E-commerce platform Shopify (SHOP) is getting attention after AI-search engine and OpenAI competitor Perplexity revealed its new AI shopping tool called “Buy with Pro.” This tool will be available to U.S. Perplexity Pro users and will allow them to search for and purchase products directly through Perplexity’s website or app without visiting third-party sites. The platform uses data from seller websites, such as Shopify-hosted stores, and is integrating Shopify’s API to enhance its e-commerce functionality.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In addition, Buy with Pro uses a machine-learning classifier to detect user intent. Once shopping intent is identified, the system displays relevant product cards with details like price. These recommendations are AI-driven, not sponsored, and provide personalized results tailored to each user’s search behavior.

Perplexity plans to roll out this AI-powered shopping assistant to more markets after its U.S. debut. While the tool could redirect some traffic from Google (GOOGL) and Amazon (AMZN), its effect on Shopify is less clear. As a result, shares of Shopify are down at the time of writing.

No Plans to Monetize the New Feature Yet

Interestingly, Perplexity does not have palns to monetize its new Buy with Pro feature yet. Instead, it is focusing on increasing search queries. Indeed, according to ADWEEK, Dmitry Shevelenko, Perplexity’s chief business officer, said that a lot of people were using the platform to “research potential purchases.” As a result, the company felt like it was a “natural extension” to allow users to purchase products as well.

Is SHOP Stock a Buy?

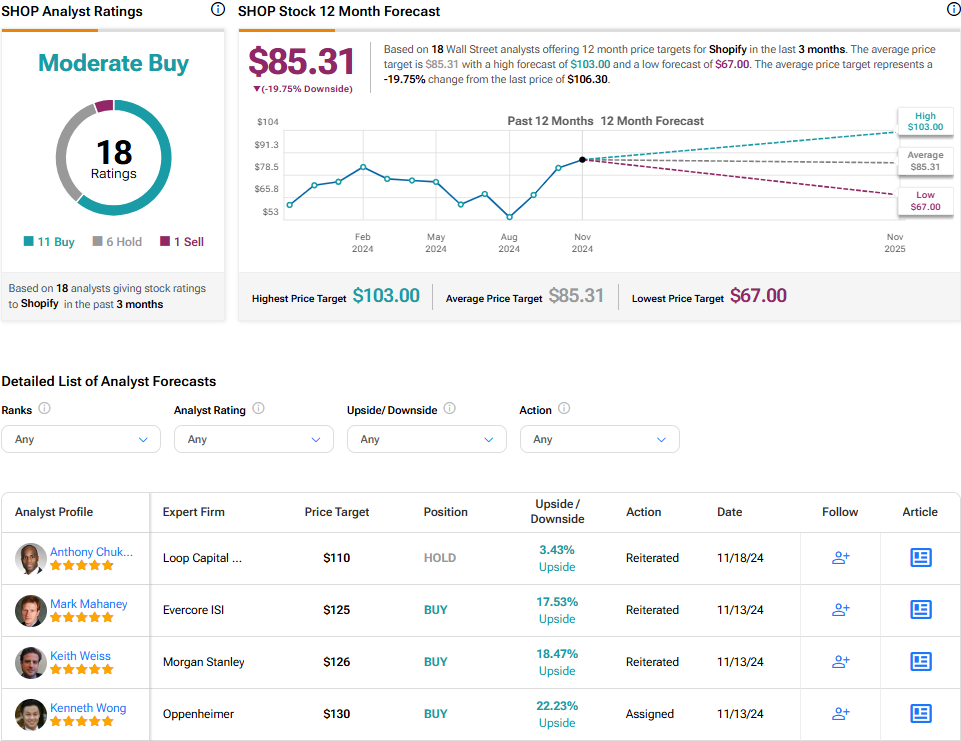

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SHOP stock based on 11 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 53% rally in its share price over the past year, the average SHOP price target of $85.31 per share implies 19.75% downside risk.