Dave & Buster’s Entertainment (NASDAQ:PLAY) reported weaker-than-expected results for the fourth quarter of Fiscal 2023. However, PLAY stock gained more than 7% in the extended trading session yesterday. The upside can be attributed to investors’ optimism about the company’s strategic plan to achieve an adjusted EBITDA of $1 billion within the next few years.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

PLAY is a restaurant and entertainment company that offers a combination of dining, arcade games, and sports viewing experiences.

Q4 Earnings Snapshot

The company reported adjusted earnings of $1.03 per share, which missed the consensus estimate of $1.10 per share. However, it compared favorably with EPS of $0.55 in the year-ago quarter. Meanwhile, Dave and Buster’s revenue increased 6.3% year-over-year to $599.1 million but missed the consensus estimate of $602.61 million.

Dave & Buster’s comparable store sales, including the Main Event-branded outlets, were down 7% year-over-year. The company attributed the decline to challenging weather conditions, particularly in January.

Additionally, Dave & Buster’s recently bolstered its shareholder confidence by increasing its stock buyback authorization by $100 million, bringing the total remaining to $200 million.

PLAY’s Strategic Plan

The company plans to open 15 new stores in the current year, reflecting its commitment to expanding its market presence. With this move, PLAY aims to capture a larger customer base and potentially drive revenue growth.

Furthermore, Dave and Buster’s plans to achieve its $1 billion adjusted EBITDA goal by focusing on store remodeling, growing store counts, and reducing costs.

Is PLAY a Good Stock to Buy?

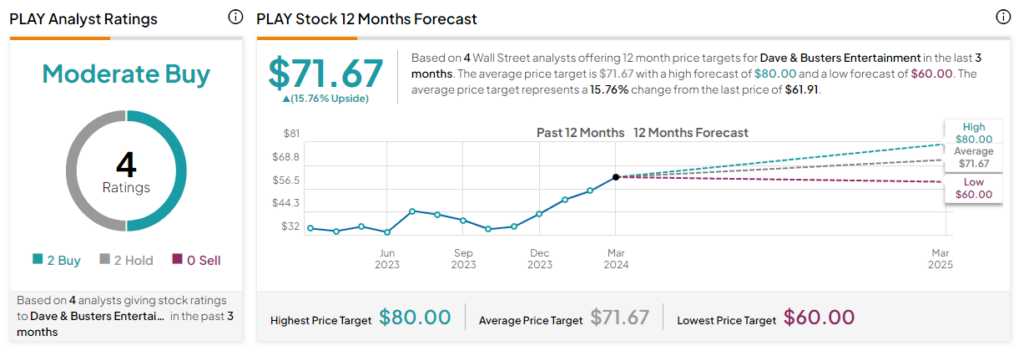

Currently, Wall Street is cautiously optimistic about PLAY. It has a Moderate Buy consensus rating based on two Buy and two Hold recommendations. After a year-to-date rally of nearly 15%, the analysts’ average price target on Dave and Buster’s stock of $71.67 per share implies another 15.8% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue