Shares of diversified energy company Phillips 66 (NYSE:PSX) are trending marginally higher today, despite its third-quarter EPS of $4.63 falling short of expectations by $0.19.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, the company generated an operating cash flow of $2.7 billion, with its crude utilization rate of 95% rising to its highest level since 2019. Further, increased realized margins drove pre-tax income in PSX’s Refining segment to $1.7 billion, up from $1.1 billion in the prior quarter. Pre-tax income in its Midstream segment also rose to $712 million from $604 million sequentially.

Importantly, PSX is focused on driving its operating performance and executing its strategic priorities. The company aims to monetize more than $3 billion of non-core assets and return at least 50% of its operating cash flow to investors. It has raised its shareholder distributions target to between $13 billion and $15 billion and hiked its mid-cycle adjusted EBITDA growth target to $4 billion by 2025. In addition to its existing $3.1 billion stock buyback authorization, the company’s Board has approved an additional share repurchase program worth $5 billion

Will PSX Stock Go Up?

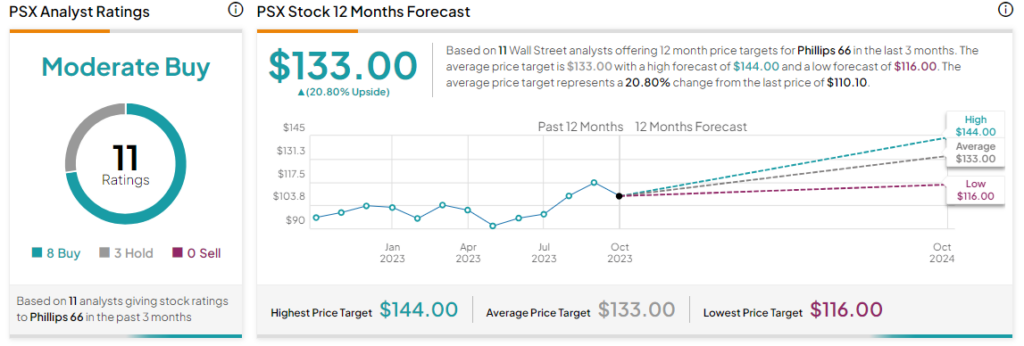

Overall, the Street has a Moderate Buy consensus rating on Phillips 66. On top of a nearly 11% price gain over the past six months, the average PSX price target of $133 implies a 20.8% potential upside.

Read full Disclosure