in market sentiment. Still, there’s plenty of evidence that AI spending isn’t going anywhere, with none other than industry oracle Nvidia CEO Jensen Huang predicting up to $4 trillion in global AI infrastructure spending by the end of the decade.

That tension between near-term valuation pressure and long-term AI demand is exactly where 5-star investor Oliver Rodzianko sees the defining issue for Palantir in the year ahead.

“The risk here is not a crash in AI demand, which is extremely unlikely, but instead the market beginning to view the AI spending curve as linear or logarithmic rather than exponential,” explains Rodzianko, who is among the top 1% of stock pros covered by TipRanks.

Rodzianko spells out the obvious valuation risk, as PLTR’s forward price-to-sales ratio of close to 100x is some 2,900% greater than the sector median. With ROI often “hard to prove,” scrutiny on AI spending could increase. This could have big implications for PLTR’s share price.

“Palantir is prone to multiple compression even without fundamental earnings revisions for its company directly, because the de-rating would be macro-sentiment driven,” emphasizes Rodzianko.

Though the investor believes the AI arc is long, he predicts that the spending could become cyclical as projects start and stop. Even if Palantir isn’t directly exposed to changes in GPU-driven spending, it could easily get caught up in any market gloominess.

That backdrop leaves PLTR’s “elite” valuation looking vulnerable, in Rodzianko’s view. For now, he sees the risk-reward as skewed the wrong way. “Investing in the current climate requires wisdom, and it requires patience and restraint,” the investor says – a mindset that leads him to a Hold (i.e., Neutral) rating on the stock. (To watch Rodzianko’s track record, click here)

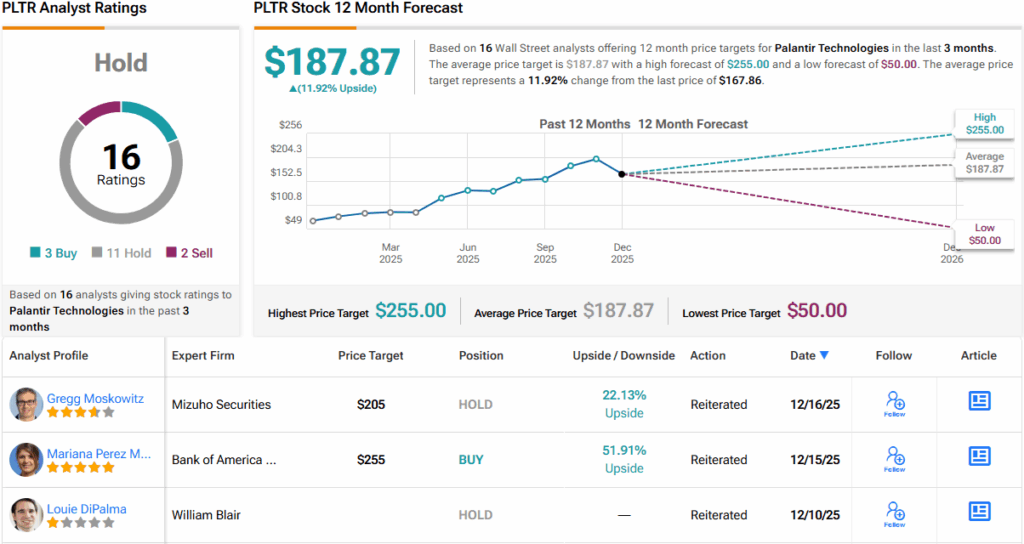

Wall Street won’t be joining the fray anytime soon, either. With 11 Holds – accompanied by 3 Buys and 2 Sells – PLTR carries a consensus Hold rating as well. However, its 12-month average price target of $187.87 still implies ~12% upside for the year ahead. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.