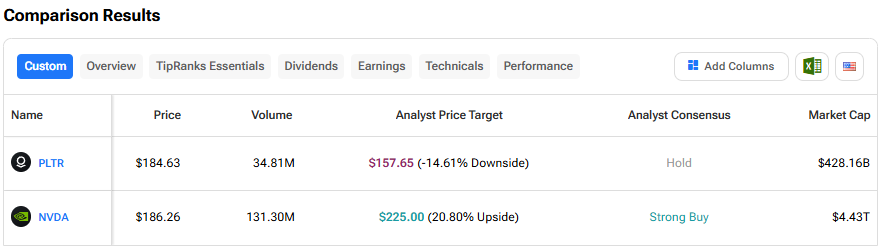

Artificial intelligence (AI) stocks continue to be in focus amid robust spending by hyperscalers and other tech giants. However, there are concerns on the valuation front, as not all companies are capturing AI-led growth opportunities to the same extent and justifying their lofty multiples. Using TipRanks’ Stock Comparison Tool, we will place Palantir Technologies (PLTR) and Nvidia (NVDA) against each other to find the better AI stock, according to Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Palantir Technologies (NASDAQ:PLTR) Stock

Palantir Technologies stock has rallied by an impressive 144% year-to-date, as the AI-powered data analytics company has impressed investors with its solid growth in revenue and earnings. After gaining a strong position in the government end market, Palantir has rapidly expanded its presence in the commercial market in recent years.

In fact, in Q2 2025, PLTR’s U.S. commercial business revenue growth of 93% outpaced the 68% rise in its U.S. government segment revenue. It is worth noting that Palantir’s overall quarterly revenue hit the $1 billion mark for the first time in the second quarter. All eyes are on PLTR’s Q3 earnings, scheduled for release on November 3. Wall Street expects Palantir to report a 70% jump in Q3 EPS to $0.17, with revenue expected to grow 50% year-over-year to $1.09 billion.

Meanwhile, Palantir continues to bolster its position through strategic deals. The company recently announced a deal with Snowflake (SNOW) that integrates the AI data cloud with Palantir Foundry and Palantir AIP to help customers build more efficient data pipelines, faster data analytics, and AI applications. On Thursday, PLTR stock rose about 3% after the company announced a multi-year, multi-million-dollar strategic partnership to help enterprises deploy AI faster and more securely in complex, multi-cloud environments.

Is PLTR a Good Stock to Buy Now?

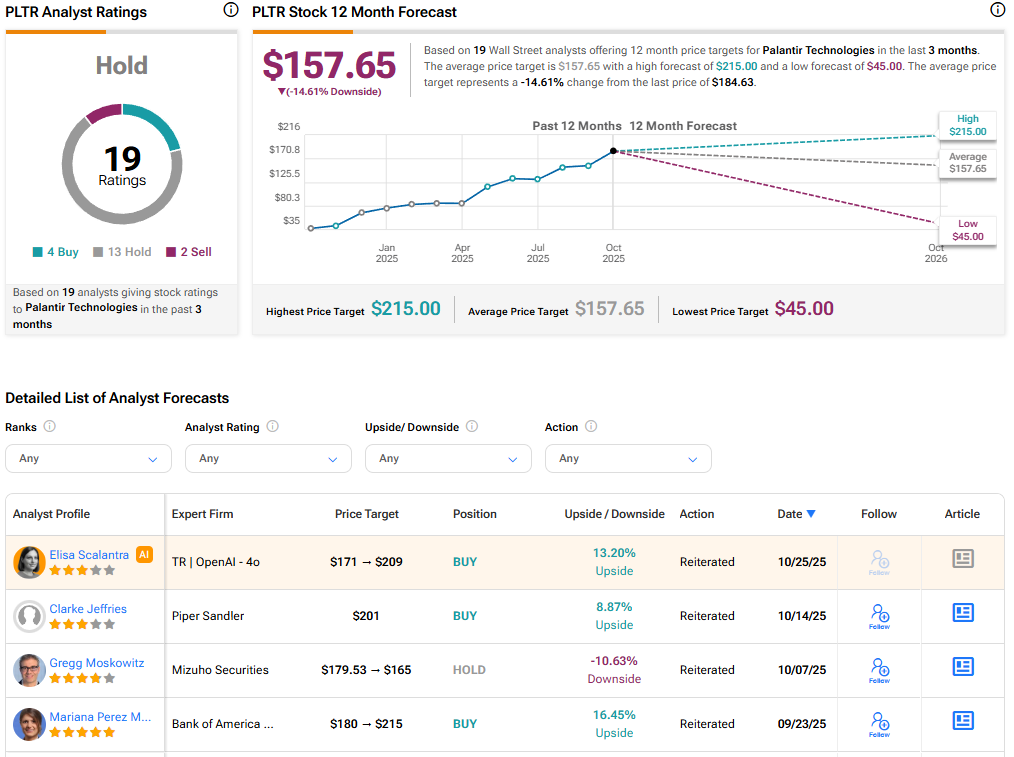

Recently, Piper Sandler analyst Clarke Jeffries reiterated a Buy rating on Palantir Technologies stock and increased his price target to $201 from $182. Jeffries agreed that PLTR’s elevated valuation leaves no room for error, particularly if any signs of moderating growth arise.

That said, the analyst believes that PLTR has still not achieved its peak growth, given robust visibility on future revenue (over $7B of defined contract value plus an estimated $4 billion of Indefinite Delivery, Indefinite Quantity or IDIQ contract value), accelerating triple-digit growth in commercial bookings year-to-date, and massive wallet share opportunity across $1 trillion of U.S. defense spending.

Unlike Jeffries, several analysts are cautious about Palantir Technologies stock. Overall, Palantir stock scores Wall Street’s Hold consensus rating based on four Buys, 13 Holds, and two Sell recommendations. The average PLTR stock price target of $157.65 indicates a possible downside of 14.6% from current levels.

Nvidia (NASDAQ:NVDA) Stock

Chip giant Nvidia is considered one of the key beneficiaries of the ongoing AI boom, which has sparked a massive demand for its advanced graphics processing units (GPUs). The company’s GPUs are used to build, train, and operate AI models.

Despite concerns about growing competition from Advanced Micro Devices’ (AMD) AI GPUs and Broadcom’s (AVGO) custom AI accelerators and the U.S.-China trade war, most analysts remain bullish on NVDA stock. Their optimism is backed by Nvidia’s dominant market share in the AI GPU market, the competitive edge of its CUDA software platform, and continued innovation. Moreover, the company’s growth story is bolstered by strong leadership, strategic partnerships like the $5 billion deal with Intel (INTC) and $100 billion investment in OpenAI (PC:OPAIQ), and growth opportunities such as sovereign AI.

Nvidia is also exploring prospects in attractive end markets like autonomous vehicles (AVs). Notably, the company is collaborating with Uber Technologies (UBER) to advance AV development.

Is NVDA Stock a Buy, Sell, or Hold?

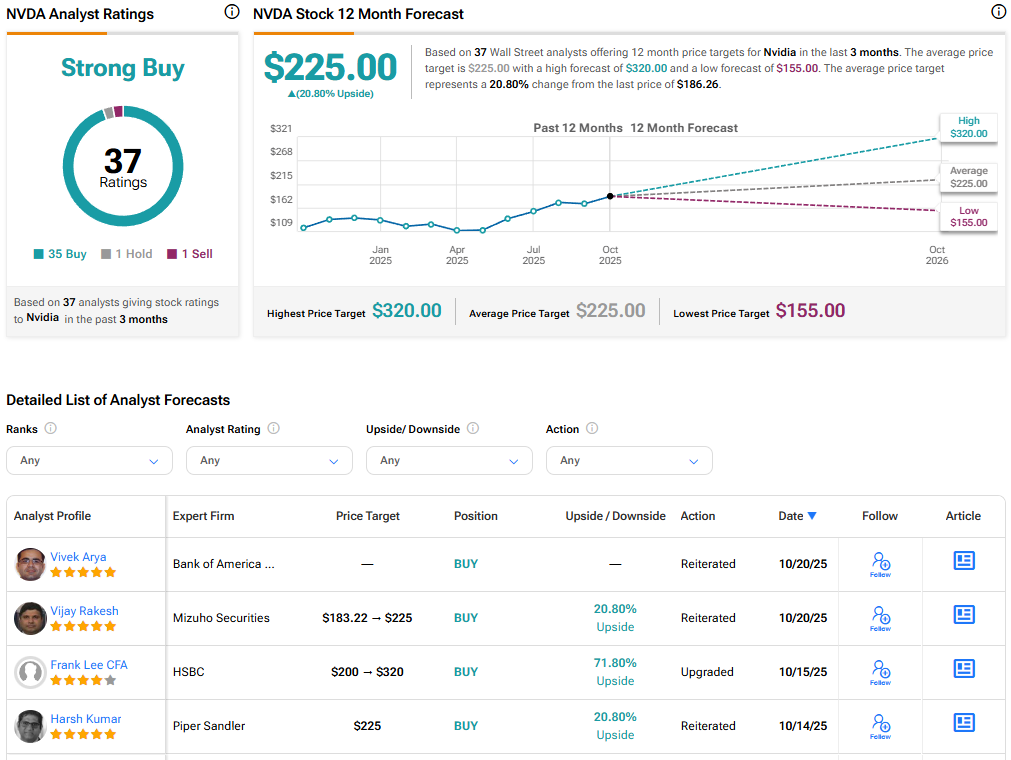

Earlier this month, Piper Sandler analyst Harsh Kumar reiterated a Buy rating on Nvidia stock with a price target of $225 following a conversation with the semiconductor company about the current business backdrop and recent investment implications. The 5-star analyst noted that business conditions remain robust for Nvidia, with demand still outstripping manufacturing capacity and supply.

In Kumar’s view, funding provided by Nvidia to several customers, such as OpenAI and CoreWeave (CRWV), is “insulated from circular financing concerns.” He highlighted that NVDA’s China business still remains “constrained,” with pressure from the Chinese government weighing on customers, although some licenses have been granted. While Q3 guidance did not include any revenue from H20 chips, Kumar believes that Nvidia is well-positioned to meet the Street’s expectations.

Currently, Nvidia stock scores a Strong Buy consensus rating based on 35 Buys, one Hold, and one Sell recommendation. At $225, the average NVDA stock price target indicates 21% upside potential from current levels. NVDA stock has risen about 39% year-to-date.

Conclusion

Both Palantir and Nvidia have been delivering solid revenue growth, driven by AI tailwinds. However, Wall Street is cautious on PLTR stock due to valuation concerns following a massive rally, while analysts see attractive upside potential in Nvidia stock. Despite concerns about rising competition in the AI chips market, most analysts remain confident about Nvidia’s long-term growth potential.