Macro uncertainty and turmoil triggered by tariffs have significantly impacted several growth stocks. However, the current sell-off presents an attractive opportunity to pick the stocks of some growth companies that can withstand short-term headwinds and deliver compelling returns over the long term. Using TipRanks’ Stock Comparison Tool, we placed Palantir Technologies (PLTR), Tesla (TSLA), and Meta Platforms (META) against each other to find the best growth stock, according to Wall Street analysts.

Palantir Technologies (NASDAQ:PLTR)

Data analytics company Palantir Technologies has impressed investors with solid growth rates across its commercial and government business in recent quarters. The company is seeing strong demand for its Artificial Intelligence Platform (AIP) offering.

The impressive momentum in the company’s business is expected to continue, with PLTR expecting around 31% revenue growth in 2025.

PLTR stock has rallied about 295% over the past year and has risen nearly 17% this year despite weakness in the broader market due to tariff wars. However, several analysts are concerned about Palantir stock’s valuation following the impressive rally.

Is PLTR Stock a Good Buy?

Recently, William Blair analyst Louie DiPalma reiterated a Hold rating on PLTR stock. The analyst stated that he expects the U.S. Army to soon announce that it awarded Palantir a contract for its Next-Generation Command and Control (NGC2) program. DiPalma expects PLTR to generate an annual recurring revenue (ARR) of nearly $100 over time from the NGC2 program, making it one of the company’s largest contracts.

DiPalma had upgraded PLTR stock last month from Sell to Hold to reflect the “changing tides” and contract opportunities such as NGC2. He added that Palantir’s commercial software seems aligned with the new administration’s emphasis on fixed-price technology delivery. The analyst highlighted that PLTR’s revenue growth and operating margin are among the highest in the software space. Despite these positives, the analyst prefers to stay on the sidelines due to valuation concerns.

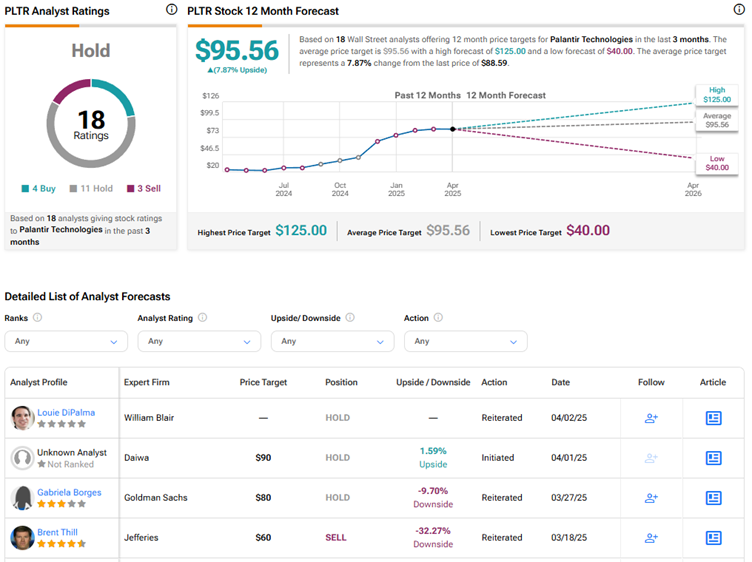

Wall Street has a Hold consensus rating on Palantir stock based on four Buys, 11 Holds, and three Sell recommendations. The average PLTR stock price target of $95.56 implies about 8% upside potential from current levels.

Tesla (NASDAQ:TSLA)

Tesla stock has plunged about 38% so far this year. The electric vehicle (EV) maker’s unimpressive Q4 results and weak Q1 deliveries due to intense competition and customer backlash related to CEO Elon Musk’s political activities have dragged down the stock significantly.

The company’s Q1 deliveries declined 13% to 336,681 units, much worse than market expectations. Even long-time Tesla bull Wedbush’s Daniel Ives slashed the price target for TSLA stock to $315 from $550 as he contends that it is a crucial moment for Musk to turn things around or “darker days are ahead.”

While Tesla bulls are being patient and focusing on the growth potential of its robotaxis and the company’s ability to turn around, other analysts are wary of the lack of innovation and loss of share in key markets like Europe and China.

Is TSLA a Buy, Sell, or Hold?

Earlier this week, Mizuho analyst Vijay Rakesh lowered the price target for Tesla stock to $375 from $430 while maintaining a Buy rating. The analyst reduced his revenue and EPS estimates for Q1 2025 from $22.30 billion and $0.57 to $20.53 billion and $0.51, respectively.

Rakesh also lowered his 2025 and 2026 revenue and EPS estimates. He now expects 2025 and 2026 deliveries to come in at 1.66 million and 2.00 million vehicles, compared to the prior estimates of 1.82 million and $2.30 million units. While Rakesh believes that Tesla remains the leader in the U.S. EV market, he acknowledged that there are potential share headwinds in the European Union and China as rivals ramp up production.

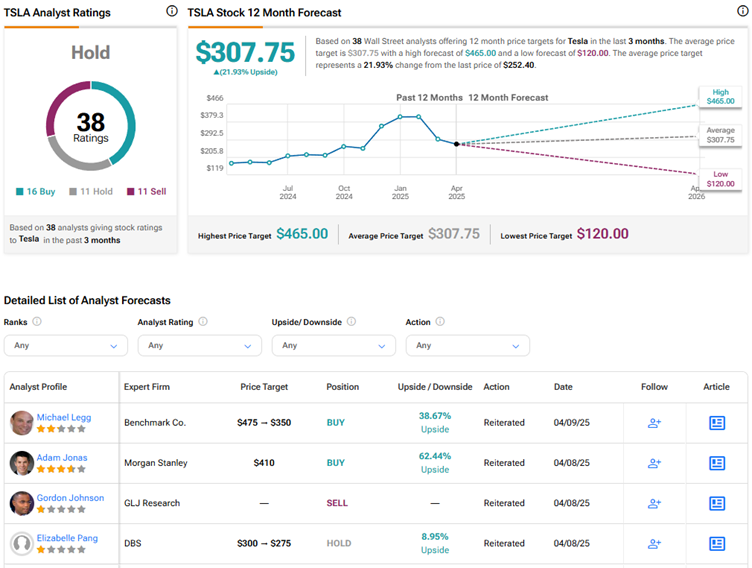

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 16 Buys, 11 Holds, and 11 Sells. The average TSLA stock price target of $307.75 implies 22% upside potential.

Meta Platforms (NASDAQ:META)

Social media giant Meta Platforms delivered impressive results for the fourth quarter of 2024. However, the stock is down about 7% year to date as investors are concerned about the impact of macro uncertainties on ad spending and, consequently, on Meta’s business.

Meanwhile, Meta is investing heavily in AI (artificial intelligence) infrastructure to capture the attractive growth opportunities in this space. The company has guided for capital expenditure in the range of $60 billion to $65 billion for 2025. It aims to enhance its family of Apps, including Facebook, Instagram, Messenger, and WhatsApp, by integrating AI features.

Meta Platforms is optimistic about the prospects for its Meta AI chatbot. Earlier this year, the company stated that Meta AI crossed the 700 million monthly active users mark, up from 600 million in December. CEO Mark Zuckerberg expects Meta AI to reach one billion users this year.

What Is the Target Price for Meta Platforms Stock?

This week, Baird analyst Colin Sebastian lowered the price target for Meta Platforms stock to $625 from $750 while reiterating a Buy rating on the stock. Sebastian stated that Meta’s high-quality ad platform is more resilient than secondary digital platforms in an unfavorable macro backdrop.

That said, he reduced his revenue and operating income estimates due to Meta Platforms’ meaningful mix of brand advertising, exposure to Asia Pacific (APAC), and exposure to discretionary product categories.

With 42 Buys, three Holds, and one Sell recommendation, Meta Platforms stock scores a Strong Buy consensus rating on TipRanks. The average META stock price target of $740.67 implies about 36% upside potential from current levels.

Conclusion

Wall Street is bullish on Meta Platforms stock but sidelined on Tesla and Palantir stocks. Analysts see higher upside potential in META stock than in the other two growth stocks. Despite a potential pressure on ad spending amid tariff wars, analysts are bullish about Meta Platforms’ growth potential, given its dominant position in the social media space and AI tailwinds.