Dave & Buster’s Entertainment (PLAY) stock fell hard on Tuesday following the release of the entertainment and dining company’s Q2 2025 earnings report. This report started with adjusted earnings per share of 40 cents, which was well below Wall Street’s estimate of 91 cents. It also represented a 64.3% decline year-over-year from $1.12.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Dave & Buster’s Entertainment reported revenue of $557.4 million in Q2 2025, which failed to meet analysts’ estimate of $562.78 million. It also only represented a slight increase from the $557.1 million reported in Q2 2024. The company also noted that comparable store sales were down 3% year-over-year.

Dave & Buster’s Entertainment stock was down 18.97% in pre-market trading on Tuesday, following a 2.33% rally yesterday. The shares have fallen 17.13% year-to-date and 24.05% over the past 12 months.

Dave & Buster’s Entertainment Guidance

Dave & Buster’s Entertainment didn’t provide guidance in its latest earnings report. Even so, Wall Street has its estimates. Analysts expect the company to report adjusted EPS of -93 cents on revenue of $465.39 million in Q3 2025. For comparison, the company posted adjusted EPS of -84 cents on revenue of $453 million in Q3 2024.

Tarun Lal, CEO of Dave & Buster’s Entertainment, spoke about the company’s future in its most recent earnings report. He said, “My immediate focus is clear: reinforce our guest-first culture, deliver memorable experiences, and drive meaningful growth in sales, cash flow and shareholder value. I am truly excited to help guide this business to realize it’s obvious and full potential with purpose, passion and excellence.”

Is Dave & Buster’s Entertainment Stock a Buy, Sell, or Hold?

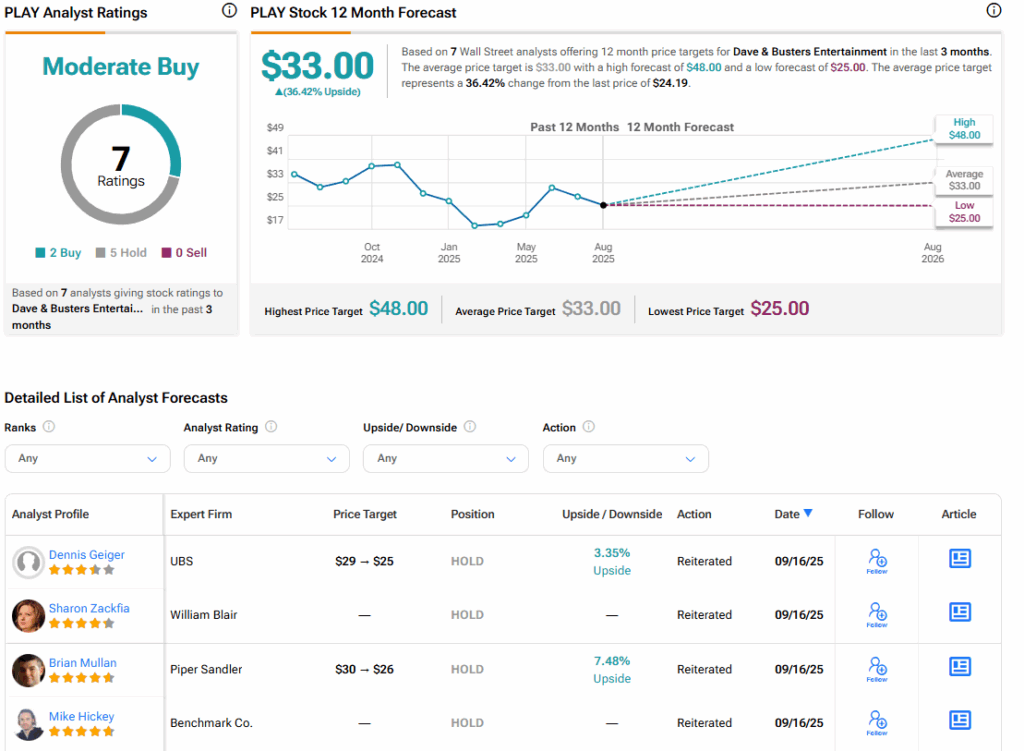

Turning to Wall Street, the analysts’ consensus rating for Dave & Buster’s Entertainment is Moderate Buy, based on two Buy and five Hold ratings over the past 12 months. With that comes an average PLAY stock price target of $33, representing a potential 36.42% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.