Shares of EV-maker Rivian (RIVN) and Chrysler-owner Stellantis (STLA) slumped on Thursday as analysts at Piper Sandler downgraded both stocks, citing “too much political uncertainty” in the auto manufacturing supply chain.

In a wide-ranging note on the auto sector, Piper also cut its price targets on Tesla (TSLA) and Ford (F). The firm cut its Tesla PT by 10% but stuck to a positive outlook on the broader electric vehicle space and the recent stock price decline, while it took a dimmer view of Ford as it slashed its price target to $9 from $13, saying its cash-generating businesses have been used to subsidize warranty campaigns and failed electric vehicle launches, which could take years to fix.

Analyst Alexander Potter meanwhile raised the firm’s price target on General Motors (GM) to $48 from $45 and kept a Neutral rating on the shares, saying buybacks and a low multiple will act as a cushion.

RIVN Cut

The firm cut Rivian to Neutral (Hold) from Overweight (Buy) with a price target of $13, down from $19. While it is appreciative of Rivian’s strategy and says the joint venture with VW helped de-risk the balance sheet, Piper struggles to identify upside catalysts for the shares in 2025. Investors are looking forward to the R2 launch next year, but until then Rivian has minimal growth and “lots of heavy lifting,” the analyst says.

Piper is wary of policy risk for the auto sector, noting Rivian is exposed to a “potential triple-whammy” in 2025. Meanwhile, Potter cut STLA from $23 to $13, but sounded a lot more upbeat on the broader electric vehicle space and stuck to a bull thesis for Tesla.

TSLA Bull Case Remains Intact

Electric vehicles are still “superior,” according to the research note, which argues the West will start to look like China with EV penetration trending towards 100%.

Piper Sandler reiterated its Overweight (Buy) rating on Tesla despite the recent volatility and decline in sales, though it cut its 2025 delivery expectations and lowered its price target to $450 from $500. According to Potter, TSLA is “cheap” based solely on autos, energy and full-self-driving.

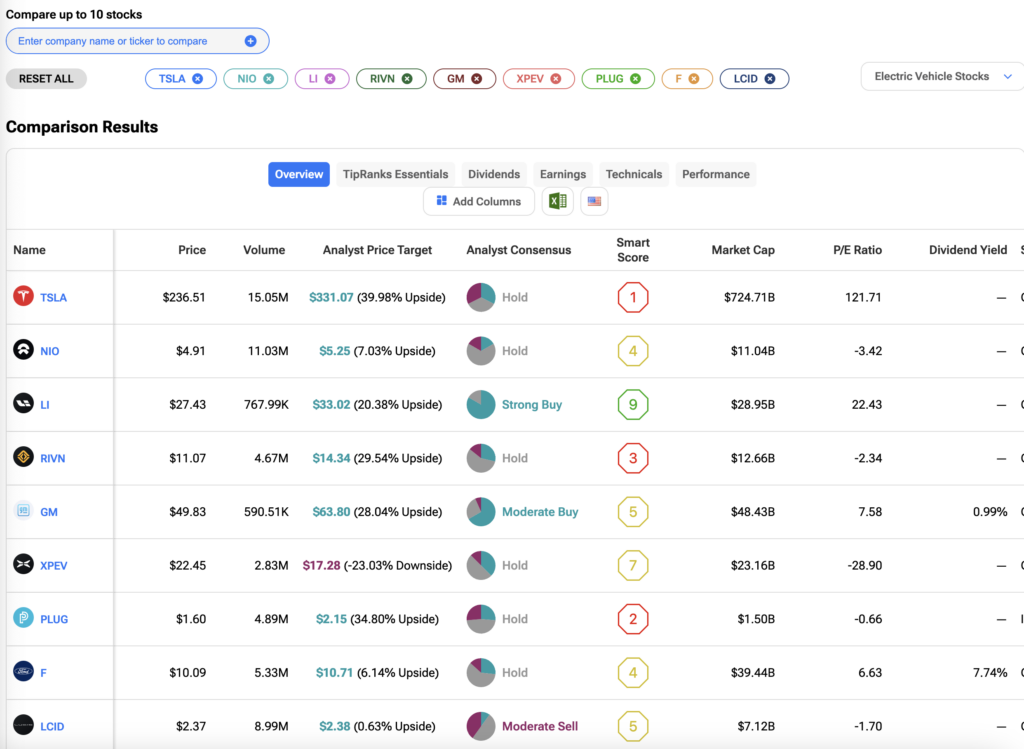

What are the Best EV Stocks?

Investors looking for the best EV stocks can compare them using the TipRanks Stocks Comparison Tool.

Questions or Comments about the article? Write to editor@tipranks.com