For healthcare stocks like Phathom Pharmaceuticals (NASDAQ:PHAT), word of a new drug approval tends to be a huge help to share prices. So too, do positive opinions from analysts. With Phathom up nearly 6% at the time of writing, it’s clear that having both of those at once is even better.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The whole snowball started rolling when word emerged from Phathom that the FDA might be approving vonoprazan, Phathom’s new treatment for gastrointestinal issues. If nothing else, an overall trajectory toward approval was looking like it would happen, and that was enough to kick off the second phase of gains for Phathom. Evercore ISI, by way of analyst Umer Raffat, stepped in and upgraded Phathom from Hold to Buy. Not so long ago, Phathom lost significant ground after the FDA wouldn’t act on a previous application the company submitted, in which it called for vonoprazan to be used to treat erosive esophagitis.

Phathom must have expected some success to come out of this, though; it’s already taken vonoprazan on the road, presenting new data about the treatment—and how it compares to lansoprazole—at the 2023 Digestive Disease Week show in Chicago back on May 6. One of the key principles in that demonstration was how Phathom was doing something downright unique in that market, with the first potassium-competitive acid blocker (PCAB) that would treat erosive gastroesophageal reflux disease (GERD).

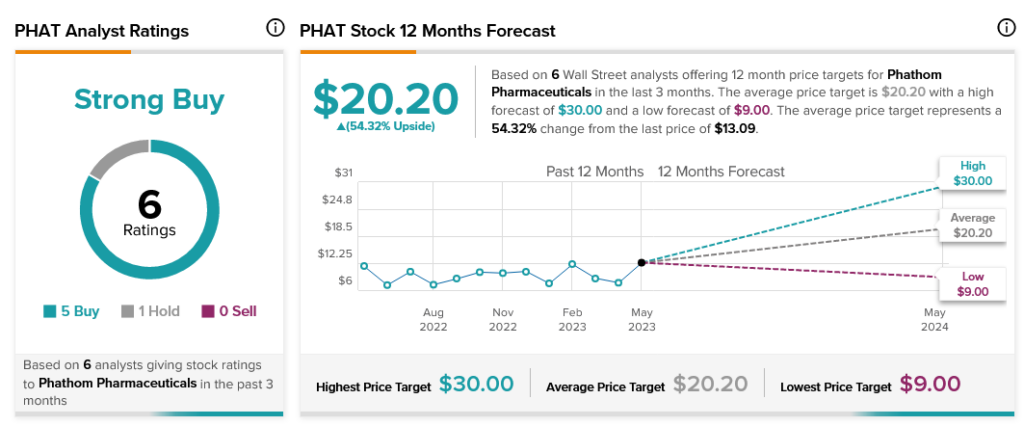

Meanwhile, most analysts are right in line with Raffat’s projections. Currently, analyst consensus calls Phathom stock a Strong Buy, thanks to five Buy ratings and one Hold. In addition, with an average price target of $20.20, it offers investors 54.32% upside potential.