Shares of big data analytics company Palantir (PLTR) soared 14% in after-hours trading after it reported stellar fourth-quarter results and beat guidance. Earnings per share came in at $0.14, which beat analysts’ consensus estimate of $0.11 per share. Sales increased by 36% year-over-year, with revenue hitting $828 million. This also beat expectations of $775.91 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales growth was driven by the firm’s U.S. Commercial segment, as revenue saw an impressive year-over-year increase of 64% to $214 million. On the U.S. government side, revenue grew by 45% from the previous year, coming in at $343 million. In terms of overall clientele, there was a notable 43% year-over-year growth.

Palantir Provides Guidance for 2025

Looking forward, management has provided the following guidance for 2025:

- Q1 revenue between $858 million and $862 million versus estimates of $799.4 million

- Q1 Income from operations of $354 million to $358 million compared to expectations of $298.1 million

- FY25 revenue between $3.741 billion and $3.757 billion versus estimates of $3.526 billion

- FY25 Income from operations of $1.551 billion to $1.567 billion compared to expectations of $1.336 billion

As you can see, guidance was much better than expected, which, when combined with the solid Q4 results, is what contributed to the stock’s after-hours move.

What Is the Prediction for PLTR Stock?

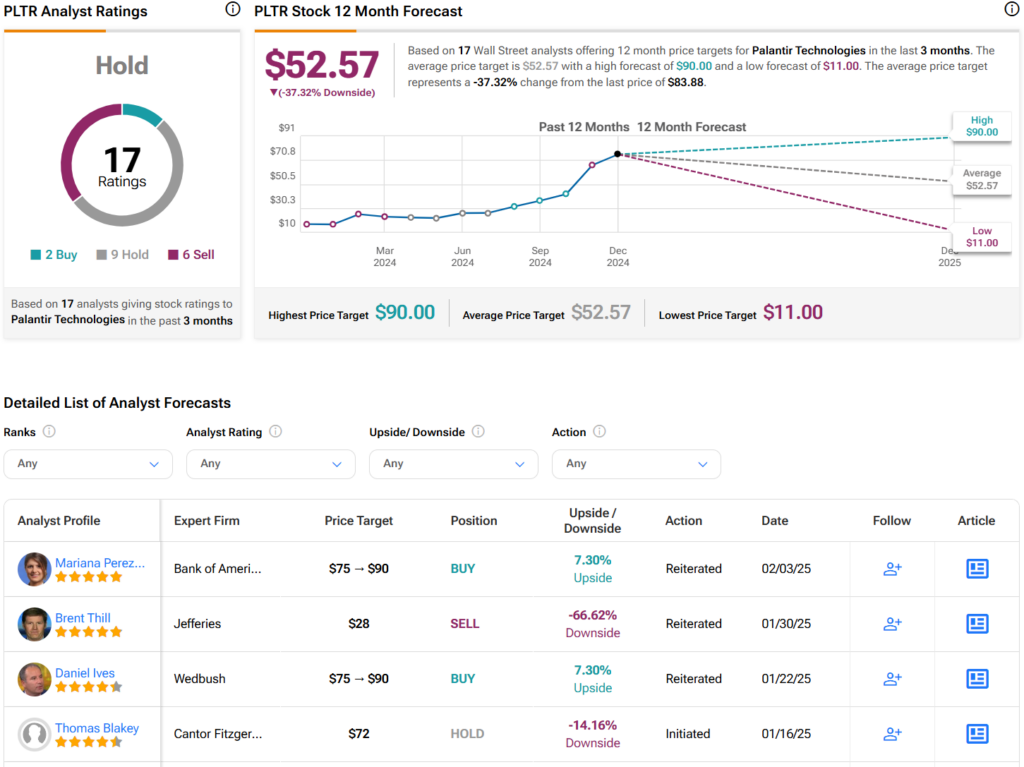

Turning to Wall Street, analysts have a Hold consensus rating on PLTR stock based on two Buys, nine Holds, and six Sells assigned in the past three months, as indicated by the graphic below. After a 401% rally in its share price over the past year, the average PLTR price target of $52.57 per share implies 37.3% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.