The shares of Pfizer (PFE) pumped up on Tuesday afternoon after the American pharmaceutical giant agreed to an arrangement with President Donald Trump to lower the prices of some of its most popular drugs. Pfizer CEO Albert Bourla also revealed that the company had obtained a three-year grace period from the Trump administration’s recent tariffs on the pharmaceutical industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

President Trump announced the deal on Tuesday during a press conference, noting that some of the company’s medications will be discounted by about 50% or more. The U.S. president further noted Pfizer will begin to price drugs sold to Americans under the Medicaid program at a “most favored nation” (MFN) price, which would bring down their costs.

Pfizer’s shares were up over 6% to around $25 per share around 2:18 p.m. EDT on Tuesday.

‘TrumpRx’ Platform to Offer Discounted Drugs

Furthermore, Trump noted that the discounted medications will be sold on a platform handled by the federal government. Media reports have identified the platform as ‘TrumpRx’, a new direct-to-consumer website where Americans can buy drugs at government-negotiated prices.

Meanwhile, Trump, who has been pushing for lower drug prices with his tariff policy on the pharmaceutical industry, bemoaned the high cost of medications in the country, noting that Americans pay about 15 times more for medications compared to other countries. In July, the president had written to 17 major pharmaceutical firms, asking that drug prices under Medicaid be sold at MFN prices — or what is equal to or lower than prices in other countries.

During the press conference held at the Oval Office, Trump decried that American consumers have been subsidizing research and development costs “for the entire planet.”

“The United States has just 4% of the world’s population and consumers, only 13% of all prescription drugs, yet pharmaceutical companies make 75% of their profits from the United States,” Trump stated.

Pfizer Pledges $70 Billion for U.S. Production

The new deal comes several days after Trump threatened to impose a 100% tariff on all branded or patented pharmaceutical products imported into the U.S., effective October 1. Earlier in July, Trump warned of imposing tariffs as high as 200% on pharmaceuticals imported into the U.S.

Meanwhile, during the Tuesday press conference, the U.S. president noted that his administration is in talks with other major pharmaceutical companies in the country to secure similar agreements. While not mentioned during the press conference, some of the other major pharmaceutical firms in the U.S. include Johnson & Johnson (JNJ), Eli Lilly (LLY), AbbVie (ABBV), and Merck & Co. (MRK), among others.

Furthermore, Trump disclosed that Pfizer has committed to invest $70 billion to ramp up its domestic manufacturing in the U.S. This comes as CEO Bourla stated that the company now has the certainty and stability it needs regarding tariffs and pricing.

Is Pfizer a Buy, Sell, or Hold?

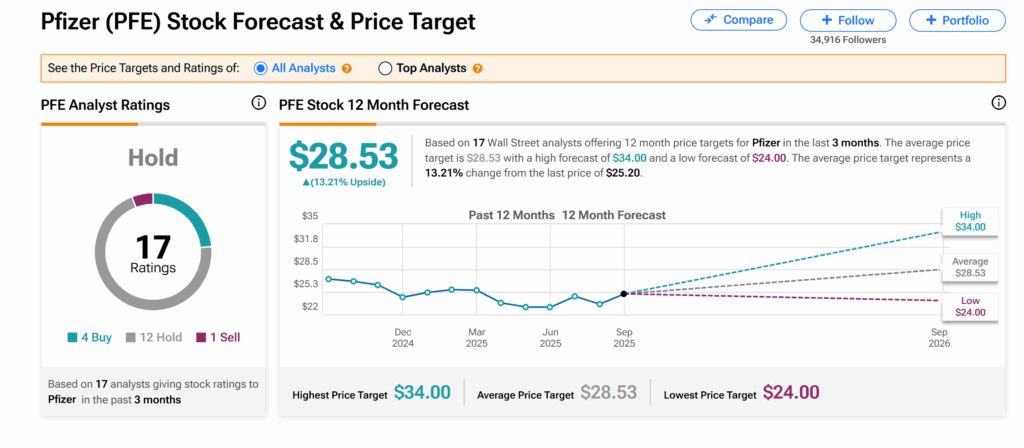

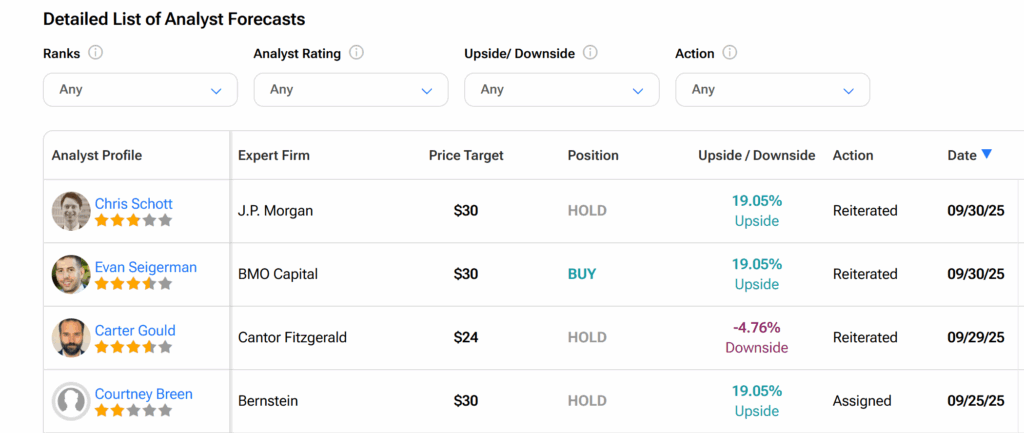

Turning to Wall Street, Pfizer’s shares currently have a Hold consensus rating on TipRanks, based on four Buys, twelve Holds, and one Sell assigned by 17 Wall Street analysts over the past three months. However, the average PFE price target of $28.53 indicates a 13.39% growth potential from the current level.