Shares in Chinese tech group PDD Holdings (PDD) dropped 1% today as it continued to pay the price of President Trump’s tariffs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Engagement Drops

According to a report in the Financial Times, Temu, the e-commerce firm owned by PDD, has had a torrid period in the last few months since the U.S. imposed huge tariffs on China and scrapped de minimis tariff exemptions, which allowed packages worth up to $800 from China and Hong Kong to enter the US duty-free.

The report revealed that Temu’s monthly active users in the United States, a measure of engagement on its app, dropped 51% to 40.2 million between March and June. In the last three months, Temu’s U.S. advertising spend has plunged 87% year over year.

Fellow Chinese group, fast fashion firm Shein, has also suffered during the period with its monthly active user base falling 12% to 41.4 million. Its advertising spend is down 69%.

Both companies have flourished in the last five years thanks to their cheaper prices compared with rivals such as Amazon (AMZN) and a huge amount of advertising on social media.

Shein IPO

But following Trump’s tariffs tirade they have had to consider different strategies such as looking to add new suppliers in Brazil and Turkey or hike prices.

Shein has also been forced to change its plans of listing in London. It is now planning to file an IPO in Hong Kong instead.

“One of the biggest hurdles for potential investors is feeling comfortable about Shein’s supply chain amid accusations that its rock-bottom prices imply widespread use of cheap labour. Investors will want reassurance that the supply chain doesn’t involve a workforce that is being exploited,” said Dan Coatsworth, investment analyst at AJ Bell.

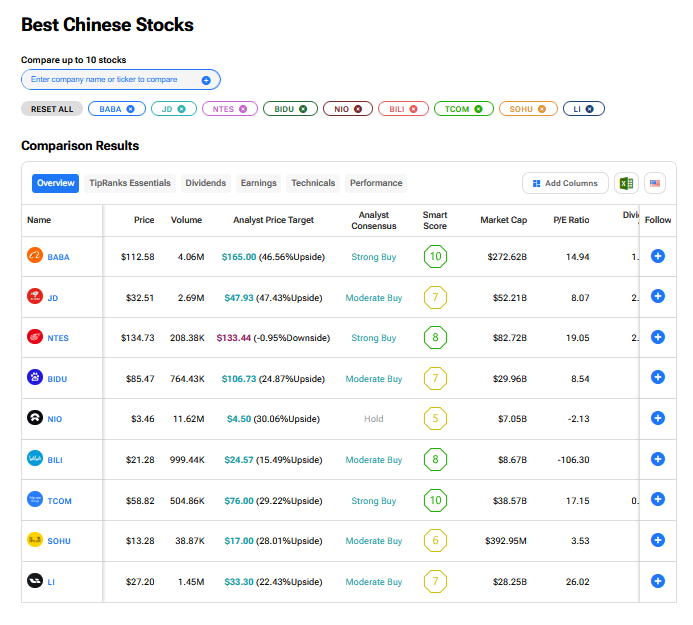

What are the Best Chinese Stocks to Buy Now?

We have rounded up the best Chinese stocks to buy using our TipRanks comparison tool.