Investors looking for a steady income stream can consider investing in Dividend Aristocrats (companies that have raised their dividends for at least 25 consecutive years). Procter & Gamble (NYSE:PG) and Atmos Energy (NYSE:ATO) are two such stocks that boast an impressive dividend history. Furthermore, Top Wall Street analysts have rated both stocks a “Strong Buy” and expect over 5% upside from their current levels.

Investors should note that TipRanks ranks the top analysts according to industry, timeline, and benchmarks. The ranking reflects an analyst’s ability to deliver higher returns through recommendations.

Now, let’s take a closer look at these two Dividend Aristocrat stocks.

Is PG a Good Stock to Buy Now?

Consumer staples giant Procter & Gamble is one such company that has a strong history of raising dividends for the past 67 years. Also, PG offers a dividend yield of 2.32%, beating the consumer defensive sector average of 2.13%. Let’s take a closer look at the stock.

PG remains focused on adapting to changing consumer choices, which helps it sustain a competitive edge in the market. Moreover, P&G’s financial strength can be seen in its consistent revenue growth and robust balance sheet.

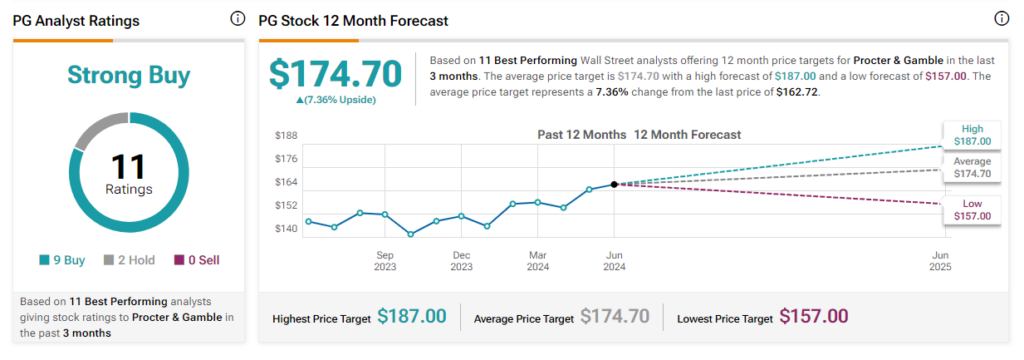

Among the 11 Top analysts covering the stock, nine rated it a Buy, and two assigned a Hold rating. The analysts’ average price target on Procter & Gamble stock of $174.70 implies a 7.36% potential upside from the current level. Shares of the company have gained 12.5% year-to-date.

Is ATO a Good Buy?

Atmos Energy is a natural gas distribution company. Importantly, it has raised dividends for 40 consecutive years. Moreover, ATO stock offers a dividend yield of 2.7%. The company’s efforts to attract new customers and its ability to increase prices bode well for bottom-line growth.

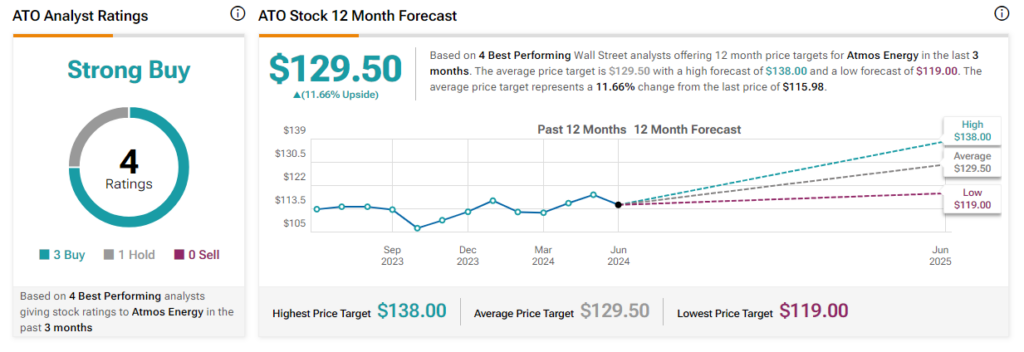

ATO has received three Buy and one Hold recommendations from Top analysts for a Strong Buy consensus rating. Further, analysts’ average price target on Atmos Energy stock of $129.50 implies 11.66% upside potential. The stock has gained 1.5% so far in 2024.

Concluding Thoughts

The Dividend Aristocrat status of PG and ATO reflects their commitment to reward shareholders with regular and growing dividends. In addition, the bullish view of Top analysts helps instill further confidence in these stocks.

Questions or Comments about the article? Write to editor@tipranks.com