Petco Health and Wellness Company (NASDAQ: WOOF) tanked in pre-market trading on Thursday after the pet retailer reported disappointing Q2 earnings. The company announced adjusted earnings of $0.06 per share in the second quarter, a massive drop of 62.5% year-over-year but in line with consensus estimates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The retailer generated net revenues of $1.53 billion in the second quarter, up by 3.4% year-over-year as compared to Street estimates of $1.52 billion.

Petco CEO Ron Coughlin commented, “With discretionary spending continuing to be pressured, we’re taking numerous strategic actions to strengthen our business, including initiatives to unlock a targeted $150 million in cost savings and productivity enhancements by the end of fiscal 2025.”

Year-to-date, Petco has paid down $75 million in principal payments and is targeting a total of $100 million in principal payments for FY23.

Looking forward, Petco has projected FY23 revenues in the range of $6.150 billion to $6.275 billion while adjusted earnings are forecasted to be between $0.24 and $0.30 per share. For reference, analysts were expecting revenues of $6.25 billion and earnings of $0.45 per share.

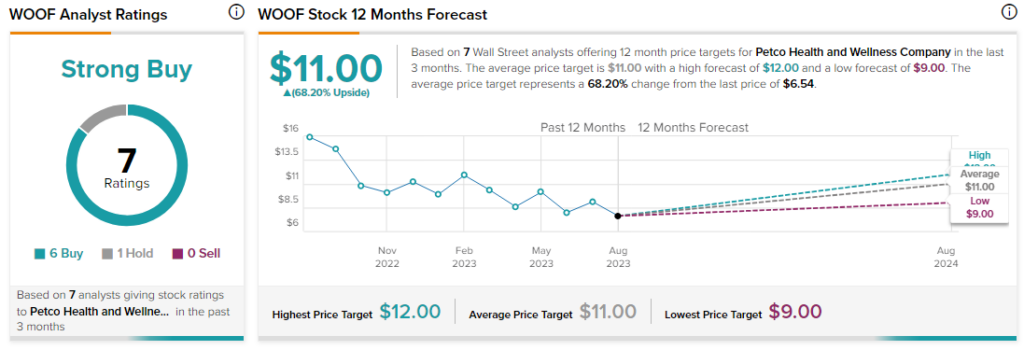

Analysts are bullish about WOOF stock with a Strong Buy consensus rating based on six Buys and one Hold.