Analysts at investment bank Piper Sandler (PIPR) are calling for a merger of e-commerce giants eBay (EBAY) and Etsy (ETSY), saying the economics of such a deal make sense.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a new report, Piper Sandler says that such a merger would help to address growth challenges for Etsy by leveraging eBay’s extensive buyer network and data capabilities. Combining eBay’s 134 million active buyers with Etsy’s platform would create a formidable competitor in the e-commerce space, approaching 60% of Amazon’s buyer base, argues the bank.

Piper Sandler goes on to theorize that an all-stock deal could value a combined eBay and Etsy at $85 per share and enhance earnings by $0.78 a share by 2026. However, the analysts at the Wall Street firm acknowledge that a merger of the two companies is unlikely, at least in the near term.

Ideal Match?

While Piper Sandler argues that an eBay and Etsy merger makes sense when one looks at the numbers and economies of scale that could be achieved, the two companies have distinctive business models. Etsy is an e-commerce company with an emphasis on selling handmade or vintage items and craft supplies. The company has been around since 2005 and went public 10 years ago.

In contrast, eBay has been a going concern since 1995, was one of the first Internet businesses, and is viewed as an original e-commerce entity along with rival Amazon (AMZN). eBay went public in 1998 during the original dotcom euphoria and today sells just about everything in 190 markets worldwide.

Both EBAY and ETSY stocks have had their ups and downs in recent years, but eBay has been the clear winner for investors. Over the past five years, EBAY stock has risen 134%, while ETSY stock has gained only 21% in the same time period.

Is EBAY Stock a Buy?

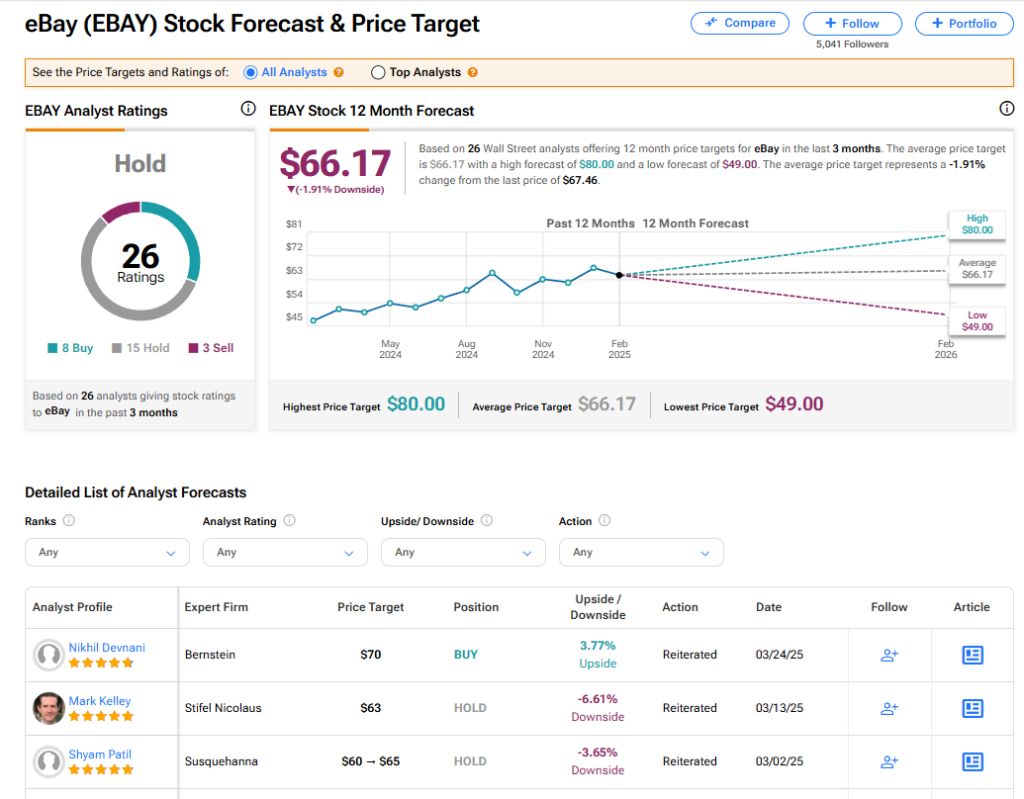

The stock of eBay has a consensus Hold rating among 26 Wall Street analysts. That rating is based on eight Buy, 15 Hold, and three Sell recommendations issued in the last three months. The average EBAY price target of $66.17 implies 1.91% downside risk from current levels.