Brazilian oil and gas behemoth Petrobras (PBR) has drilled better-than-anticipated second quarter numbers and shares of the company are already up 6.8% in the pre-market session today.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Driven by rising brent and natural gas prices coupled with increased volumes, revenue jumped 65.4% year-over-year to $34.7 billion, outperforming estimates by $3.2 billion. Impressively, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) jumped 69.7% to $19.94 billion during this period.

The company continued to capitalize on the higher crude price levels and improved its return on capital employed to 12.8% from 5.1% a year ago. Additionally, free cash flow generation at $12.8 billion remained robust during the quarter (a 37.1% increase over the prior year).

Petrobras Management’s Comments

Petrobras CFO, Rodrigo Araujo, commented, “Second quarter results show the resilience and strength of the company, which is able to generate sustainable results, following its trajectory of value creation.”

Further, Petrobras pared its gross debt by 9% sequentially to $53.6 billion and boosted capital expenditures by 74% over the prior quarter to $3.1 billion.

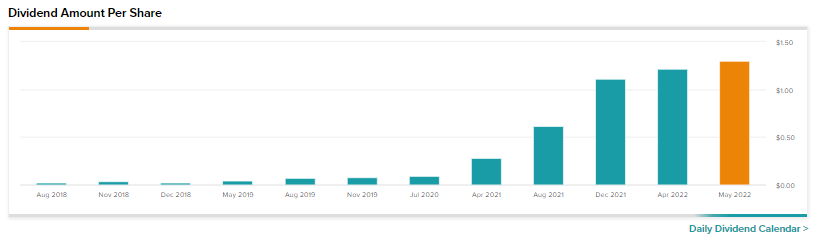

The company has also announced a massive $17 billion dividend payout as higher oil continues to drive its cash flows. The dividend of R6.732 per share will be paid in two equal tranches on August 1 and September 20. This takes Petrobras’ dividend yield to 22.55%, with a payout ratio of 95.43%. Notably, this is the ninth dividend hike undertaken by the company since December 2018.

Analysts’ Take on PBR

The Street is cautiously optimistic about Petrobras with a Moderate Buy consensus rating alongside an average price target of $17.35. This implies a further 29.57% potential upside on top of the 21% share price gain over the past 12 months.

Closing Note

Petrobras continues to capitalize on the current macro environment that is driving the oil and gas industry. Shareholders are already cheering the dividend windfall. Our data dig at Tipranks shows the number of top investor portfolios on TipRanks that hold Petrobras has increased by 9.8% in the last thirty alone. This indicates very positive investor sentiment about Petrobras.

Read the full Disclosure