PDD Holdings (PDD), the parent company of the fast-growing e-commerce platform Temu, continues to exhibit sustained momentum, as demonstrated in its most recent Q2 results. However, as Temu expands globally, it faces increasing scrutiny from regulators, particularly in the U.S. and Europe, raising concerns that could hinder its growth trajectory. Thus, while PDD’s position remains strong, these investigations may pose significant risks to its long-term outlook. Accordingly, I am neutral on PDD stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Q2 Results: Excellent Growth, Robust Profitability

As written above, PDD’s second-quarter results show continual growth. However, my concerns about the stock and, hence, the neutral position lie elsewhere. Let’s start with the positives:

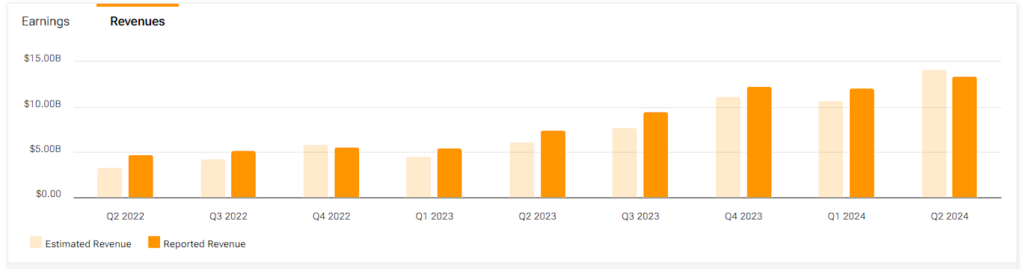

In Q2 2024, PDD Holdings posted total revenues of $13.36 billion, marking a year-over-year increase of 86%, powered by robust online marketing and transaction services performance. Marketing services contributed $6.76 billion, registering a growth of 29%, while transaction services soared by 234% year-over-year, reaching $6.60 billion. Both figures illustrate PDD’s ability to grow its ecosystem by improving consumer engagement and expanding product offerings across its platforms. It’s also worth noting that the 86% growth registered for the quarter implies an acceleration compared to 66% last year.

Moreover, PDD’s operating profit was even more impressive, surging by 156% to $4.48 billion. Consequently, PDD’s adjusted net income also rose by 125% to $4.74. The much higher profitability growth rates than revenue growth highlight that PDD can leverage economies of scale to drive a significant margin expansion.

It’s important to note that PDD acknowledged that its revenue growth is expected to face pressure from intensifying competition and external challenges. The management team stated they remain committed to long-term investments, which could also lead to short-term fluctuations in profitability. Nevertheless, PDD’s momentum is phenomenal, and given that management has historically been prudent, I doubt if any such investments will meaningfully impact the bottom line. I believe the actual risk is related to Temu’s ongoing scrutiny.

Temu Under Scrutiny

Now it’s time to move on to the less positive aspects of the PDD stock.

While PDD Holdings enjoys tremendous growth, Temu, its flagship platform, is grappling with regulatory investigations that could pose significant challenges. This explains my neutral rating despite the company’s admittedly impressive financials. Specifically, in recent months, U.S. regulators, including the Consumer Product Safety Commission (CPSC), have called for investigations into Temu over safety concerns related to specific products, including items that allegedly do not meet U.S. safety standards for infants and toddlers.

Moreover, a coalition of 21 U.S. state attorneys general launched an investigation into Temu, accusing the platform of selling goods potentially made with forced labor. The inquiry focuses on whether products sourced from Xinjiang, a region known for human rights violations, are sold on the platform without adequate oversight. Temu has been criticized for not conducting sufficient audits to ensure compliance with labor laws such as the Uyghur Forced Labor Prevention Act.

Security Data Concerns

In addition to labor concerns, Temu is also under fire for its data security practices. U.S. officials, including Senator Rick Scott, have raised alarms about the platform’s handling of consumer data, especially whether it is adequately protected from misuse or potential access by the Chinese government. These concerns have pressured Temu to clarify its data privacy policies and ensure compliance with U.S. laws.

Beyond the U.S., Temu is facing regulatory hurdles in Europe, too. European consumer groups have accused the platform of using manipulative sales techniques and breaching the European Union’s Digital Services Act. These complaints could very well result in additional investigations by European regulators, which could, in turn, potentially lead to stricter oversight of the platform’s business practices.

What Does This Mean for Temu and PDD?

Predicting the development of the ongoing Temu scrutiny concerning PDD is still speculative. However, we can examine some potential outcomes. Specifically, the ongoing regulatory scrutiny poses major risks to Temu’s expansion plans. Investigations into forced labor, product safety, and data security could lead to significant penalties, increased compliance costs, or restrictions in major markets like the U.S. and Europe.

Such measures could diminish consumer trust and hurt transaction growth, all while Temu faces intense competition globally. In that case, Temu’s spectacular growth trajectory could be substantially impacted, altering its role as a critical driver of PDD Holdings’ revenue. This could potentially lead to downgrades in analysts’ forecasts for PDD’s revenue, earnings, price targets, and valuation multiples, and may result in a shift in sentiment and significant declines in PDD’s share price.

Is PDD Stock a Buy, According to Analysts?

Wall Street’s view on PDD stock remains quite bullish. PDD Holdings features a “Strong Buy” consensus rating based on 11 Buys and two Hold recommendations in the past three months. At $166.58, the average PDD stock price target implies 82.43% upside potential.

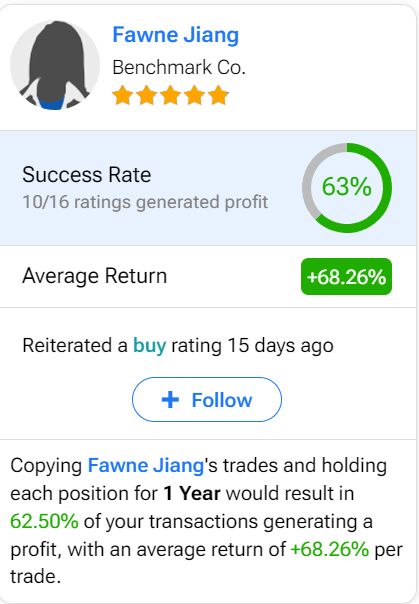

If you’re wondering which analyst you should follow if you buy and sell PDD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Fawne Jiang, a five-star analyst according to Tipranks’ ratings, from Benchmark Co., with an average return of 68.26% per rating and a 63% success rate.

Conclusion: Strength Overshadowed by Regulatory Risks

PDD delivered an exceptional Q2, showcasing strength in both its top-and-bottom lines. However, the regulatory challenges facing Temu could prove a substantial headwind for the company in the coming quarters. As investigations into product safety, labor practices, and data security continue to unfold, the risks associated with Temu’s expansion could have a detrimental impact on PDD’s long-term investment case. Hence, I urge you to remain cautious as the company works to address these growing concerns.