Planet Fitness (NYSE:PLNT), the operator of fitness centers around the world, gained in pre-market trading after the company reported earnings for its third quarter of FY23. The company reported adjusted earnings of $0.59 per diluted share, up by 40.5% year-over-year, which beat analysts’ consensus estimate of $0.55 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s total revenues increased by 13.6% year-over-year to $277.6 million, beating analysts’ expectations of $268.2 million. Planet Fitness’ system-wide same-store sales increased by 8.4% in the third quarter.

Governor Craig Benson, Planet Fitness’s Interim CEO, commented, “We ended the third quarter with more than 18.5 million members, drove 8.4 percent system-wide same-store sales growth primarily from an increase in members, and grew our store count to nearly 2,500 locations globally.”

Planet Fitness raised its FY23 forecast and now expects its revenues to grow by 14% year-over-year. For reference, it previously projected a 12% revenue increase. In addition, adjusted earnings per share are likely to rise by 35% year-over-year compared to the prior forecast of 34%.

Is Planet Fitness a Good Stock to Buy?

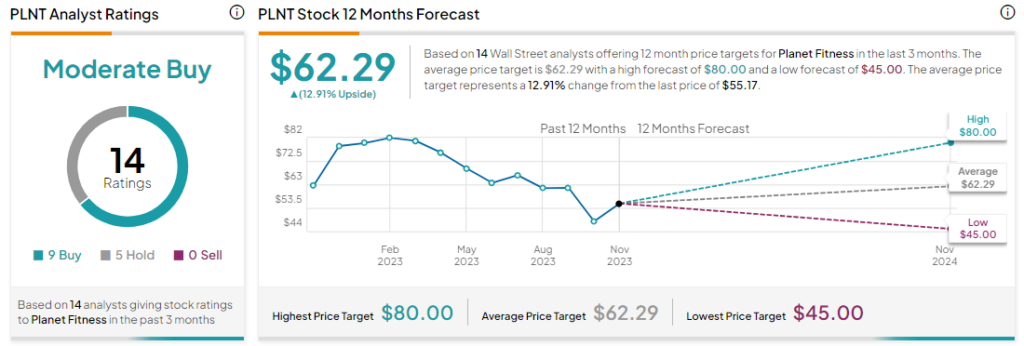

Analysts are cautiously optimistic about PLNT stock with a Moderate Buy consensus rating based on nine Buys and five Holds. The average PLNT price target of $62.29 implies an upside potential of 12.9% at current levels.