Peloton (NASDAQ:PTON), an interactive fitness platform operator that shot to fame during the pandemic, does not seem cheaply valued, even though it’s near an all-time low after reporting disappointing financial results recently. A few Wall Street analysts are turning bullish on Peloton at a time when the company is betting on a transition toward a subscription-based business model. However, I am bearish on Peloton, as I believe there is more pain in the cards.

The Mounting Challenges

Peloton stock reached a high of over $170 in 2021, with the company emerging as a leading at-home fitness solutions provider – from equipment to content – during the pandemic days. Coinciding with a noteworthy decline in financial performance, Peloton has lost more than 95% of its market value since then.

Peloton, unfortunately, is still struggling to recover from most of the challenges it has faced in the last three years. There are both company-specific and macro challenges Peloton is facing today.

First, there is a notable softness in hardware sales, including the once-popular Bike, which is directly impacting the company’s profitability and cash flows. For the second quarter of Fiscal 2024, which ended last December, Peloton reported connected fitness products revenue of $319.1 million, registering a 16% year-over-year decline. During the recent earnings call, CFO Liz Coddington warned that the softness in product sales will continue in the next couple of quarters as well.

Second, Peloton’s substantial inventory of Tread+ products may come to haunt the company in the future if demand does not pick up as expected. During the Q2 earnings call last week, CEO Barry McCarthy also claimed that the company’s lack of experience in selling these products at the full price may impact projected sales in the coming quarters. If Peloton fails to move Tread+ products out from its inventory in time, the company may have to book losses.

Third, Peloton has failed to meaningfully innovate in the last couple of years, as the company was forced to relaunch existing products such as Tread+ to address safety hazards that came to light during this period. This lack of innovation at a product level may have opened the doors for competitors to eat into Peloton’s market share in the fitness equipment sector.

In addition to these challenges, investors will have to pay close attention to the continued inability of Peloton’s management to meet their expectations. A classic example is the management’s decision to revise free cash flow targets for Fiscal 2024.

During the Q1 earnings call in November, the company guided for a substantial improvement in free cash flow in the second half of the year with a goal of achieving near-breakeven free cash flow for the full year. Last week, the company revised this target and acknowledged that positive free cash flows can only be generated in Q4 and that the company will fall short of achieving its goal for the full year.

From a growth perspective, Peloton does not expect to return to positive revenue growth until the fourth quarter of Fiscal 2024. The company has reported year-over-year declines in quarterly revenue in each of the last eight quarters, which highlights the continued challenges faced by the company in reviving its growth. The company recently issued a warning that growth at scale will continue to be a challenge in the foreseeable future.

Is Peloton at Risk of Bankruptcy?

Peloton carries $1.7 billion in long-term debt against $738 million in cash and short-term investments. The most significant debt maturity on the horizon is $1 billion worth of convertible bonds due in 2026.

In recent quarters, the company has been able to stop some of the bleeding in operating cash flows, which is a good sign. The company’s operating cash outflow reduced to $31.2 million in Q2 compared to $670.2 million in the March 2022 quarter.

This improvement in operating performance came on the back of strategic cost reductions and a focus on the subscription business. Assuming these improvements will continue in the foreseeable future, Peloton should be able to service short-term debt obligations without diluting existing shareholders.

Peloton does not seem to be at risk of bankruptcy in the short term, but a continuation of lackluster revenue growth, challenging industry conditions, and product issues will increase bankruptcy risk in the long term. Therefore, investors will have to keep a close eye on these metrics to identify potential inflection points in Peloton’s story.

Is Peloton Stock a Buy, According to Analysts?

Wall Street analysts were forced to aggressively slash their expectations for Peloton’s revenue and earnings in 2021 when the post-pandemic era proved to be more challenging than initially thought. Now, however, some analysts are growing in confidence regarding Peloton’s turnaround potential.

After digesting Peloton’s Q2 earnings, Citi (NYSE:C) analysts highlighted the improvement in subscriber and engagement metrics to establish that the company’s recovery is progressing well. The narrowing free cash flow loss is another positive development noted by Citi analysts.

JPMorgan (NYSE:JPM) analysts Dough Anmuth and Bryan Smilek are also turning bullish on Peloton based on the company’s recent success in identifying growth areas to focus on while discontinuing partnerships and products that are unlikely to meaningfully contribute to growth.

Gene Munster, the Managing Partner at Deepwater Asset Management, holds the view that Apple (NASDAQ:AAPL) will benefit from a business combination with Peloton, given that Apple Fitness lacks a hardware component, which is something Peloton can bring to the table. However, Gene Munster believes that Peloton is still a broken business, which could be the biggest reason holding Apple from making a move to acquire Peloton.

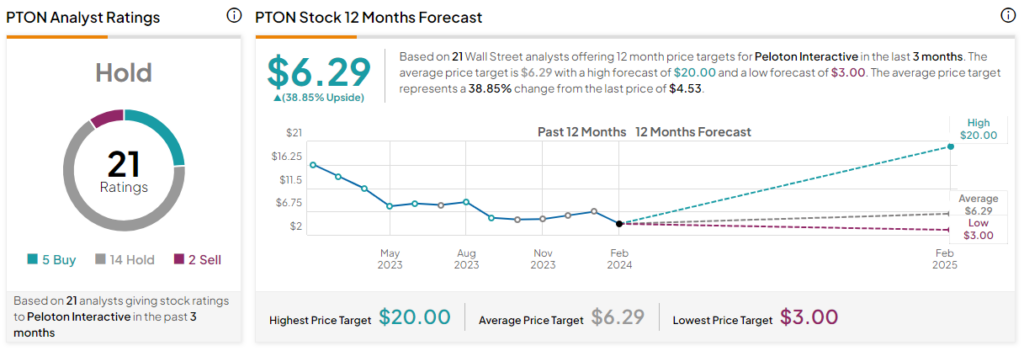

Overall, based on the ratings of 21 Wall Street analysts, PTON stock comes in as a Hold. The average Peloton stock price target is $6.29, which implies upside of 38.9% from the current market price.

Why Peloton Stock Isn’t Cheap

Near an all-time low, PTON stock is valued at a forward price-to-sales multiple of just 0.6, which may sound attractive at first. However, given that the company is still years away from profitability and is yet to overcome revenue growth challenges, the seemingly cheap valuation can be deceptive.

The Takeaway: Peloton’s Path to Recovery is Uncertain

Compared to 2021, Peloton is a leaner and more agile business enjoying operating efficiencies. The company, however, faces several challenges that limit its growth potential. To make matters worse, profitability seems years away at best. The seemingly cheap valuation of the company, on the other hand, may be deceptive given these challenges.