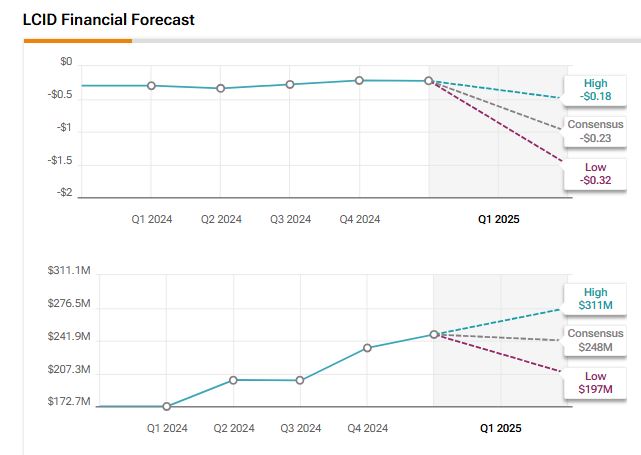

Luxury electric vehicle (EV) maker Lucid Group (LCID) will report its Q1 results on May 6. This penny stock has fallen about 16% year-to-date due to a tough macro backdrop, tariff wars, rising losses, production challenges, and growing competition in the EV space. Wall Street forecasts a Q1 2025 loss of $0.23 per share, an improvement from the $0.30 per share loss in the same quarter last year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, revenues are expected to rise by 44% from the same quarter last year, reaching $248.5 million, according to data from the TipRanks Forecast page. Importantly, Lucid has missed earnings estimates four times in the past nine quarters, reflecting the struggles in the EV market.

Things to Know Ahead of Q1

On April 11, Lucid acquired the Arizona-based facilities of bankrupt EV maker Nikola through an auction. The deal includes Nikola’s manufacturing plant in Coolidge and its Phoenix headquarters, adding over 884,000 square feet to Lucid’s operations in the state.

Earlier, on April 2, Lucid reported that it delivered 3,109 vehicles in Q1 2025—a 58% increase year-over-year. This continues the company’s steady growth in deliveries over recent quarters, as shown in Main Street Data’s chart.

That same day, Lucid also revealed in an SEC filing that it expects Q1 2025 revenue between $232 million and $236 million, which falls short of the consensus estimate of $256.3 million.

Analysts’ Views on LCID Ahead of Q1 Results

Ahead of Lucid’s Q1 results, Bank of America Securities analyst John Murphy reiterated a Sell rating on the stock with a $1.00 price target, citing several ongoing challenges. He believes the recent departure of CEO Peter Rawlinson could hurt product development and weaken customer demand, which may also make it harder for the company to secure new funding. Also, Murphy pointed to delays in the delivery of Lucid’s highly anticipated Gravity SUV. He noted that this could weigh on the company’s future revenue.

On a positive note, the analyst sees Lucid’s acquisition of Nikola’s former facilities in Coolidge and Phoenix, Arizona, as a smart move. These sites are located near Lucid’s AMP-1 plant and should support increased production capacity. The analyst also believes the company likely acquired the assets at a low cost, making the deal even more favorable.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 11.86% move in either direction.

Is LCID Stock a Buy?

The stock of Lucid Group has a consensus Hold rating among seven Wall Street analysts. That rating is currently based on one Buy, seven Hold, and three Sell recommendations issued in the past three months. The average LCID price target of $2.38 implies 5.93% downside from current levels.