PepsiCo (PEP) has been experiencing a decline in sales volumes in recent quarters. Nonetheless, I believe investors should remain confident about the company’s long-term outlook. Despite the headlines depicting weak revenues, PepsiCo’s investment case remains compelling, driven primarily by its aggressive pricing power, expanding margins, and attractive valuation. Accordingly, even with somewhat softer top-line results, I remain bullish on PepsiCo stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

What’s Happening to Sales Volumes

PepsiCo released its Q3 results last week, posting a 2% decline in beverage unit volume. This marked the ninth consecutive quarter of volume declines. Clearly, such a prolonged negative trend might seem alarming to some investors, as it could signal weak demand across PepsiCo’s product categories. Yet, these volume drops are not uniform across the board and are partially influenced by specific situations affecting certain segments. I remain constructive on PEP shares.

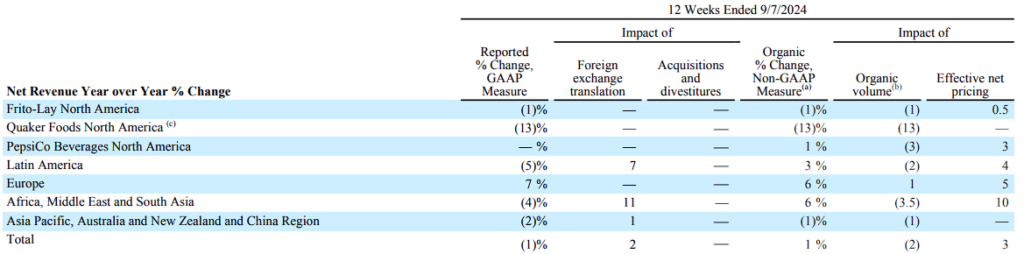

PepsiCo’s Quaker Foods division was significantly impacted by a product recall, leading to a staggering 13% volume drop. Frito-Lay North America, which has historically been one of PepsiCo’s most lucrative segments, saw a soft 1% volume decline, which isn’t too worrying in this market. PepsiCo Beverages North America managed to keep volumes flat as well. Globally, there were some mixed results, with Latin America and parts of Asia showing some growth, offset by weakness in other regions such as Europe and China. However, in my view these variances are nothing out of the ordinary.

Overall, I don’t see any major issues for investors to be concerned about. PepsiCo’s slight drops in sales volumes have been consistent for quite some time now. Some of this is a direct impact of Pepsi’s pricing strategy which, as I’ll explain, has ultimately worked out well for them.

Pricing Power: Inelastic Demand on Display

As I just hinted, PepsiCo’s sustained decline in sales volumes is not necessarily concerning but rather an expected outcome of leveraging its inelastic business model to drive higher pricing. To elaborate, PepsiCo’s products, particularly its snacks and beverages, enjoy strong consumer loyalty, which can often allow the company to implement substantial price increases without suffering a corresponding material decline in demand. In other words, PepsiCo has permitted modest single-digit sales volume declines in exchange for notably higher product pricing.

The pricing strategy is evident beginning in Q2 of 2022, when PepsiCo introduced a 12% average increase in effective net pricing. That was followed by a 10% increase in Q3 2022, with net pricing growth peaking at 17% in Q4 of that year. Each of the four quarters of 2023 saw year-over-year pricing growth (of 16%, 15%, 11%, and 9%) on top of the double-digit hikes of the year before. During this period, PepsiCo has posted declining sales volumes between 2% and 3%, while the worst result was a 4% drop in Q4 of 2023. In all cases, however, the price increases have been considerably larger than the volume hit.

Even in the first three quarters of 2024, the fairly soft but higher effective net pricing increases of 5%, 5%, and 3%, respectively, have significantly outpaced the declining sales volumes of 2%, 3%, and 2%. PepsiCo has been consistently driving decent revenue growth over the past two and a half years, despite the headlines.

Expanding Margins Bolster Profitability

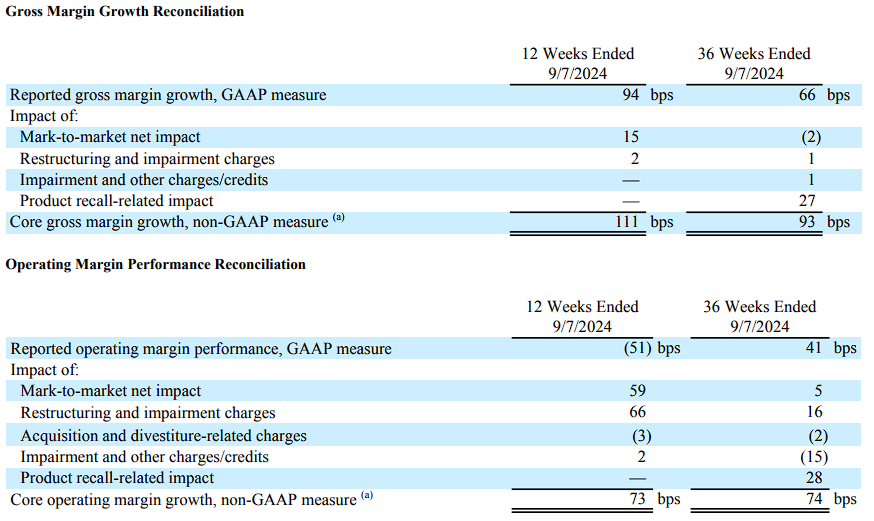

PepsiCo’s pricing strategy has led to margin expansion. In its most recent Q3, the company’s adjusted gross margin expanded by 111 basis points year-over-year, while its adjusted operating margin expanded by 73 basis points. Thus, Q3 was another quarter of organic revenue growth (even if that was by a soft 1.3% this time) and one with higher earnings. Adjusted EPS, in fact, grew by 5% to $2.31, reflecting PepsiCo’s higher margins.

PEP Stock Valuation Offers a Reasonable Entry Point

With all this in mind, I believe PepsiCo’s valuation remains attractive. Following the company’s solid year-to-date performance and expectations for Q4, analysts expect PepsiCo to post $8.15 in adjusted EPS for 2024, representing year-over-year growth of 7%. This also implies a P/E ratio of 21.6x, which I find pretty respectable for a company of PepsiCo’s stature. PepsiCo is a Dividend King, with 52 consecutive years of dividend increases. Its diversified portfolio of iconic brands span recession-proof categories such as snacks, beverages, and convenience foods.

Is PepsiCo Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, PepsiCo maintains a Moderate Buy consensus based on seven Buy ratings and nine Hold ratings assigned in the past three months. At $184.07, the average PEP stock price target implies 4% upside potential.

If you’re uncertain about which analyst to trust on PEP stock, Kaumil Gajrawala from Jefferies looks like your best bet. Over the past year, Mr. Gajrawala has been both the most accurate analyst covering the stock. He boasts an impressive a 88% success rate. He currently has a $198 price target on PepsiCo stock.

Concluding Thoughts

In summary, despite the recent declining trend in unit volume sales, PepsiCo’s aggressive pricing power and expanding margins position the company for sustained earnings growth, in my view. I would, in fact, argue that the volume declines seem to stem from a deliberate strategy to focus on pricing. In the meantime, the stock’s valuation seems reasonable, and most investors already know that company of PepsiCo’s caliber rarely trades at a discount. I remain bullish on PEP stock’s prospects.