With inflation fears mounting across global markets, precious metals are once again commanding investor attention—but this time, platinum is leading the charge. The metal has more than doubled from below $1,000 in May 2025 to as high as $2,500 in December. Following a notable spike in volatility over the past two weeks, the metal is trading at approximately $2,000 as we enter 2026.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Notably, platinum has outpaced both gold and silver as supply constraints, robust industrial demand, and shrinking inventories converge to fuel the rally. According to analysts, both the white metal’s rally and gruesome volatility may linger well into 2026, which means investors with platinum exposure may need to hedge some of their positions.

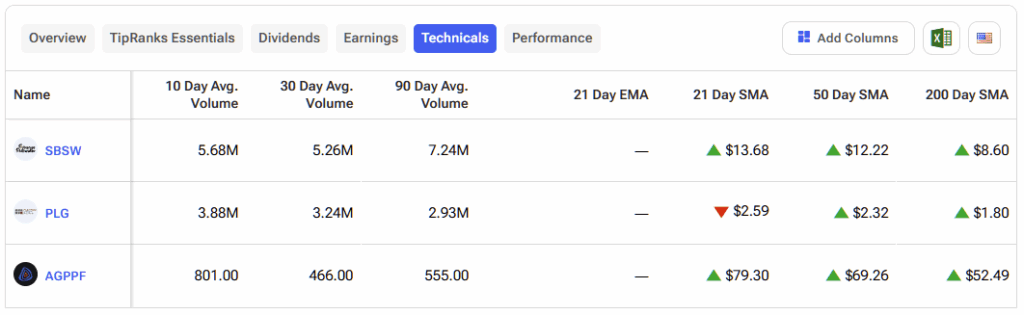

The effect on stocks has been understandably profound, with three platinum stocks now dominating investor (and speculator) attention: Valterra Platinum (AGPPF), Sibanye Stillwater (SBSW), and Platinum Group Metals (PLG).

The trio has seen their fundamental and technical outlooks shift considerably, with moving averages ticking up across the board throughout 2025.

As a result, the platinum trifecta is currently green across the board. SBSW, in particular, has risen by more than 310% last year.

Long overshadowed by gold’s dominance, platinum’s breakout suggests it is carving out a more prominent role among both safe-haven and industrial assets. And it’s not rising in isolation—gold and silver are climbing in tandem. All in all, the trio is having its best year since 1979, with the prices of all three metals currently just below all-time highs.

However, a potential fly in the ointment has emerged. Since mid-December 2025, platinum’s price volatility has surged, driving a dramatic expansion in the metal’s average daily trading range. Illustrating these sharp gyrations, platinum was trading near $2,000 per ounce on December 23, vaulted to roughly $2,500 by December 29, and then slid back toward $2,000 at yesterday’s close. Such abrupt and outsized moves have fueled concerns that the precious-metals market is currently thinly traded, with prices increasingly influenced by speculative activity rather than underlying fundamentals.

From another perspective, a strong pullback could serve as a healthy consolidation, shaking out weak longs before a renewed uptrend, or so the theory goes.

What’s Driving the Platinum Price Surge?

Platinum started 2025 trading between $900 and $1,100 per ounce, but by mid-year it had broken decisively higher—crossing $1,400/oz in multiple sessions and reaching multi-year highs. In June alone, the metal gained nearly 30%, marking one of its strongest monthly rallies in decades.

Analysts attribute the rally to tightening supply as the key driver. The World Platinum Investment Council recently forecast a 6% decline in mine output, projecting a market deficit of roughly 850,000 ounces. Recycling and secondary supply have also lagged, while inventories are being steadily drawn down—potentially falling to critically low levels near 2.5 million ounces.

On the demand side, platinum continues to benefit from a rebound in the automotive sector, particularly in emission-control catalysts, alongside early momentum from clean energy applications such as hydrogen fuel cells. In addition, as gold prices soar, some investors and jewelers appear to be experiencing “gold fatigue,” which is summarily cured by rotating into platinum for its diversification benefits and relative value appeal.

Valterra Platinum (OTC:AGPPF)

South African miner Valterra is considered the world’s leading platinum producer, accounting for approximately 38% of global platinum output. The company was spun off from the larger platinum group metals (PGMs) conglomerate Anglo American Platinum (ANGPY) in 2025.

However, its PGM operations have not been without challenges. Analysts note that unusually heavy rains and flooding in 2025 disrupted mining activity, resulting in a year-on-year production decline of approximately 17% in the first quarter. With capital discipline and cost management now more critical than ever, Valterra faces the challenge of sustaining output while navigating ongoing operational volatility.

Sibanye Stillwater (NYSE:SBSW)

Also from South Africa, Sibanye Stillwater has amassed a diversified portfolio that includes platinum, palladium, gold, and recycling operations. The group holds significant PGM assets in Zimbabwe and the U.S. Its PGM portfolio includes not only platinum and palladium but also rhodium, iridium, ruthenium, and other by-products such as chrome, nickel, and copper.

Despite a 4% decline in production, South African PGM operations remain within guidance, with a positive outlook driven by robust prices. According to the miner, it produced 1.73 million ounces of PGMs from its SA operations in 2024 and plans to increase production to beyond 1.85 million ounces in 2026.

The miner has acquired significant PGM assets over time, and with its operations becoming increasingly economically viable as prices rise, SBSW could be considered “well-positioned.” However, challenges remain in the form of margin pressure, declining ore grades, and the need to optimize its asset base.

Platinum Group Metals (NYSE:PLG)

Canadian miner Platinum Group Metals is entirely focused on advancing its Waterberg Project in South Africa. Planned as a fully mechanized, shallow, decline-access mine, Waterberg is expected to be one of the largest and lowest-cost underground PGM operations globally, producing platinum and other precious metals. PLG’s near-term goal is to secure construction financing and offtake agreements to move the project toward development.

The company is also pursuing innovation through Lion Battery Technologies, a partnership with Valterra and Florida International University. This initiative examines the application of platinum and palladium in next-gen lithium batteries, potentially creating new markets for PGMs beyond traditional applications in the automotive sector and jewelry.

To fund its strategy, PLG has tapped both private placements and equity programs, including a 2025 at-the-market offering, raising over $12 million.

Platinum Steps Out of Gold’s Shadow

Platinum has long lived in the shadow of gold. While gold is entrenched as the ultimate safe haven and inflation hedge, platinum’s identity has been tied to its role as an industrial metal—leaving it vulnerable to cyclical swings. Periods of weak GDP or slowing industrial output have often triggered sharp drops in demand and price. But 2025 told a different story, with 2026 looking even brighter for platinum investors.

Supply disruptions, depleted inventories, and investor rotation away from gold have propelled platinum into the spotlight—lifting not only the metal itself but also shares of key platinum producers. If momentum holds, platinum’s reputation may evolve from being merely gold’s industrial cousin to a more established investment asset in its own right, meriting a place in diversified portfolios.

Risks remain firmly in play: a broader macroeconomic slowdown, a rebound in mine supply, or an abrupt shift in investor sentiment could quickly erase recent gains. Even so, a 100% rally over the course of 2025 is impossible to overlook, volatility notwithstanding. For the first time in decades, platinum is reclaiming some of the attention and prestige long reserved for gold, and alert investors can gain exposure to this resurgence through leading platinum stocks whose fortunes are closely linked to the metal’s price.