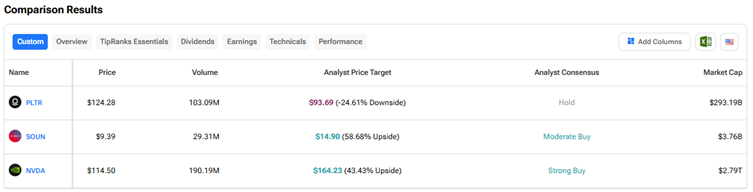

AI (artificial intelligence) stocks have been volatile this year due to news around tariff wars, concerns about a slowdown in spending due to macro uncertainties, and growing competition from Chinese rivals. Despite short-term pressures, Wall Street remains bullish on some AI players due to their ability to withstand near-term headwinds and capitalize on the solid growth opportunities in the generative AI space over the long term. Using TipRanks’ Stock Comparison Tool, we will compare Palantir Technologies (PLTR), SoundHound AI (SOUN), and Nvidia (NVDA) to find the AI stock that scores a “Strong Buy” consensus rating from Wall Street.

Palantir Technologies (NASDAQ:PLTR)

Data analytics company Palantir Technologies has been impressing investors with its solid financials in recent quarters, supported by robust demand for its AI-powered offerings across its Commercial and Government businesses. Notably, the company’s AIP (Artificial Intelligence Platform) offering has been driving solid growth.

PLTR stock has rallied 64% year-to-date, massively outperforming the broader market. However, several analysts are cautious on the stock due to its lofty valuation, concerns about the impact of a potential economic slowdown on PLTR’s Commercial business, and the impact of government spending cuts on its Government business.

Palantir is scheduled to announce its first-quarter results on May 5, after the markets close. Analysts expect PLTR to report EPS (earnings per share) of $0.13, reflecting a year-over-year jump of 62.5%. Moreover, Q1 revenue is expected to rise about 36% to $862.17 million.

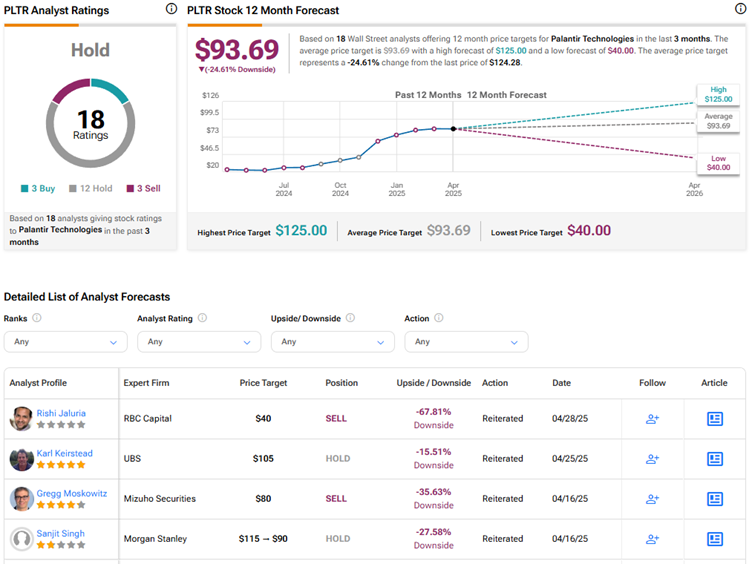

Is Palantir Stock a Strong Buy?

Heading into the results, UBS analyst Karl Keirstead reiterated a Hold rating on Palantir Technologies stock with a price target of $105. After interacting with six Commercial and Government customers to assess their spend intentions, the 5-star analyst concluded that the company seems very resilient. However, one key risk that PLTR is exposed to is Federal deal delays that his checks reveal are happening currently.

While Keirstead is constructive on Palantir’s fundamentals, he remains on the sidelines due to the solid year-to-date rally in the stock and its steep valuation multiple at about 123x 2026 free cash flow (estimate).

Wall Street has a Hold consensus rating on Palantir Technologies stock based on three Buys, 12 Holds, and three Sell recommendations. The average PLTR stock price target of $93.69 implies 24.6% downside risk from current levels.

SoundHound AI (NASDAQ:SOUN)

SoundHound AI is a conversational AI specialist that offers voice AI solutions across automotive, TV, IoT, and customer service industries. The company gained spotlight when Nvidia disclosed its stake in the emerging AI player.

However, the semiconductor giant offloaded its entire stake in SOUN stock in the fourth quarter of 2024. SOUN stock has plunged about 53% so far in 2025. Nonetheless, the company is focused on driving further growth through continued innovation and strategic deals. Last year, SoundHound acquired Amelia, an enterprise AI software company, to expand its scale and reach in new verticals like healthcare and financial services.

SoundHound is scheduled to announce its first-quarter results on May 8. Analysts expect the company to report a narrower loss per share of $0.09 compared to $0.12 in the prior-year quarter. They expect SoundHound to deliver revenue of $30.86 million, reflecting a 166% year-over-year growth.

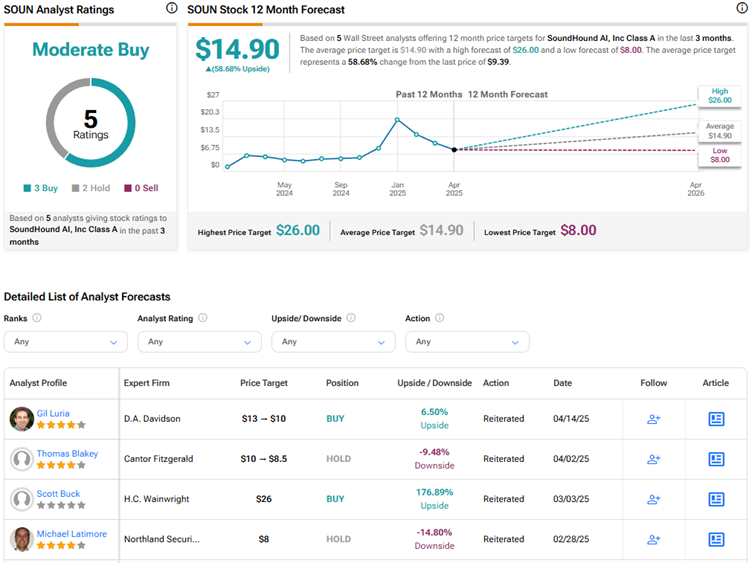

Is SoundHound AI Stock a Buy, Sell, or Hold?

Ahead of the results, D.A. Davidson analyst Gil Luria lowered his price target for SoundHound stock to $10 from $13, while maintaining a Buy rating. In a broader research note on D.A. Davidson’s Software group, the analyst said that the firm is now assuming a base case of one or two quarters of negative GDP in the U.S. in 2025, translating into to lower growth, with valuations already down.

The analyst added that regardless of how the current tariff scenario plays out, he sees a slowdown in consumer activity and corporate investment, at least for the next couple of quarters.

With three Buys and two Holds, Wall Street has a Moderate Buy consensus rating on SoundHound AI stock. The average SOUN stock price target of $14.90 implies about 59% upside potential.

Nvidia (NASDAQ:NVDA)

After witnessing a strong rally last year, Nvidia stock is down 15% year-to-date. Chip export restrictions, tariff wars, concerns about rising competition in the AI chips space from players like China’s Huawei Technologies, and a slowdown or decline in AI spending.

However, most analysts are looking beyond the ongoing headwinds and are confident about Nvidia’s ability to capture continued demand for AI chips through its innovative offerings like the Blackwell platform.

Nvidia is scheduled to announce its results for the first quarter of Fiscal 2026 on May 28. Analysts expect Q1 EPS of $0.89, reflecting a year-over-year growth of about 46%. Revenue is estimated to rise 66% to $43.1 billion.

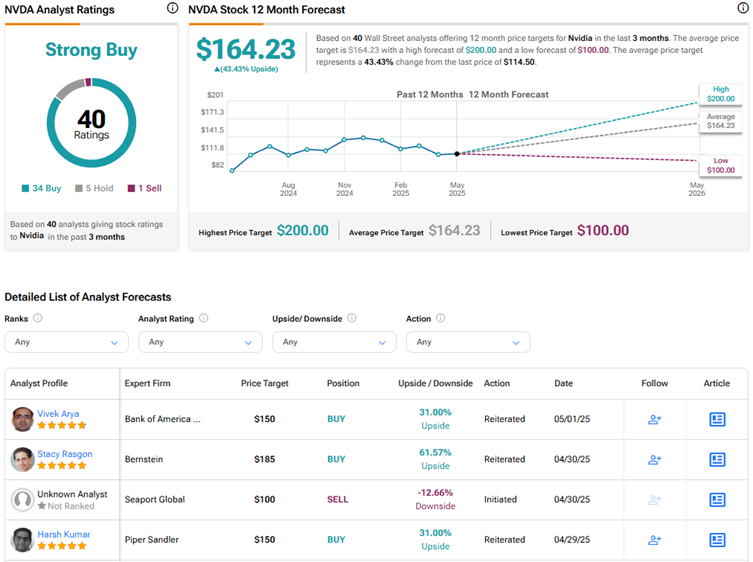

What Is the Prediction for Nvidia Stock?

Recently, Bank of America analyst Vivek Arya reiterated a Buy rating on Nvidia stock with a price target of $150. The 5-star analyst highlighted strong performance expectations and the company’s solid positioning in the AI infrastructure market. Arya expects to deliver a modest sales beat for Q1, with revenue expected to come in at $44 billion compared to the street’s consensus estimate of $43 billion.

While Arya acknowledged some expected headwinds in the second quarter due to geopolitical pressures and the ban related to China exports, he views these challenges as manageable and believes that they have already been priced into the stock price. He also highlighted NVDA stock’s valuation, trading at the lower end of its historical range. He added that the company’s offerings continue to see solid support from U.S. cloud customers.

Overall, Wall Street remains bullish on Nvidia stock, with a Strong Buy consensus rating based on 34 Buys, five Holds, and one Sell recommendation. The average NVDA stock price target of $164.23 implies 43.4% upside potential.

Conclusion

Despite the ongoing pressures, Wall Street remains highly bullish on Nvidia stock while being cautiously optimistic on SoundHound and sidelined on Palantir. The consensus estimate on NVDA stock is a “Strong Buy” based on analysts’ optimism about continued demand for the company’s GPUs in building and training AI models, solid financials, innovation, and management’s strong execution.