The stock of Porsche (POAHY) is down 8% on Sept. 22 after the German sports car maker lowered its guidance for the remainder of this year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The steep drop in Porsche’s stock comes after management slashed its 2025 profitability outlook and delayed the launch of new electric vehicle models, citing weak global demand. Volkswagen (DE:VOW3), Porsche’s largest shareholder, also fell 8% on news of the guidance cut.

The sell-off in Porsche’s stock pulled down the entire automotive sector in Europe, with the Stoxx Europe Automobiles and Parts index declining 2.6% in London trading. The global automotive industry is struggling with U.S. import tariffs and weakening consumer demand for electric vehicles.

Problems at Porsche

Porsche also noted that its profits this year are likely to take a hit from an economic slowdown in China. Management at Porsche said they now expect the company’s 2025 profit margin to be no more than 2%, down from previous guidance of 5% to 7%.

This is the third time in 2025 that Porsche has revised its outlook due to tariffs and sluggish global sales. A 2035 ban on sales of gas-powered vehicles is looming in the European Union (EU), although executives at Porsche and other automakers are urging lawmakers to relax that goal, claiming it is no longer realistic.

Is POAHY Stock a Buy?

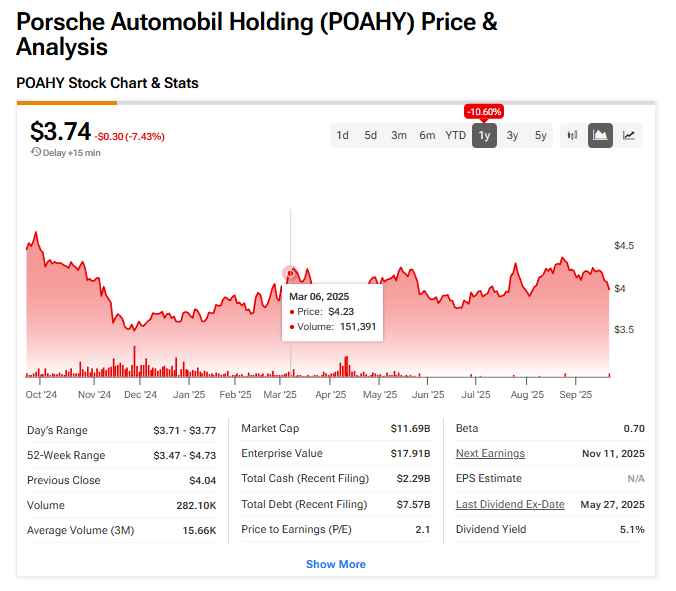

Currently, only one analyst in the U.S. covers Porsche stock. So instead, we’ll look at the performance of the share price over the last year. As one can see below, POAHY stock has declined 11% in the past 12 months.