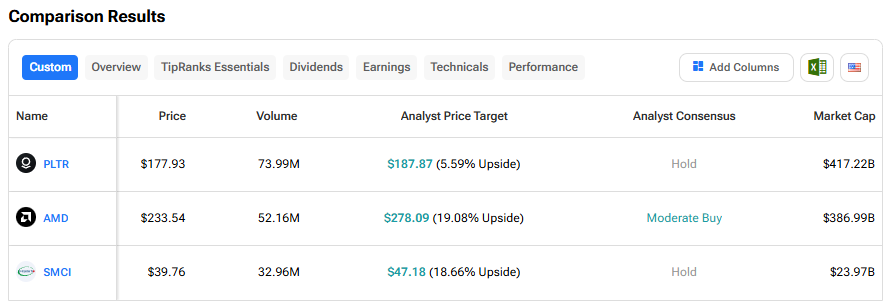

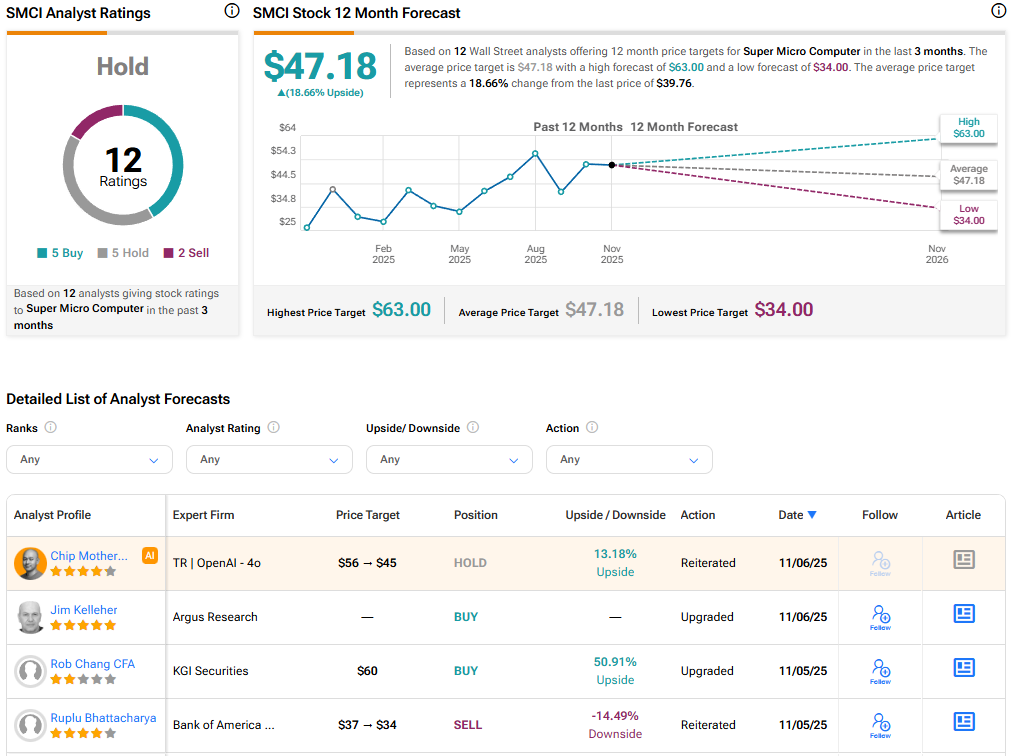

Artificial intelligence (AI) and tech stocks took a major hit in recent trading sessions amid concerns about their lofty valuations. While some companies are witnessing solid demand and have struck massive AI-related deals, others are not justifying their high valuations. Using TipRanks’ Stock Comparison Tool, we placed Palantir Technologies (PLTR), Advanced Micro Devices (AMD), and Super Micro Computer (SMCI) against each other to pick the most attractive AI stock, according to Wall Street analysts.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Palantir Technologies (NASDAQ:PLTR) Stock

AI-powered data analytics company Palantir Technologies yet again delivered robust quarterly results and issued solid guidance, reflecting strong execution and continued demand for its AIP (Artificial Intelligence Platform) offering across its commercial and government businesses.

Despite stellar results, PLTR stock fell due to valuation concerns. Moreover, “Big Short” investor Michael Burry revealed bets against Palantir and Nvidia (NVDA), making matters worse. In response, in an interview with CNBC, Palantir CEO Alex Karp accused short sellers of “market manipulation.”

While many Wall Street analysts acknowledge Palantir’s operational excellence and robust growth prospects, they remain cautious given the stock’s steep valuation. Notably, PLTR stock trades at a forward P/E (based on non-GAAP earnings) multiple of 246x compared to the sector median of 23.9x.

What Is the Price Target for Palantir Stock?

Impressed by Q3 results, Cantor Fitzgerald analyst Thomas Blakey increased his price target for Palantir Technologies stock to $198 from $155 and reiterated a Hold rating. The 5-star analyst raised his price target to reflect his increased revenue and profit estimates following the strong results.

Blakey acknowledged that he remains impressed with Palantir due to its products, Forward Deployed Engineer (FDE)-driven business model, and strong execution. Moreover, checks by Cantor indicate that Palantir is well-positioned to benefit from enterprise and government adoption of AI tech. Despite all these positives, Blakey remains cautious on PLTR stock due to its high relative valuation, with shares trading at a 5x higher multiple than the median for stocks in Cantor’s infrastructure software coverage.

Turning to Wall Street, the Hold consensus rating on Palantir Technologies stock is based on 11 Holds, three Buys, and two Sell recommendations. At $187.87, the average PLTR stock price target indicates 5.6% upside potential. Even after the recent selloff, PLTR stock is up more than 135% year-to-date.

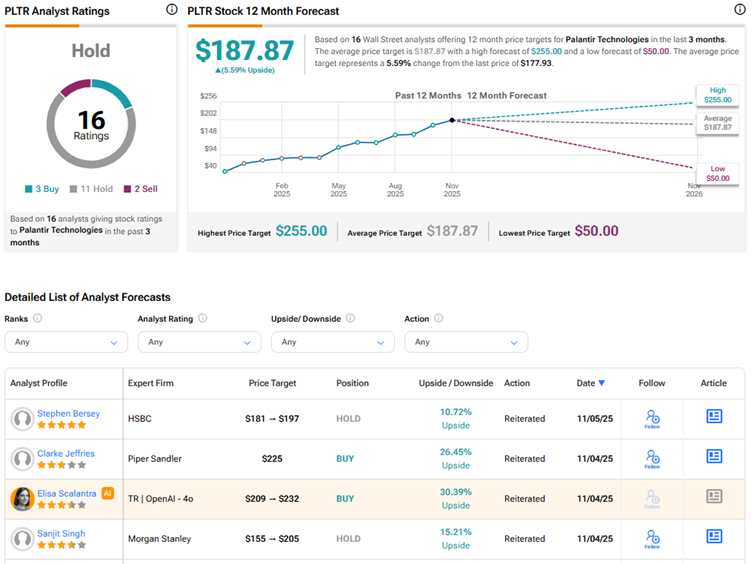

Advanced Micro Devices (NASDAQ:AMD) Stock

Despite the pullback in AI stocks due to valuation concerns, Advanced Micro Devices stock is still up by an impressive 93% year-to-date. The chipmaker’s shares gained from the growing data center business and demand for the new AI GPUs (graphics processing units), bolstered by deals with OpenAI (PC:OPAIQ) and Oracle’s (ORCL) OCI (Oracle Cloud Infrastructure).

AMD recently reported upbeat Q3 results and issued a solid revenue outlook for the fourth quarter, driven by strength in its data center and gaming segments as well as artificial intelligence (AI)-led demand.

Looking ahead, several analysts are optimistic about AMD’s growth potential, driven by the upcoming data center GPU ramps and demand for server CPUs needed for AI workloads. Investors now await updates on AMD’s innovations at the upcoming Analyst Day on November 11.

Is AMD Stock a Buy or Sell?

In reaction to the Q3 performance, Piper Sandler analyst Harsh Kumar increased the price target for AMD stock to $280 from $240 and reiterated a Buy rating. The 5-star analyst highlighted AMD’s robust results, with the chipmaker surpassing estimates across all metrics and “importantly in the data center line item.” Kumar noted the 22% year-over-year jump in AMD’s data center business, with solid demand for both MI series and EPYC servers.

Additionally, Kumar noted that AMD’s Q4 revenue outlook beat estimates by nearly $400 million, with both EPYC and Instinct series expected to deliver strong sequential growth. While AMD’s GPU server business is smaller than its EPYC server business, Kumar expects a “crossover” in late 2026, with the OpenAI deployment in Q4 2026. Overall, Kumar increased his price target based on AMD’s GPU growth prospects and revenues from the OpenAI deal in the times ahead.

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 27 Buys and 10 Holds. The average AMD stock price target of $278.09 indicates 19.1% upside potential.

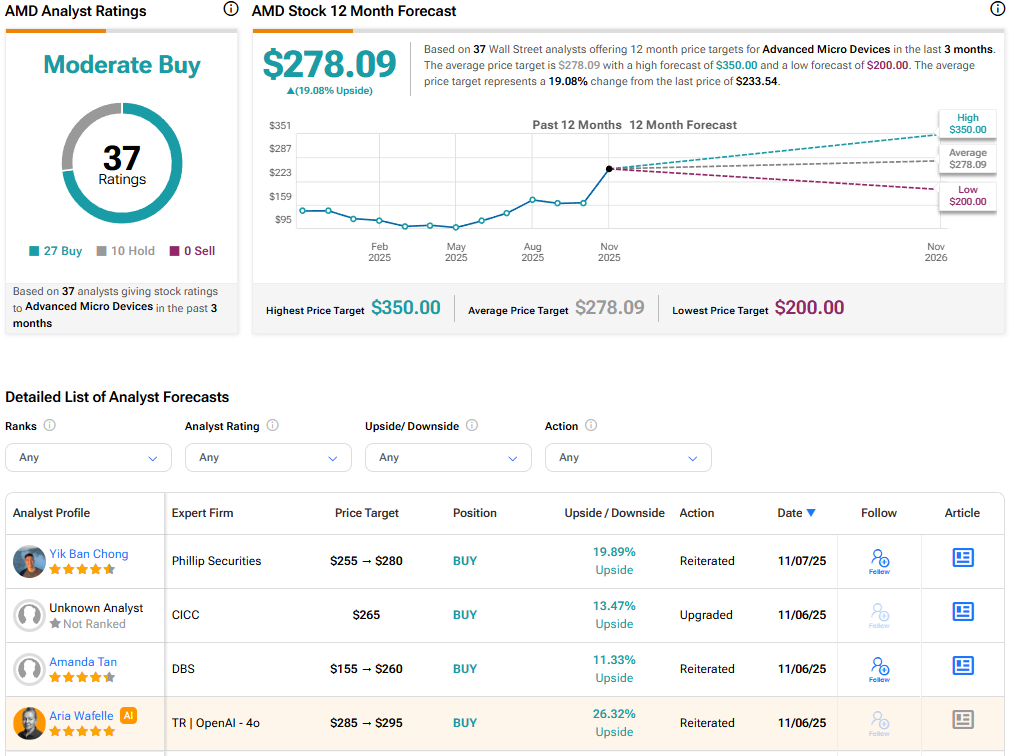

Super Micro Computer (NASDAQ:SMCI) Stock

Shares of AI server company Super Micro Computer took a hit after reporting lower revenue and weak earnings for the first quarter of Fiscal 2026. In its preliminary update ahead of the Q1 earnings release, the company had cautioned that “design win upgrades” pushed some revenue to the second quarter.

The AI boom has fueled robust demand for SMCI’s servers that feature Nvidia GPUs. However, intense competition from players like Dell Technologies (DELL) and concerns about contracting margins have impacted sentiment about SMCI stock.

Is SMCI a Good Stock to Buy?

Following the print, Bank of America analyst Ruplu Bhattacharya reduced his price target for Super Micro Computer stock to $34 from $37 and reiterated a Sell rating. The 4-star analyst expects SMCI and its peers to deliver solid revenue growth as long as AI capital spending remains robust. He highlighted that SMCI’s competitive advantage is its significant manufacturing capacity, which enables monthly shipments of thousands of liquid-cooled racks.

That said, Bhattacharya remains concerned about the intense rivalry in the AI server market and the lower margins on large deals resulting from competitive bidding. In particular, he highlighted that SMCI’s gross margin guidance for the December quarter significantly lagged his estimates, impacted by a rise in certain costs as the company ramps production of the new Nvidia GPU racks (Blackwell Ultra). The analyst contends that such costs can recur with subsequent GPU launches where the rack structure undergoes a notable change.

Overall, Wall Street has a Hold consensus rating on Super Micro Computer stock based on five Buys, five Holds, and two Sell recommendations. The average SMCI stock price target of $47.18 indicates about 19% upside potential. SMCI stock has risen over 30% year-to-date.

Conclusion

Currently, Wall Street is sidelined on Palantir and Super Micro Computer stocks and cautiously optimistic on Advanced Micro Devices amid the ongoing valuation concerns. The bullish stance on AMD stock is backed by the demand for its server CPUs and GPU offerings amid the AI boom. The company’s recent deals and strong AI spending have bolstered Wall Street’s confidence about the chipmaker’s long-term growth potential.